Health-Conscious Britain

Read our latest report, in conjunction with Reward, to uncover the latest UK health and wellness trends through market-level spend analysis.

Download our report now

Are consumers following through on their New Year health and wellness resolutions, or is spending telling a different story?

With January 2025 behind us, many have embraced new habits and lifestyle changes after the festive season. We’ve delved into consumer spending trends to uncover whether these fresh commitments to health and wellness are reflected in how people are choosing to spend their money.

In this report, we’ll cover

![]()

Health and wellness spending shifts

![]()

Growth in online shopping

![]()

Market-wide transactional insights

![]()

Opportunities for retailers

Sneak peek

What's inside the report

Introduction

January 2025 has been and gone, bringing with it a wave of new resolutions following the indulgence of the festive season. We set out to explore how these resolutions correlate with consumer spending and whether people are staying committed to their health and wellness goals.

And our initial findings reveal that they are. Analysis of consumer spending over the six weeks ending 20th January 2025 shows a 6% rise in nutrition and fitness-related transactions, including gym memberships, home meal services, and organic grocery products. In fact, we saw an 11% spike in gym sign-ups in December, followed by a 4% sustained rise in fitness spending into January – indicating that fitness resolutions are planned ahead of time.

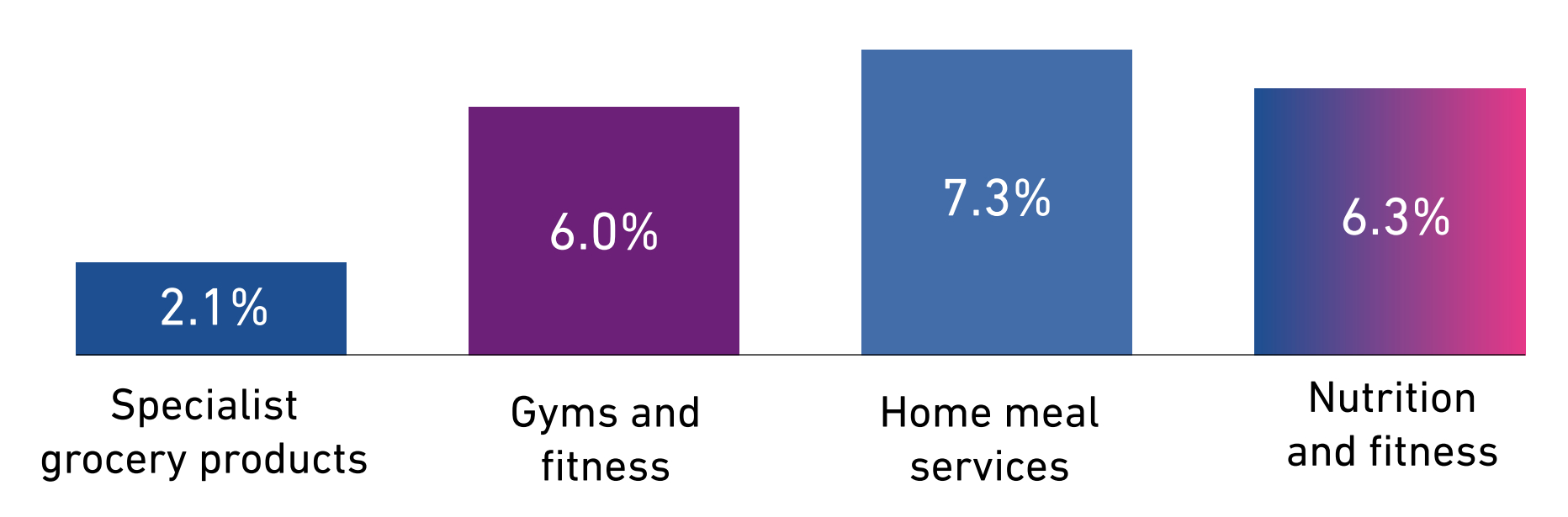

YoY spend change in Nutrition and Fitness sectors

- Nutrition and fitness spending: gym memberships, home meal services and specialist grocery products

- Specialist grocery products: premium organic brands

- Home meal services: Recipe Kits and Meal Prep delivery boxes

At the same time, we examined consumer spending behaviour around the January sales period to understand how discounts influenced purchasing decisions. With the cost of living still a key concern, consumers are becoming increasingly selective about where they spend their money.

Working with our partner Reward, we analysed over 1.4 billion card transactions from 10% of UK households across 4,000+ retail brands. Incorporating demographic insights, we identified key consumer groups where the most significant shifts in spending have occurred, while recognising that all age ranges have seen increases. This analysis explores the segments experiencing the greatest changes and the factors influencing their purchasing decisions at the start of 2025.

Want to read on?

Download the full 'Health Conscious Britain' report now

Read our paper to uncover the latest UK health and wellness trends through market-level spend analysis.