What is a business credit score and how can you improve it?

Why improving your business credit score is important for business success

Understanding and improving your business credit score is key to navigating the challenges ahead and safeguarding your business in uncertain economic times. It could also help you open the door to new opportunities. From winning new business, to securing finance and investment.

To help you get started, we’ve put together this guide to managing your business credit score, and how to check the business credit score of your suppliers.

What is a business credit score?

A business credit score is the measure of a business’s creditworthiness, which is made up from a number of factors to understand the financial position of a business and its level of financial risk. The score ranges from 0 to 100, with 0 representing a high risk and 100 representing a low risk.

How can business credit scores protect your company in difficult economic times?

Just as a good personal credit rating can help you secure the best deals on financial products like a credit card, loan or mortgage, a good business credit score can help you access finance and investment for your company. As well as providing extra funds at a crucial time, it could also save your business money, by making you eligible for better deals and lower interest rates.

If your business credit score is low, you’ll have to pay more to secure finance, pushing up your overall costs while giving you less to invest. For example, investing in energy efficiency measures are helping small businesses (SMEs) to manage their energy costs and improve their sustainability to win new business.

However, a good business credit score isn’t only important for securing finance and investment. It’s likely that new suppliers and partners will complete a company credit check before agreeing to do business with you or agreeing credit terms.

And, if your clients are other businesses, rather than consumers, it’s likely your customers will complete a business credit score check too, to check the financial health of your company.

A good score could help you bring a great new supplier or partner onboard, agree more flexible credit terms, or win valuable new business. A low score could limit your options and mean you miss out on new opportunities.

This also works the other way of course. At a time when many businesses are struggling, taking the time to check the credit score of new suppliers, partners and business clients is more important than ever. Understanding the financial risk of the businesses you work with will help you manage cash flow and avoid bad debt and fraudulent activity, by alerting you to any red flags. It will also help you save the time and money it takes to chase late or missed payments.

What is a good business credit score?

A business credit score ranges from 0 to 100, with 0 representing a high risk and 100 representing a low risk. The higher your score, the better your business credit rating. To improve your company credit score, your aim is to get as close to 100 as possible.

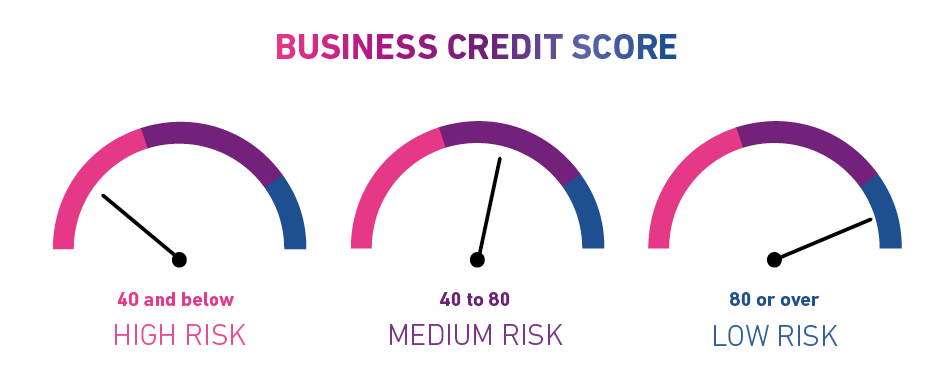

Here’s an overview of what high, medium, and low risk might look like to a lender1.

80 or over: A business credit score above 80 is typically considered excellent. It could also help you access better deals on financial products like business loans, including lower interest rates.

40 to 80: You could be asked to provide additional information by lenders or other businesses such as suppliers, to help them understand your financial position and creditworthiness. Especially if your score is at the lower end of the range.

40 and below: Usually, lenders are looking for a credit score above 40 before they will agree to a loan for example. Providing additional information may help, but your business credit rating could still impact the decision. Similarly, it could put other businesses off working with you.

What affects your business credit score?

So, every business owner’s goal is to get as close to 100 as possible. There are a number of factors that can influence whether your score increases or decreases. Below, are factors that can help you achieve a healthy business credit score.

The type of accounts you file

At the end of every financial year all companies, whether you’re a SME sole trader or a limited company, must file their accounts, Company Tax Return or Corporation Tax with HM Revenue and Customs (HMRC). It’s important to file the accounts fully rather than submitting abbreviated or micro entity accounts. Though it might extend the process, filing the full accounts on time and in line with guidelines can lead to a better company credit rating in the long run.

Your payment performance

Just like with your personal accounts, your history of paying bills in a timely manner can affect your credit score. Get in the habit of paying all your business bills on time to avoid any negative outcomes.

County Court Judgments (CCJs) and insolvency proceedings

If you have either of these against your business, it could make it very difficult to secure finance or credit terms from suppliers. It’s bad news for your company credit score and possibly your personal one too, depending on the terms of the credit you took out.

How is a business credit score calculated?

This information provides credit reference agencies with more insight into the financial health of your business. Our business credit score is calculated by a statistically derived algorithm, designed to determine risk based on multiple factors.

How can you improve your business credit score?

There are some regular habits that form good business practice and can help towards improving your business credit rating. Here are seven top tips that could help put you on the road to success:

- Pay your business bills on time to improve your payment performance and avoid action being taken to chase late or missed payments, which could lead to CCJs or insolvency proceedings. This will also help you to build good relationships with the businesses you work with. You can ask your suppliers or partners to share payment information on your behalf to credit reference agencies like us, to help build a positive payment history.

- File full accounts with HMRC and Companies House, rather than abridged, filleted or micro-entity accounts, on time and in line with guidelines, to provide more data about the financial health of your business. Abridged and filleted accounts have recently replaced abbreviated accounts.

- If any of your business information changes, such as your registered office address, update it quickly with HMRC and Companies House, and notify suppliers, partners and customers. This will help to keep your business credit score data accurate and up to date.

- If you’re a sole trader or part of a non-limited partnership seeking business financing, it’s crucial to be aware of the potential impact on your credit rating, which differs from limited businesses. Many lenders offer the option of checking your eligibility for financing without any adverse effect on your credit score. However, for non-limited businesses, applying for financing without this eligibility check may trigger a credit search, subsequently recorded on your business credit record. If your application is denied, it can lead to a credit score decrease. Additionally, making multiple financing applications simultaneously could signal financial struggles to lenders. To enhance your application’s approval prospects, use eligibility checkers or request quotes before officially applying, safeguarding your credit score and only applying when essential.

- If you’re a new start-up or a microbusiness, it’s important to use business finance rather than personal credit or personal guarantees to build up your business credit score and provide an accurate picture of your business’s financial health. This will help you to keep your personal and business finances separate and protect you from risk. In the meantime, lenders may look at your personal finances, if you have very little business information to share. Start by opening a business bank account to manage your business finances.

- Regularly check your business credit score and sign up for alerts that notify you when your credit record changes. This will help you to sort out any issues quickly and take advantage of the benefits as your credit score improves.

- Regularly check the business credit scores of the businesses you work with, including your suppliers, partners and clients. This will help you to spot any signs that they could be in financial difficulty, and work with them to avoid any issues, such as late or missed payments, or reduced credit terms.

How can we help?

We provide tools and solutions to help small business owners make better decisions about their suppliers and customers, and understand and manage their own business credit score.

- Experian Business Express allows you to run credit checks and monitor any company you work with, so you can spot signs of trouble early on and make informed decisions.

- With My Business Profile, you get full visibility of your business credit profile, enabling you to understand what’s affecting your company credit score and preventing you from being able to obtain that all important company finance.

- With our Score Review Service, simply provide additional financial information to us and we’ll review your business credit report. 96% of reviews result in a positive uplift.

Get in touch

Make your business stronger. Review your own business credit score and improve it.

Get in touch[1] How a good business credit score can help you grow your company, Federation of Small Businesses