Why does income and employment verification matter?

In 2024, new credit applications have risen by 6%, with new lending increasing by 15% year-on-year. Despite this growth in applications, financial institutions are seeing processing times growing longer too, leading to delays, wasted resources, and customer frustration.

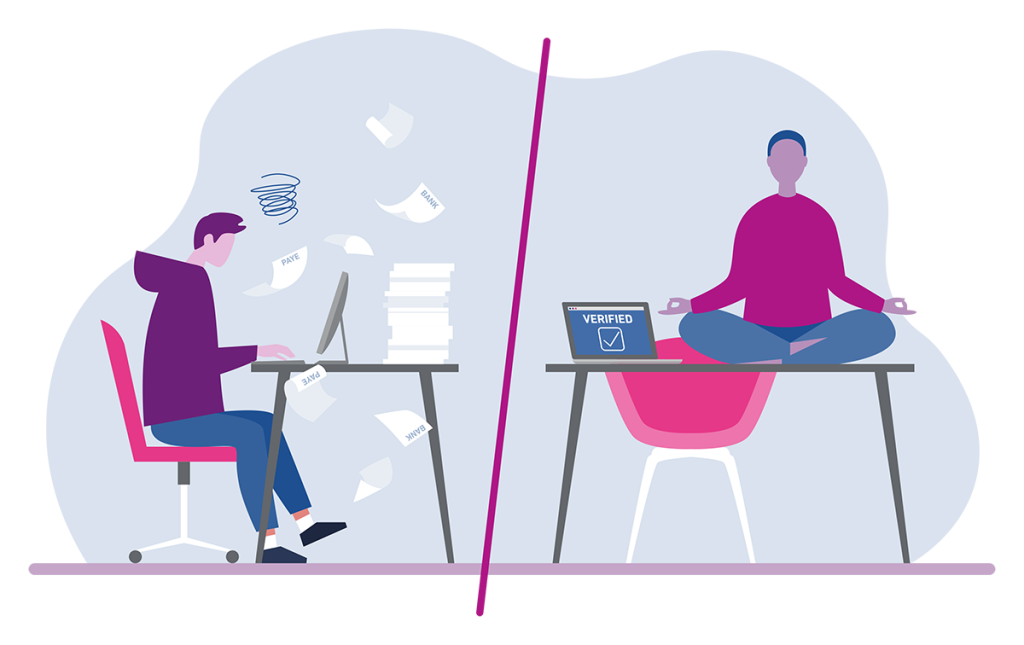

Income and employment verification are crucial for background screening, lending checks, rental applications, and job applications. Automating the income verification process removes the need for manual verification, saving time and benefiting both customers and businesses.

What is income verification?

Income verification is the process of confirming an individual’s income and earning history using documents such as pay slips, tax returns and bank statements.

Financial institutions typically perform income verification checks during affordability assessments to:

1. Ensure the financial product is suitable for the individual.

2. Confirm that the risk of offering credit stays within the lender’s accepted limits

What is employment verification?

Employment verification is the process of checking a person’s work history, including the dates and places of employment. Employment verification can be very useful in a number of situations:

Why use employment verification?

Hiring decisions

Potential employers might check a candidate’s employment status during the hiring process to ensure the candidate is truthful, gain first-hand references, and validate that the candidate has the right experience for the role.

Credit decisions

Employment verification can be useful for financial institutions, too. For example, credit agencies might want to see concrete evidence of a stable work history before lending to a new customer, as this may decrease their risk.

Landlord letting decisions

Landlords often verify an applicant’s employment status before moving forward with a rental process.

All in all, employment verification serves two purposes:

- Provides an accurate overview of an individual’s work history for a new employment basis.

- Provides evidence of repayment capabilities for financial institutions and landlords to decrease credit risk.

How do you verify employment and income history?

Verifying both income and employment history is commonly done manually, with typical employment and income verification documents collected and data recorded. Manual sourcing, however, can lead to difficulties in accessing income and employment data.

The organisation can only move as fast as the applicant can. Clients tell us that manually processing documents takes between 30 minutes to an hour per application. That includes requesting and validating documents, processing the data and finally, making the decision.

Jim Leafe, Product Manager at Experian

Key takeaway

Automating income verification eliminates delays, improves data security and accuracy, reduces errors, and creates a seamless customer experience by removing the need for manual document uploads.

A manual employment and income verification process

Step 1

Applicant submits application

Step 2

Initial review

Step 3

Preliminary decision

Step 4

Request for evidence

Step 5

Applicant sources documents

Step 6

Documents processed

Step 7

Underwriter review

Step 8

Applicant accepted

Step 9

Terms agreed

Step 10

Start of agreed terms

Tasks for verification

During income and employment verification, teams aim to confirm the following:

- Does the document belong to the applicant?

- Is the information on the document accurate?

- Has the document been altered or tampered with?

- Is this the most recent version of the document?

- Is the document’s quality sufficient for clear review?

When financial institutions request multiple documents, such as the last three payslips, it is also essential to ensure they are sequential. Once the documents are validated, they can be passed to an underwriter for a final decision.

Automation of employment and income verification

Automation can reduce the verification process to as little as two minutes, depending on the extent of automation and processes.

Each small automation in the process leads to a slicker customer experience, increasing customer satisfaction and likely raising the Net Promoter score.

Automation of verifications can remove the need for validating and processing, leaving the organisation to focus on decisioning.

Jim Leafe, Product Manager at Experian

Example of verification automation: car loan application

A customer is applying for a car loan online. Traditionally, the process requires back-and-forth communication to collect and verify income and employment details, causing delays for the lender and frustration for the customer.

Solution

By using Experian’s Work Report verification automation in the application process, the lender can streamline complex processes into efficient, customer-friendly verification.

Customer consent is provided within the online form, requiring the applicant to provide only their National Insurance number. This allows the system to securely access income and employment data directly from the source via an API, ensuring the information is tamper-proof.

Outcome

The automated solution instantly delivers the verified data to the lender, eliminating the need for additional evidence requests. This results in faster application processing, greater data security and accuracy, and improved customer satisfaction with a seamless experience.

Clients want to reduce friction in the customer journey as much as possible. Requiring document uploads during the application adds unnecessary steps. Instead, allowing customers to simply provide their National Insurance number and consent streamlines the process. This approach dramatically speeds things up by accessing the data upfront.

Jim Leafe, Product Manager for Verification and Affordability at Experian

Income verification for mortgage eligibility

Mortgage brokers and lenders frequently rely on income verification as part of their processes.

Currently, brokers and lenders depend heavily on self-declared information from applicants. They must then cross-check this data against other sources, such as credit bureaus. However, this method has significant problems.

Mortgage brokers must obtain payslips because it is a regulated activity. This is required 100% of the time as part of due diligence. There’s often a time gap between the request and response. Over the past few years, mortgage rates have been constantly shifting. Even a short delay in receiving the required documentation can lead to a consumer securing a significantly different mortgage rate.

Laura Doyle, Senior Product Manager for Verifications Affordability at Experian

Risks and human error

Another concern is the UK public’s attitude towards honesty in financial applications. Research shows that 16% admit to intentionally misleading mortgage companies about their annual salary in order to purchase a dream home.

When customers are asked to submit their own payslips, brokers are relying on them to:

Be truthful.

Provide the correct documents.

Submit files in a clear and readable format.

The process introduces multiple security risks during the downloading, uploading, and emailing of sensitive information. With so many potential vulnerabilities, it’s clear that the current system leaves much room for error.

When mortgage brokers obtain customer consent to automatically access payslips from the first interaction, they eliminate the risks of delays, poor-quality uploads, or incorrect documents.

Open banking vs income verification

Open banking collects transaction and expenditure data, but it can be difficult for lenders to distinguish employment income from other sources, such as rental property earnings or regular payments from family. Automated systems used by lenders may misclassify these payments as employment income.

Income verification from Work Report connects directly with payroll providers and benefits firms, offering precise income and employment data.

Work Report is importantly less intrusive than open banking. It’s the only data source in the market that provides accurate insight into gross income, which is exactly what mortgage brokers and lenders need. Our network includes the largest payroll and benefit providers in the UK and now also includes data direct from HRMC.

Jim Leafe, Product Manager for Verification and Affordability at Experian

Benefits of employment and income history verification

Regulatory compliance

Regulatory compliance is one of the foremost pressures of any financially-focused business, and it requires significant operational resources to get right.

With the likes of monetary fines and reputational penalties at stake, 75% of compliance decision-makers believe that regulatory demands of their team have increased within the last year. It’s fair to say that an effort across the board is required to stay on the right side of the regulators.

As such, automated background checks and income verification can be the perfect way to ease the burden on the regulatory team itself. Performed without the need for human intervention, compliance can rest assured that the process is working and error-free.

The recent Consumer Duty regulation is a good example. The purpose of this regulation is to improve transparency, fairness and access within the financial industry, and to prevent the mis-selling of financial products that are unsuitable for the customer.

Income verification is helpful in compliance with Consumer Duty because institutions get access to information straight from the source. By integrating with open banking sources, firms can rely on the information they’re given, and make a true eligibility assessment. In particular, this satisfies the suitability criteria of Consumer Duty because it’ll ultimately ensure that customers are eligible for the financial products they receive. This should also lead to fewer defaults.

Key takeaway

Automated income and employment verification helps lenders meet regulatory compliance and Consumer Duty standards, promoting fairness and the sale of suitable financial products to consumers

Decrease credit risk

After the financial crash of 2008, liquidity rules and requirements have become more enforced in the financial sector. For example, CONC regulation states that firms must complete a creditworthiness assessment for customers before entering a lending agreement.

Income and employment verification becomes relevant because institutions have traditionally relied on data sources which might not show the full picture. For example, by relying solely on credit bureau information, which often takes between three and six months to update, firms may miss out on recent changes to a person’s situation, such as a job loss.

However, relying on alternative data sources like income and employment verification provides additional context to an applicant’s financial circumstances. This increases the reliability of the entire application, and can give institutions a better idea of credit risks.

Key takeaway

Income and employment verification provides accurate context to an applicant’s changing financial situation, improving creditworthiness assessments and reducing reliance on outdated data sources.

One of our clients is using employment and income verification data to transform their risk policy. They can use a smaller dataset for one group of applicants and a more detailed dataset for another. Over nine months, they are comparing acceptance rates between these groups and evaluating the accuracy of their decisions based on positive repayment patterns. This approach is helping them fine-tune their credit risk levels and adapt their policy. Now they better understand the amount of data needed to make the most informed decisions for their customers.

Jim Leafe, Product Manager for Verification and Affordability at Experian

Eliminate fraud risks

Without employment and income verification checks, fraudsters can exploit weaknesses in traditional validation methods. Manual payslip sharing, often done through email, creates multiple security vulnerabilities that cybercriminals can target.

Platforms like Experian Work Report eliminate these risks by providing tamper-proof income and employment validation, ensuring data integrity and security.

Key Takeaway

Reduce fraud risks by using ‘golden source’ data – information of the highest quality direct from source – that is shared through an API and can’t be edited or tampered with.

This benefit is especially valuable in situations like:

Credit providers

Ensuring that the applicant matches the name on the application form.

Recruiters

Confirming that candidates are not misrepresenting their experience.

Governments

Preventing fraudulent claims in benefits applications.

Landlords

Proving that prospective tenants have stable employment and are beyond their probationary period.

Improved customer experience

By automating and streamlining the validation and processing stages of an assessment, businesses can optimise their use of employees. Skilled individuals could be moved to a role that’s more valuable to the business, or reorganized to help an organisation meet its staffing goals.

But there is another angle to streamlining operations which builds on the previous mortgage example. Laura reveals:

When the interest rate drops, providers tend to get a flood of new applications that can soon build into a long pipeline. One company recently experienced a flood like this in January and was still working through these applications in June. Often, lenders will actually have to temporarily ‘shut shop’ to make their way through the backlog. There’s no need for this if the onboarding process is made less resource-consuming.

Laura Doyle, Senior Product Manager for Verifications Affordability at Experian

FAQs

Employment verification provides very black-and-white data, providing a record of employment. Alternatively, a reference check supplements this with a recommendation, and provides more context around the role fulfilled.

A finalisation assessment is essentially the last verification stage before an applicant’s decision is made. Final assessments are commonly performed by HMRC in order to assess a student’s eligibility for a grant or loan while in higher education.

In 2018, a major lender in the US identified 63 cases of fake employers listed in lending applications. If you suspect that someone has presented fake employment records, an investigation is likely to be the first port of call. Using a platform with ‘golden source’ API data such as Experian’s Work Report means that you can ultimately verify whether an individual has or has not been employed at the place they are claiming.

How can Experian help?

Work Report is a quick, simple and secure way for employees to share their income and employment information in real time. Eliminate the need for paper or digital payslips and instead help applicants to sail through the verification process with ease.

Work Report with a bespoke demo.

With direct API integration, you can lighten the load of your HR team and drive huge time and cost efficiencies, contributing to a better customer experience.

Find out more