Single Customer ViewA guide to comprehensive identity resolution

Guide

Why does a Single Customer View matter?

A Single Customer View can be a game-changing tool for helping businesses gain deeper customer insights and improve marketing effectiveness. By cleaning and consolidating customer data into one unified profile, you can better understand consumer needs and preferences. More than that, you can make more strategic business decisions built on a solid foundation of high quality data. SCV isn’t just about collecting data—it’s about transforming how data is managed and analysed to drive significant business growth.

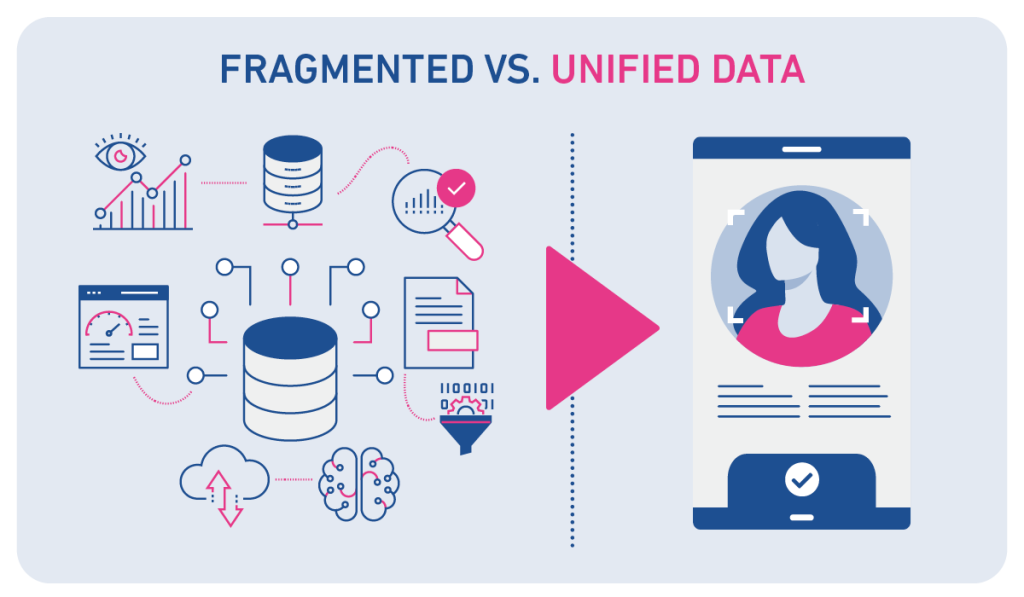

Businesses of all types collect vast amounts of customer data to enhance marketing, improve experiences, and drive revenue. But when data is scattered, unmanageable, outdated, or duplicated, it creates confusion and inefficiency.

A Single Customer View (SCV) solves this by unifying data from multiple sources into a complete customer profile. This deeper insight enables more relevant and effective interactions. Its impact is clear—90% of companies say SCV reduces costs, 80% see it as a sales driver, and businesses expect a 70% increase in customer value annually.

However, SCV isn’t just about merging data—it requires a strategic shift in how data is collected, maintained, and analysed. It also needs organisation-wide support and buy-in.

What is a Single Customer View?

A Single Customer View (SCV) is a complete, up-to-date record of a customer, combining data from multiple sources into one profile. It helps businesses understand behaviours and preferences, allowing them to target customers more effectively and personalise interactions.

Understanding a Single Customer View

A SCV puts all of a customer’s known online and offline data and account information into one place, allowing brands to better understand their:

- past behaviour

- past purchases

- communication preferences

- debt history (or lack of)

- propensity to buy new products or services.

Every customer wants to be treated as an individual, with their history, wants, and needs accounted for. By putting all of the information you hold about a customer into one internally accessible place, every member of your company will be able to better serve that individual customer by understanding their prior relationship to the brand.

A SCV is key to improving customer retention across financial services, telecommunications, retail, utilities, and banking. It also supports regulatory requirements, particularly those related to responsible lending, and ensures you manage your customers in a fair and compliant way.

You can also consider it the key ingredient when planning and executing truly effective multi-channel marketing strategies. This is particularly important because customers expect a joined up approach. Being sent a campaign email that follows seamlessly from an online ad or SMS ensures their brand experience is consistent and relevant.

It’s important to remember however, that a SCV is not the finished product and won’t transform your marketing efforts simply by existing. It’s the actionable insights gleaned from the SCV that will allow you to share effective marketing at the right time and through the right device.

Applying a Single Customer View to different sectors

While the benefits and challenges of a SCV are largely universal, there are of course sector-specific considerations to acknowledge.

Banking and financial services

As well as adherence to strict regulatory requirements that ensure banks and lender treat customer fairly, robust data management helps financial organisations to better understand the customer’s:

- total amount of investments

- total amount of credit

- number of products or accounts

A clear and coherent SCV made up of this data is particularly important when you think about the complex structures of financial organisations, and the need to better understand a customer and their behaviour before making a lending decision.

A SCV is also a crucial element when it comes to mergers and acquisitions, which have become more frequent within the financial sector of late. Implementing one ensures you have accurate and up-to-date customer records and an understanding of the crossover of existing and acquired customer base. This reduces the risk of non-compliance with GDPR and provides the basis of understanding calculated risk for things like FSCS (Financial Services Compensation Scheme). Similarly, it helps organisations adhere to the Financial Conduct Authorities requirement of having a clear understanding of their customers.

On a more logistical level, by pulling fragmented customer data from multiple systems, organisations can merge and consolidate duplicate records, ensuring consistency and eliminating redundant data for more effective working.

Gambling and gaming operators

Bonus abuse is a hot topic within gambling right now, with some players signing up for multiple accounts in order to exploit special offers meant for new account holders, such as extra money or free plays.

A SCV provides the information needed to determine bonus abuse and save gaming organisations money, as well as adhering to gaming affordability checks and the Gambling Commission’s regulations.

In fact, being able to understand players is such an important aspect of this industry, that it has its own tailored SCV called a Single Player View. This allows gaming operators to get a clear view of vulnerable individuals, avoid bonus abuse, and minimise the risk of gambling related harm.

Charities

Poor quality, out-of-date, and incorrect data can seriously hinder an organisation’s income, which is a major issue for charities.

Having a mass of information stored in multiple places can lead to data silos and ultimately an unclear view of donors. This makes it extremely difficult to personalise messaging and deliver the communications in order to generate donations.

By undertaking a data cleanse, de-duplicating information, and enriching data, charities can drive operational efficiency and optimise supporter engagement.

Key takeaway

A Single Customer View creates an aggregated, consistent representation of all the data known by an organisation about its customers. Benefits include more effective marketing and a better customer-brand relationship, which can lead to a competitive edge and business success.

Understanding identity resolution

Identity resolution unifies customer data by linking interactions, identifiers, and records across multiple sources. It is the first step in creating a Single Customer View (SCV), ensuring data quality and accuracy before it is used for insights and engagement.

As people move location, change names, incorrectly fill out forms, or provide misinformation (intentionally or not), the more likely your customer relationship management (CRM) is going to be full of duplicates and outdated information.

Identity resolution can help resolve this. It’s a data management process that will enable you to clean up your data prior to using it, so you can be confident you have high quality information to work from.

- Resolve data duplications or inconsistencies

- Prepare, cleanse, merge or migrate data

- Identify marketing targets

- Improve analytics

- Prevent fraud

- Ensure compliance with data or sector regulations.

Key takeaway

Identity resolution cleans up and connects the dots of a customer’s data, identity, and brand interactions in order to create a single, holistic picture. It is the first step in creating a Single Customer View, as it helps organisations ensure their data is high quality before it is used.

What are the benefits of a Single Customer View?

For businesses

- A holistic overview of a customer’s complete history, allowing timely and appropriate communication, as well as an enhanced brand relationship.

- Better understanding of customers’ needs, leading to more targeted product development.

- More valuable customer insights, allowing for more accurate cross- and up-selling, as well as retention.

- Accurately targeted marketing offers and tailored communications, leading to higher sales and increased customer loyalty.

- Reduction of customer call times, leading to fewer complaints and reduced operational costs.

- Insight into debt, allowing for high-risk collections and activities to be prioritised.

For customers

- Useful and more relevant product or service information, leading to more brand trust.

- Being served the right product / service / information, at the right price and right time, leading to customer advocacy and loyalty.

- Regular communication and early warnings to help better manage payments or debt.

- Seamless, helpful customer care and a better brand experience all round.

…and the challenges to overcome?

The benefits of a SCV ring loud and clear however, there are three considerations that could be blockers in using your holistic data effectively.

1. Poor data quality

Data quality is critical to the usability and success of your SCV. In fact, without accurate and reliable data, a SCV just isn’t possible.

We’ve said it before but it’s always worth repeating: good quality data is the key to a SCV.

2. Siloed areas within your marketing team

A marketing team that splits their work by platform e.g. having a social media specialist, an email marketing specialist, an OOH specialist etc. may sound efficient from an expertise point of view. However, you won’t be able to use a SCV effectively if organised this way.

By taking a singular view of one part of the customer journey – and measuring campaign performance individually – siloed areas won’t be able to provide a comprehensive and joined up marketing approach, which ultimately means the customer will suffer with mismatched communications and irrelevant incentives.

3. Inability to merge technologies

As well as breaking down the messaging silos, you’ll need to merge your technologies into one place too. After all, how can you talk to your customers effectively if you have multiple touch points (e.g. emails, SMS, and online ads) that aren’t connected or coordinated?

And finally, a note on GenAI

GenAI is an important tool to consider when creating your SCV strategy and implementation. It can be used to produce highly customised marketing material, as set out by the SCV, which in turn can increase cross-sell opportunities and reduce churn. It can also provide tailored responses to individual customer needs, helping to provide proactive solutions that bolster a positive customer experience.

It’s always worth exploring GenAI and considering the solutions it can provide to ensure time efficiencies within your teams. However, it’s vital to remain cautious when doing this. GenAI is very much in its infancy for creating personalised marketing models, and a human touch will always win out in order to provide a deeper, more holistic understanding of your customer.

Key takeaway

High quality data is the key to an effective Single Customer View. With it, organisations can better understand and analyse their customers, leading to more meaningful and seamless multi-platform messages.

How to create a Single Customer View

One of the most important things to remember about a SCV is that it’s not simply a dump of all the data you have on a customer, consolidated into a single place for ease. Rather, it’s a strategic step in being able to refine your understanding of that customer to better serve them.

Take a look at the key steps when planning, creating, and maintaining a SCV.

1. Prepare your business for change

A SCV provides benefits for every department in your business; from creating a unified platform for customer service teams, to ensuring the marketing department can deliver full-scale campaigns across a number of touchpoints. However, buy-in and effort is crucial from all teams in order to make this happen.

It’s also important to remember that even though creating and managing a SCV isn’t a top-down process, it will likely need championing from senior teams in order to drive meaningful change.

2. Define your objectives

To better determine your objectives, start with where you are now and conduct an honest appraisal of your current data quality and its capabilities. Doing this will help you understand what areas of information are missing.

You’ll then want to prioritise key data feeds and set clear objectives of what you want the SCV to help you achieve.

3. Identify your data sources

Identifying data sources can be the trickiest part of consolidating all your information to a SCV. After all, widely dispersed and fragmented data can lead to missing information and an inaccurate picture overall. A great way to start this task is by asking each department to locate all of the sources they use to manage information. This could include sales records, CRMs, or email databases.

Remember, the volume of data you’ll be handling is likely to be so high that manual processes simply won’t cut it. Invest in technology to ensure accuracy and organisation.

4. Collect and cleanse data

Arguably the most important step in creating a SCV is to collect and collate your data, otherwise known as the identity resolution process. As customers change their names, move locations, or incorrectly provide information, your data is likely to become inaccurate, outdated, or full of duplicates.

An identity resolution will help you clean up this misinformation in real time, ahead of creating a SCV. This will then give you the confidence that any data used is high quality, meaningful, and correct.

5. Unify customer profiles

With all of your high-quality data now in place, it’s time to merge the information into a singular database. Remember, even after cleansing your data, one customer could have multiple profiles which means you need to merge the data and remove any repetition.

Connecting your sources at this stage means you can also ensure that any new data will be allocated to the correct profile.

6. Enrich your data with additional information

Fill any gaps in information with additional data sources or third-party data, for a more comprehensive view of your customers.

This isn’t an essential step, but it’s one we’d certainly recommend to provide a well-rounded look at your customers.

7. Invest in analytics to gain insight

Gathering data and organising it appropriately is only half the story. Understanding what that data is telling you and putting it into an effective plan is where the real value of a SCV comes into play.

For example, by viewing information like loyalty scheme data alongside previous purchases, you can better understand what your customers may want or need, which can then be translated into promotions or new business offerings.

8. Action those insights

Don’t let all that hard work go to waste. Revisit your objectives from earlier in the process to see how your data analysis can be actioned.

9. Continually maintain and update the SCV

Data can become outdated quickly, so regularly monitoring the information your SCV holds is an essential part of the process.

For example, when it comes to assessing the accuracy of the contact details you have on file, you could use monitoring technology as part of a broader data-management strategy or keep track of specific campaign response rates, like email bounce or returned mail.

In conclusion

A SCV is more than a data consolidation tool. It’s a strategic asset that enhances customer relationships, optimises marketing efforts, and drives business growth.

By integrating high quality and accurate information across all touchpoints, organisations can deliver seamless personalised customer experiences that enhance trust and loyalty, as well as ensuring they hit regulatory requirements with ease. However, creating an effective SCV requires full organisational commitment to data quality, cross-functional collaborations, and the right technology.

We can help

Implementing a SCV is fundamental when building effective marketing strategies, driving business success, and ensuring a first-class customer experience. Creating one requires both cultural and systematic changes from within an organisation, and can be a complex process. But with our help, it doesn’t have to be.

Experian has a wealth of experience managing the data, rules, and logic needed to create a clear and comprehensive SCV. We also draw on our own extensive data assets to support the process.

Together this means we can provide full cross-channel insight – from social media and email, to mobile repositories – helping you communicate with your customers effectively, no matter the platform or device. This level of targeted engagement can then be translated into tangible ROI that helps drive your business forward.