From an increase in ‘dubious’ company addresses to organisations being set up with directors based outside of the UK, the past few years have seen a stark rise in suspicious business activity.

In fact, between 2019-2021 there was a 116% increase in EU-defined countries who are deemed high risk at purportrating money laundering. The total bill of this particular financial crime? An extraordinary £1.8 trillion and counting.

As a business owner who works with other businesses – either exclusively or alongside individual consumers – this is understandably worrying. How do you know that the company you’re doing business with isn’t a front for criminal operations that could leave you open to financial and reputational damage?

While no industry has a single source of truth to verify whether a company is legitimate and safe to do work with, multi-source data corroboration and verification – such as Know Your Business checks – can help.

What is KYB?

KYB stands for Know Your Business and is the review of a business client before engaging with them.

What are ‘Know Your Business’ checks?

A Know Your Business check – also known as a KYB check – is the process of identifying and verifying a company during onboarding, remediation or in-life monitoring. Checking that the organisation’s identity is genuine and valid can help prevent financial crimes, such as money laundering, terrorist financing, and fraud.

KYB checks confirm that a company exists and is active, and are considered due diligence that will ensure your business adheres to Anti-Money Laundering (AML) regulations. They will also allow you to better understand a company’s:

- Customer profile

- Directors

- Jurisdiction of operations

- Persons of Significant Control (PSC)

- Principal activities

- Shareholders

- Suppliers

- Ultimate Beneficial Owners (UBOs)

Using multiple data sources, such as the Financial Conduct Authority (FCA), Charities Commission, Companies House, and open government-licensed data, will mean you can corroborate and validate the information you find. This in turn will allow you to better assess the level of financial risk the company may expose you to.

Let’s take a look at this in practice.

Say a customer you’re planning on working with is found with consistent information across five different third-party data sources, you should feel confident that they exist and undertake legitimate business activities.

Now let’s say the customer appears inconsistently across a set of data sources – if at all – or there’s evidence to suggest they provide undisclosed monetary services…

These red flags should give cause for concern and encourage you to seek further information or clarification on who owns the business and exactly what they do, before you decide to work together.

Put simply, a successful KYB check will surface any potential red flags that could indicate a greater risk of illegal activities taking place within an organisation.

How is KYB different from other checks?

There are three main checks businesses can put in place to assess their risk of financial crimes: Anti-Money Laundering, Know Your Business, Know Your Customer (KYC).

The main objective of each of these is to ensure all financial transactions made with them are legitimate and safe. However, the difference can be found in the type of customers they check.

KYC checks

focus on consumers and identifying a named individual. KYC checks are often completed for named individuals within businesses too.

KYB checks

focus on verifying businesses, their owners and shareholders, and suppliers.

AML checks

help ensure that a business or consumer is not involved in financial crime. KYC and KYB checks are a base component of AML compliance.

Who should undertake KYB checks?

For banks and financial institutions, undertaking KYB checks and ensuring AML compliance is mandatory. This is due to the high risk of them being exploited for money laundering, terrorist financing, fraud, and other financial crimes.

However, this isn’t the only industry subject to the checks. In fact, any business that is required to adhere to AML regulations should ensure KYB due diligence too. These include:

- Accountants and tax advisers

- Auditors

- Asset managers

- Banks, credit, and financial institutions

- Cryptoasset marketplaces and businesses

- Estate agents

- Gaming, gambling, and casino businesses

- Government and public services

- Insurance

- Legal and compliance professionals

- Notaries

- Online banking

Remember, the above list is not exhaustive and even if your company isn’t required to undertake KYB checks, they’re still a good idea as they can help protect you from financial crimes and reputational damage.

What are the benefits of KYB checks?

Risk mitigation

Due to the prevalence and evolution of financial crimes, large companies can spend over £100m on remediation activity each year. KYB checks can help prevent you from doing bad business, making it an essential and straightforward way to mitigate risk.

Financial crime prevention

Financial crime is said to cost the UK economy around £290 billion per year. From terrorist financing and money laundering to fraud, ensuring due diligence through KYB compliance means you can help prevent illegal financial activities.

Improved lender acceptance rates

Putting in place a KYB solution enables swift and accurate business verification, reducing the need for lenders to do manual checks and speeding up approvals. This approach not only makes onboarding more straightforward, but also supports safer and more efficient lending decisions.

Reduced time and cost for investigation

KYB checks are a verification method that makes due diligence more efficient, allowing financial institutions to focus time and attention more effectively elsewhere.

Product and service personalisation

For banks and financial service providers specifically, KYB checks will give you access to more detailed client information. This is beneficial as you’ll be able to gather insight into the products and services your customers may be using, therefore allowing you to develop and update your solutions accordingly. Also, a more accurate view of your customer can allow greater automation within the due diligence processes, developing targeted pathways depending on the risks associated with the company.

Regulation compliance

Regulated businesses, particularly within financial services, must adhere with requirements and due diligence to prevent money laundering and other financial crimes. KYB procedures help ensure adherence and avoid the legal repercussions or brand-reputation damage that can happen by not staying compliant. Furthermore, using multiple sources of data to corroborate information can further evidence, to the regulator, the stringent checks you’ve put in place.

Real-time and continual updates

If working with a KYB service provider or using an automated KYB system, you can ensure real-time database monitoring which can flag up missing information and risks as they happen. This in turn provides greater protection for your business. You can stay up to date with changes to customer profiles and risk, as well as reducing the cost, time, and resource requirements needed for manual KYB checking.

How do I undertake KYB checks?

KYB requirements can vary from country to country and be subject to regional laws and regulations. However, there are three fundamental steps that all KYB processes should include.

1. Company verification

There are as many as 150 different data points that can be used for KYB verification. While it’s not necessary to source data for every single area, collating as much information as you can about a business you’re planning to work with is always a good idea. After all, the more you know, the better you can manage risk.

The company’s legal name

A registered address as well as trading address (if the two differ)

A registration status and eligibility to conduct business

Licensing documentation for legal operations

UBO, PSC and Director verification

Share capital and shareholders information

Company information, including the number of employees and owned assets

Debt information, including amounts, claimants, and payment statuses

It’s essential that this documentation is obtained from reliable sources and can be scrutinised to ensure authenticity and verification.

It’s also worth remembering that while Companies House can be a valuable source of data, it does not confirm the legitimacy of that data, meaning this verification needs to be done elsewhere.

Validation

Is there any proof that the applicant exists at the address in question?

Incidence of data

How many sources of data can corroborate the information provided?

2. UBO verification

A UBO is the individual who ultimately benefits from a company or has ultimate effective control over it.

KYB checks require the identification of a company’s UBO to help identify any risk associated with ownership, as well as prevent the use of shell companies and ensure the business isn’t being used for illegal activities.

Identify

Understand who owns and controls a company

Verify

Confirm the owners exist and that they are who they say they were

Screen

Check owners do not appear on PEPs and Sanctions databases

3. Ongoing monitoring

Just because a company and its people aren’t involved in suspicious activity now doesn’t mean they won’t be in the future. So, following onboarding and the initial verification of data points, identities, and ownership structure, you must remain vigilant to change and future risk. This isn’t just for the benefit of your business but to ensure FCA and regulatory compliance too.

Regular monitoring of updated information, and periodic transaction reviews will help flag suspicious or fraudulent activity.

Data sources for KYB verification

Experian use over 20 different data sources for KYB, and the data sources can be broadly categorized into four main categories of: address verification, bureau data, public data and fraud and watchlist data.

Address verification

- Current and previous addresses

- Usual Residential Address

Bureau data

- Commercial

- Consumer

- Credit Account Information Sharing (CAIS)

- Current Account Turnover Data

Public data

- Companies House

- Electoral Role

- FCA Register

- Local Data Company

- VAT register

- Many more

Fraud and watchlist data

Typical KYB ‘flags’ and adverse markers of suspicious activity

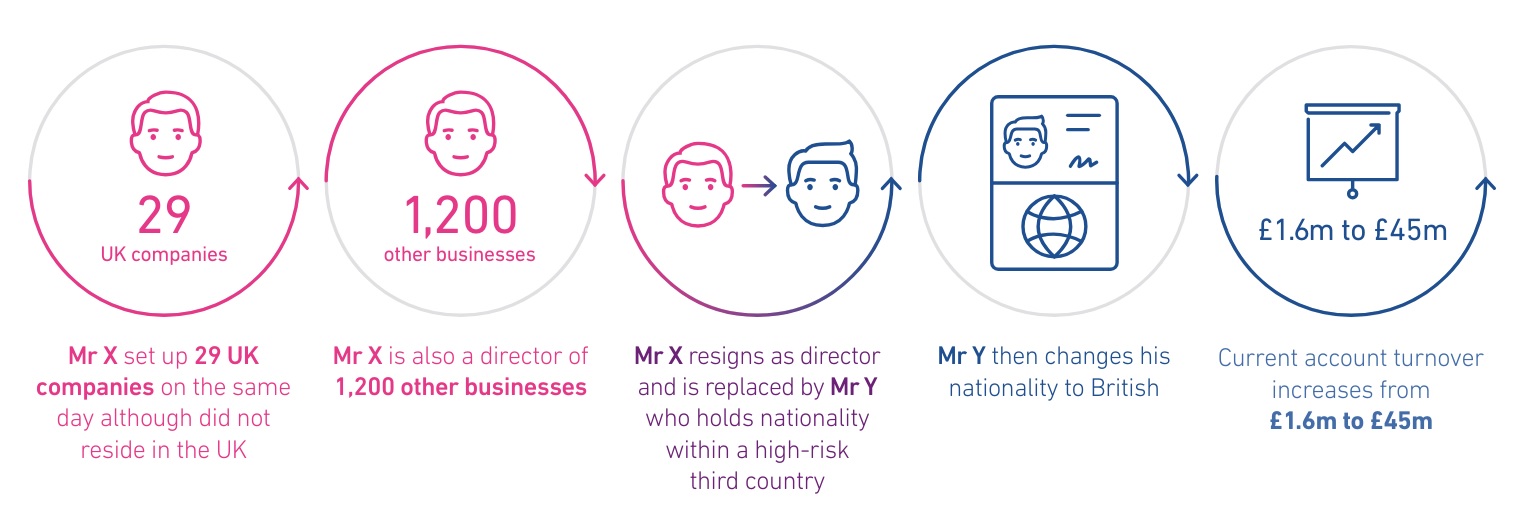

There are many key indicators used to identify potential risks or irregularities within a business’s operational and structural setup during the verification process. These can include the following:

Person of significant control (PSC) missing

Phoenix company

Limited Liability Partnership (LLP) or Scottish Limited Partnership (SLP) ownership

Residential, mailbox or default Companies House address

High volume of companies at residential address

No, high-risk or multi-company directors

Changes of registered address or director nationality

Consistent over performance

Fast money movement

Low average balance

Cash inflow inconstant with filed turnover

Multiple current accounts

Multiple banks

Trading activity while dormant

How we can help

Manual KYB checks can be demanding on your company’s resources, as well as taking up time and budget to ensure they’re done correctly. More than this, automating your KYB checks and verification process can make for easier, faster, and more efficient AML compliance.

We can provide access to the market’s most comprehensive breadth of data, plus our multi-source data corroboration uses over 20 different sources to help expose risks.

Together, this can help you:

- Better understand your customers through multiple data sources

- Gain access to enhanced authentication of directors and PSC

- Spot and deal with suspicious activity

- Verify and evidence customer information and corporate structures

- Streamline your processes and run automated checks

To see how we can help optimise your KYB processes and minimise the risk of financial crime, get in touch.