Overview

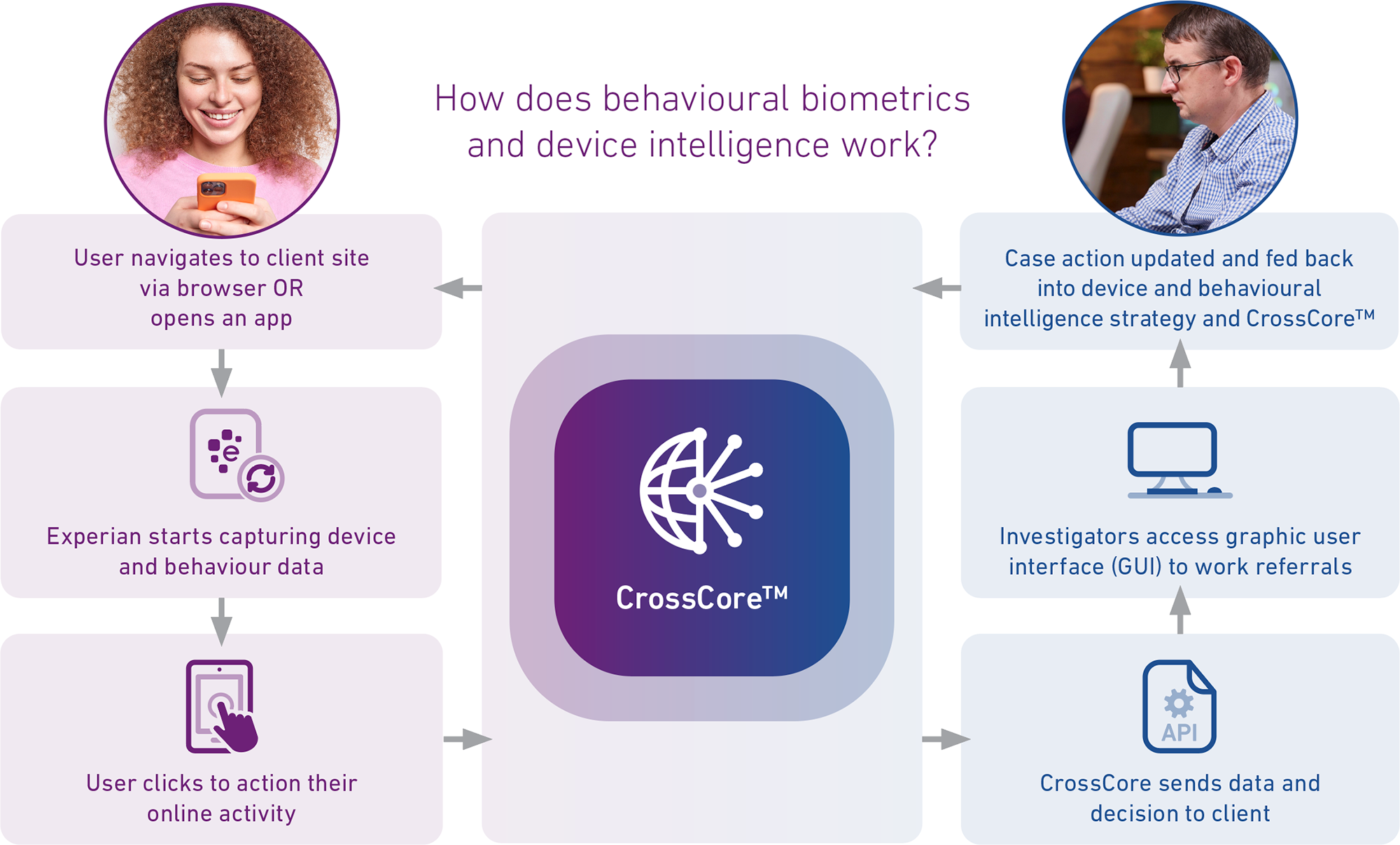

Our behavioural biometrics and device intelligence solution, available via CrossCore, continuously monitors thousands of signals to predict the likelihood of a user’s session being fraudulent

Leveraging both bespoke rules-based risking and supervised machine learning models, the service is designed to optimise fraud catch whilst minimising false positives through the customer journey.

What's new?

Know Your Customer (KYC) and standard fraud tools focus on assessing the individual and their standard personally identifiable information (PII) attributes, if there are fraud consortium matches (Experian Fraud Exchange, CIFAS) and whether there’s a change of address.

Device and behavioural biometric data add additional attributes, providing further insight into the user, the device and their location which has proved crucial in the fight against fraud.

Download product sheet

How can I access Behavioural Biometrics & Device Intelligence?

The solution is delivered via our CrossCore that brings together all the data and services you need into a single view via one platform. Offering flexibility and an open API approach, it gives you greater control to manage your risk profile and customer journeys particularly when you need to adapt to changing circumstances.

Request a consultationThe benefits at a glance

A single view of every customer touchpoint

Reidentify returning customers and all their devices, whilst easily seeing every interaction

Compliance

Provides additional support when demonstrating compliance with regulatory requirements

Improved decision-making

By understanding the risks associated with each device and customer interaction, you can make more informed decisions

Device consortia

Protect your organisation by quickly identifying devices that have been involved in fraud elsewhere

Efficiency

Streamline the risk assessment process by automating the collection and analysis of device and behaviour-related data

Reduce false positives

Support more accurate customer recognition, improving customer experience and reducing false positives

Improved customer experience

Genuine customers can access accounts quickly and easily while preventing even if they have login credentials

Single open platform

Where data and services can be quickly and easily added to enable you to adapt to the changing environment