How can we help?

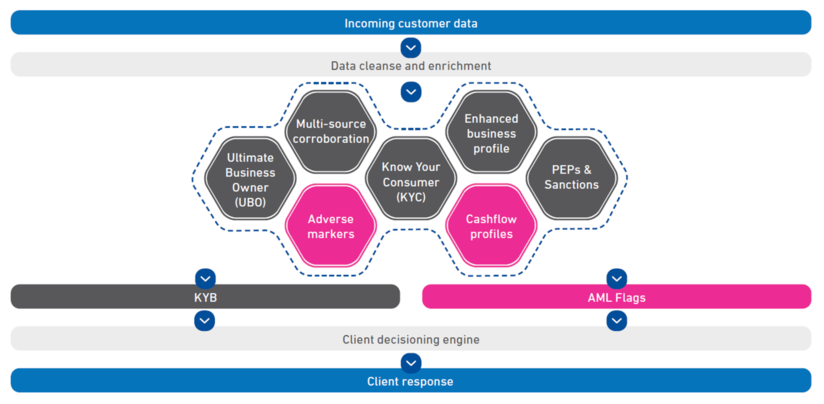

Take a proactive approach to fighting financial crime and enhance your Know Your Business (KYB) processes with analytical insights derived from key data sources. Experian has undertaken extensive research to understand how criminals used registered businesses to perpetrate crimes and how data trends from multiple sources can be used to spot suspicious behaviour.

Using a data-driven approach which provides adaptable, client-controlled AML strategies and analytics, we allow you to automate manual processes, improve your ability to detect risk, and enable you to provide the smooth experience being demanded by your customers.

How do AML flags work and what's the data behind them?

Adverse Markers

AML Flags analyse two data sources for patterns which can indicate suspicious activity. The first is Adverse Markers.

Adverse Markers use Companies House data to highlight predictive characteristics to identify unusual behaviour. Companies displaying a combination of these markers require enhanced due diligence. There’re four categories of flags:

- Business profile – The way a company was incorporated and the ownership structure.

- Address profile – Identifies addresses commonly used in Financial Crime and whether trading activity is suspicious.

- Ownership profile – Looks at the directors and key parties and highlights risk concerns.

- Activity profile – Highlights if there’s a suspicious number of registered address changes or the director has changed nationality.

Cash flow profiles

The second data source is cash flow profiles.

Cash flow profiles play a crucial role in identifying financial crime within a portfolio. By analysing the patterns and trends of cash flows in an account, firms a can uncover suspicious activities and detect potential fraud.

Learn more about our AML Flags API

Interested in discovering our API’s? On Experian’s Developer Portal you can easily access our AML Flags API, via our Know Your Business (KYB) API. Get insight into Experian integration criteria by viewing instructions on how to easily access and integrate data and understand how our API’s meet your business needs.

Download product sheet

How can I access AML Flags?

We will provide a solution that fits with your budget and requirements, but you can rest assured that our data is collected, compiled and delivered to the highest possible quality.

Request a consultation