Transactional segmentation isn’t just a nice-to-have marketing tactic, it should be considered a vital part of your eCommerce strategy if you’re to share messages that resonate and generate higher sales.

As one of the most reliable sources of information for customer behaviours and habits, transactional data can help you turn browsers into buyers and ensure all customer journeys yield actionable insights.

If you’ve ever received a marketing email or social media advert that feels incredibly specific to a product or service you’re interested in, it could be the result of a successful transactional segmentation campaign.

What is transactional segmentation?

Transactional segmentation is the analysis of customers’ purchasing behaviours and histories to categorise them into smaller, distinct groups based on common traits, allowing for more targeted and effective marketing.

What is transactional segmentation?

Marketing segmentations are a means to better understanding your customers, and transactional segmentations are no exception.

Put simply, transactional data gives you a clear understanding of customers interaction with your business, allowing you to split your customer base into smaller, more defined groups based on shared purchasing characteristics.

By becoming aware of a customer’s purchasing behaviour and history, you can begin to spot patterns and preferences and create more relevant, appealing, and effective marketing campaigns which lead to higher sales.

The types of transactional data you can collect include what they bought, when they bought it, and how much they spent. Together this gives you an idea of their behaviours, such as buying patterns, purchase history, purchase frequency, and the products or services they prefer.

All this information will help you draw handy conclusions about your customers, such as which group is more likely to take you up on offers and promotions, or who is more likely to buy bigger ticket products and services.

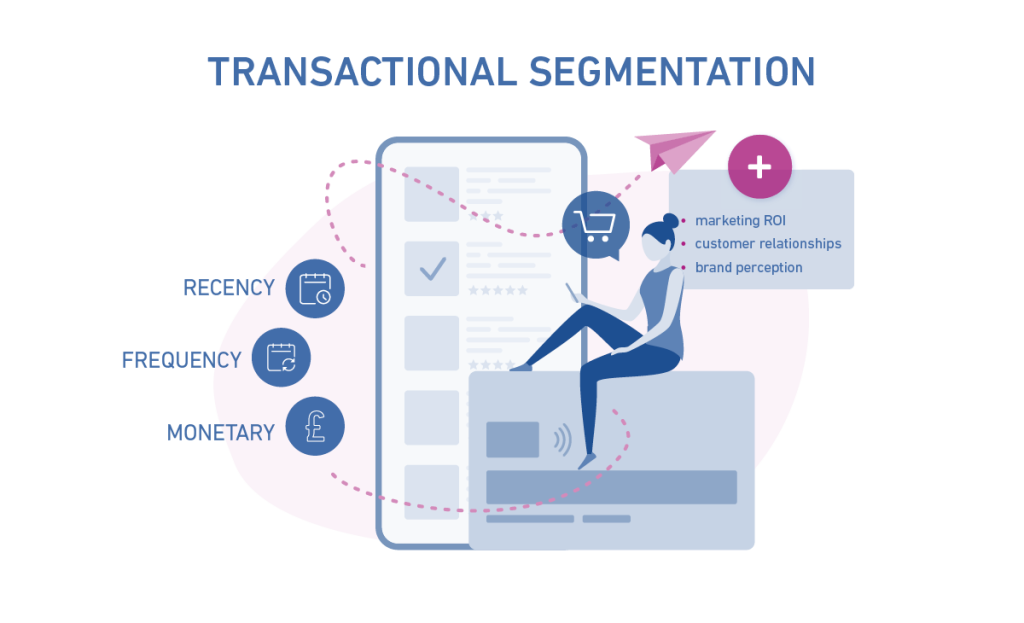

Creating campaigns that speak directly to a consumer’s interests and behaviours can be powerful in three ways, as it:

- Maximises the impact of your marketing spend, as you’re effectively increasing your chances of offer uptake, resulting in a better ROI.

- Helps build strong customer relationships. By providing a needed or wanted product or service, customers are likely to remain loyal.

- Allows your brand to stand out. In a crowded market, targeted campaigns that make a customer feel special and valued go a long way.

What is an RFM model?

RFM modelling stands for modelling, and is a structured and systematic way to categorise customers into transactional segments. It is also known as RFV (Recency, Frequency, and Value) modelling. RFM and RFV models are built using three key factors:

- Recency – how recently a customer has made a transaction with your business.

- Frequency – how frequently a customer engages or transacts with your business.

- Monetary / Value – how much money a customer spends with your business.

RFM analysis is one of the most common forms of transactional segmentation. Instead of taking all your transactional data and pouring through it manually hoping to spot consistencies, an RFM model helps to articulate this information in a clear and logical way.

Using the model, you’ll be able to spot both high- and low-value segments of your customer base, as well as map out predictions of how they’re likely to interact with your business in the future.

Once you have all of that data to hand, you can use it to facilitate transactional segmentation that answers questions such as:

- Who are your best customers?

- Which of your customers are likely to increase your churn rate?

- Which of your customers can be retained?

- Which of your customers are likely to be won back?

- Which of your customers has the potential to become valuable?

The answers from these questions will help you create targeted messages, campaigns, and promotions that best match the customer’s relationship with your business.

Key Takeaway: Refine your RFM model

Continuously refine your RFM model by updating it with the latest transactional data and adjusting segment criteria as necessary. This ensures that your segmentation remains accurate and reflective of evolving customer behaviours.

How to create an RFM model for analysis

There are four basic steps when creating an RFM model and analysing it:

1. Build your RFM model

You first need to assign your Recency, Frequency, and Monetary values to each customer. You can find the raw data for these categories within your company’s CRM database. The data can then be compiled into a spreadsheet.

2. Divide your customers

You’ll now want to divide the customer list into tiered groups for each of the three attributes(i.e. Recency, Frequency, and Monetary). It’s recommended to divide customers into at least four tiers per attribute. For example, low-tier customers, mid-tier customers, high-tier customers, and top-tier customers.

This would look something like this:

| Recency | Frequency | Monetary |

| R1 – (most recent) | F1 (most frequent) | M1 (highest spend) |

| R2 | F2 | M2 |

| R3 | F3 | M3 |

| R4 (least recent) | F4 (only one transaction) | M4 (lowest spend) |

3. Create customer groups

Now’s the time to attribute specific types of communications and messaging to each customer group, based on their RFM segments. An example of this could be taking those found in the R1, F1, and M1 tiers – i.e. those who spend the most money, do it frequently, or have done it recently – and labelling them your ‘Best Customers’.

4. Create targeted marketing strategies

Following customer grouping you can now start to create marketing strategies and campaigns that will best resonate with their transactional behaviours.

Some examples of this could include:

- Rewarding your best customers with loyalty programs or first access to new products and services, as they’ll act as champions who’ll help promote your business.

- Winning back customers who used to buy often but haven’t recently, with relevant promotions to encourage another purchase.

- Sending personalised reactivation campaigns and surveys to customers who haven’t spent at all recently, to spark a purchase and provide qualitative data on why they left.

Key Takeaway: Personalise customer communications

Leverage the insights gained from transactional segmentation to personalise your customer communications. Craft tailored messages and offers that speak directly to each segment’s preferences and behaviours, increasing engagement and driving sales.

What are the benefits of transactional segmentation and RFM modelling?

Affordable to implement

RFM modelling and analysis don’t require advanced marketing knowledge, which means you won’t need to hire specialists or spend money on analytical training.

Effective for customer insights

You don’t need to create large or complex marketing campaigns to get the data needed for RFM modelling. A simple, cost-effective email campaign can provide just as useful information.

Great for customer retention and satisfaction

Let’s say you segment a regular customer into a VIP list and acknowledge their loyalty with a ‘thank you’ promotion. As well as increasing their sentiment to your brand, you may also increase their purchase spend and the likelihood they’ll come back.

Increased response rates

If you create a single marketing campaign for all of your customers, it’s likely the response rate will be low as it can’t speak to everyone’s needs and preferences. However, by segmenting campaigns more specifically, you’ll be able to hit upon specific messaging that resonates with each customer group.

Simple and straightforward to complete

RFM modelling can be done using a standard spreadsheet and doesn’t require complex tools. The results will also be easy to understand, interpret and act upon, meaning you won’t have to get to grips with any new analytical software.

Are there any downsides?

RFM modelling may be a powerful tool but it does have its limits, as it:

Can be prone to human errors

Only needing a spreadsheet and set of customer data to get going with RFM modelling is a huge benefit for those on a budget, but does also mean it’s open for human error. Manually inputting data can cause inconsistencies and issues with your analysis, so it’s best to have a process in place to check this is done accurately.

Could lead to excessive campaigns

With great data comes great responsibility. Don’t fall into the thinking that high-tier customers would be happy to be blitzed with multiple marketing messages and campaigns. You could negatively affect response rates and contribute to a poor customer journey.

Only looks at historical data

You can make logical assumptions on future customers, activities, preferences, and responses with RFM modelling. However, by its nature it uses past customer behaviours which aren’t always as robust or accurate as predictive analytic technologies.

Only looks at three factors

RFM modelling is incredibly useful, but it does only take three specific factors into consideration. They may be important ones, but there are many other variables that could be more relevant to your business, or prior campaign responses.

Inward looking

It’s important to recognise that relying solely on internal transactional data might provide an incomplete picture of customer behaviour. While RFM modeling offers valuable insights into a customer’s past interactions with your business, it lacks context from external sources that could significantly impact their purchasing decisions.

Enriching transactional data for segmentation

Enrichment of transaction data with additional details like customer demographics and behavioural patterns can significantly improve its quality and benefits for marketing activity.

Incorporating further data can enhance marketing targeting by allowing for the following additional segmentation methods:

- Demographic segmentation

- Geographic segmentation

- Behavioural segmentation

- Psychographic segmentation

Additionally, incorporating our Spend Insights into your transactional segmentation can deepen your understanding of customer behaviour. By analysing data from 4 million debit and credit accounts and 3,000 consumer facing brands, Experian tracks both online and offline store-level spending at a daily level. These insights allow for detailed customer profiles, revealing their lifestyle choices, shopping preferences, and spending power, which helps in creating more targeted and effective marketing campaigns.

This enriched data not only improves customer segmentation but also offers a comprehensive view of consumer behaviour, including the impact of economic changes and market trends. It allows you to understand how different channels influence purchasing decisions and measure the incremental impact of your marketing activities. By assessing performance against competitors, you can identify areas for improvement and adjust your strategies accordingly. This leads to better marketing effectiveness and ROI, helping you tailor your messages to resonate more with your audience.

Key Takeaway: Integrate external data

Enhance your transactional segmentation efforts by incorporating external data sources, such as demographic information, spend insights across categories and locations, and competitor intelligence. This provides a more holistic view of customer behaviour and allows for more targeted and effective marketing campaigns.

How can we help?

An RFM model and subsequent analysis of transactional data is a powerful segmentation strategy for eCommerce, and is something we’d definitely recommend using. But it’s not the only one out there.

We can help you with a wide range of customer and consumer segmentation solutions, ensuring you have an up-to-date understanding of how your customers interact with your business.

We can also help you understand how your customers are behaving with competitors and affinity brands and how this is varying month on month through our Spend Insights data.

We are expert in helping organisations activate their segmentation strategies into addressable audience strategies – link to addressability & linkage

From geographic and demographic, to psychographic and age segmentation, why not speak with our experts on how best to categorise your customers to ensure effective and successful marketing?