Sustainability in businessThe benefits of ESG reporting for SMEs and corporations

Guide

Sustainability in business has become imperative. Cultivating authentic sustainability strategies that address environmental and societal impacts and risks is how companies set themselves apart from competitors, increase their attractiveness to investors and foster customer loyalty.

But beyond that, it’s acknowledging the commitment to be part of a necessary change to help save the planet and those on it.

Understanding sustainability as part of your business

Business sustainability is a company’s ability to operate in an environmentally, socially, and economically responsible manner across every part of their business and chain. It’s a broad spectrum, from Net Zero targets, to employee wellbeing, to community engagement.

It can be broadly split into two key facets: risk and impact.

Risk: is the environment a risk to your business?

For example, if you’re a mortgage lender with a lot of properties in low-lying lands, these may be at risk of flooding in the future.

Or you may be an investment firm with shares in a mining company. As we move towards fully-sustainable energy efforts, companies like this are a transition risk.

Impact: does your business impact the environment?

For example, are your suppliers only using virgin source materials for products?

Part of a business’s sustainability efforts is their adherence to Corporate Social Responsibility (CSR) – this mandates that companies manage their business processes to produce an overall positive impact on society. It’s about taking responsibility for the company’s effects on environmental and social wellbeing. CSR is often internally driven and voluntarily adopted by businesses that wish to exceed the basic legal requirements.

Environmental, Social, and Governance (ESG) criteria, on the other hand, are a set of standards for a company’s operations that socially-conscious investors use to screen potential investments.

ESG: the three pillars of corporate sustainability

Corporate sustainability is typically broken down into the three pillars of ESG (Environmental, Social and Governance) that businesses should focus on to achieve positive impacts long-term:

Environmental covers how a company performs as a steward of nature.

It includes metrics on:

- Energy use

- Waste management

- Pollution

- Natural resource conservation

- The treatment of animals.

- How a company manages environmental risks and opportunities, particularly those related to climate change.

Businesses need to report their carbon emissions and other environmental impacts as part of their ESG and TCFD obligations.

Social examines how a company manages relationships with employees, suppliers, customers, and the communities where it operates.

Key topics include:

- Employee diversity and inclusion

- Labour standards

- Treatment of workers

- Health and safety

- Impact on local communities

ESG reporting includes workforce metrics and community engagement practices which are crucial for comprehensive sustainability strategies.

Governance (or Economic) involves the system of rules, practices, and processes by which a company is directed and controlled.

It includes:

- The company’s leadership

- Executive pay

- Audits

- Internal controls

- Shareholder rights

Robust governance practices reported in ESG disclosures help businesses ensure compliance and ethical operation which enhances investor confidence and regulatory compliance.

What is transition investing?

Transition investing is concerned with the unique investment challenges and opportunities presented by the shift towards a sustainable economy, in which critical sectors like energy and transportation will see significant change.

It’s important to note a shift in the investment industry from ‘ESG investing’ towards ‘transition investing’. An example saw BlackRock, the world’s largest asset manager, pivoting their investment strategy and language towards this term. Although they are similar, overall they have different focuses.

ESG investing adopts a holistic approach, focusing on a company’s commitment to the environmental, social, and governance pillars when making investment decisions.

Transition investing, on the other hand, examines the distinct challenges and opportunities presented by the shift towards a sustainable economy. It aims to strategically navigate and benefit from changes in pivotal sectors like energy and transportation in the coming years and decades.

ESG reporting for transparency and accountability

ESG reporting is how businesses are held accountable for their performance and impacts in these three areas. It’s critical in assessing a company’s long-term value and sustainability, influencing investment decisions, consumer behaviours, and regulatory compliance.

In the UK, most ESG regulations are mandatory for public companies with 500 employees and a £500 million turnover, as well as for large private and premium-listed companies. That means SMEs aren’t subject to ESG reporting, however, as they are part of the supply chain to larger corporate organisations who are subject to TCFD (Taskforce on Climate-related Financial Disclosures) reporting, in reality some of this burden of responsibility does fall on SMEs.

Key takeaway

For bigger businesses, you need to look beyond your own operational efforts. ESG reporting will hold you accountable for your entire value chain, upstream and downstream. That means that the sustainability of your own business relies on the sustainability of the businesses you do business with (and who they do business with).

The importance of your supply chain

Implementing effective supplier sustainability measures may feel like a lot to manage. However, the right strategy can help align your suppliers with your sustainability goals:

- Develop clear sustainability criteria that aligns with your company’s sustainability goals. These might include energy efficiency, waste reduction, ethical labour practices, and transparent governance.

- Conduct thorough assessments of existing and potential suppliers against your sustainability criteria. This could involve self-assessment questionnaires, on-site audits, or third-party certifications.

- Offer training programs to help suppliers understand your sustainability requirements and improve their practices where necessary.

- Make sustainability a key factor in procurement decisions.

- Encourage suppliers to be transparent about their supply chain and sustainability practices. This could involve sharing best practices and participating in sustainability audits.

- Promote collaborative initiatives that help suppliers overcome challenges in achieving sustainability goals. This could include joint ventures on new technologies or collective participation in sustainability workshops and seminars.

If there are SMEs in your supply chain, be aware of their resource limitations when it comes to reporting – SME sustainability data is notoriously difficult to collate as it can be quite resource intensive for smaller businesses. If you’re an SME, start to prepare for expected sustainability assessments from the businesses you supply to.

Navigating business sustainability as an SME

SMEs have a different level of accountability compared to big businesses. For example, they’re generally not subject to ESG Reporting unless they are listed entities. In a lot of ways, business sustainability is happening to SMEs as opposed to for SMEs, so it’s key SMEs understand how they can get on the front foot.

Key takeaway

By representing sustainability efforts as well as possible, SMEs can better retain current business and win more business ahead of the competition. It also prepares you for sustainability requirements from insurance and financing.

Cost-effective data solutions should be at the forefront of any sustainability strategy for SMEs. With data, you’re able to:

- Offer greater transparency to consumers

- Feed data into Customer TCFD emissions reporting

- Benchmark sustainability efforts

- Provide the bigger businesses in your supply chain with what they need, fostering a stronger relationship in the process

Why sustainability is so important to businesses

Companies that excel in integrating effective sustainability practices not only enhance their risk management, but position themselves attractively for lower insurance premiums and stronger investor confidence.

Risk mitigation

Insurers increasingly favour businesses that demonstrate proactive sustainable practices, potentially resulting in more favourable insurance terms. And going forward, insurers may stop issuing policies or charge higher premiums for businesses that aren’t implementing more rigorous sustainability efforts because these businesses are deemed a higher risk.

Like insurers, investors are increasingly aware of the risks of a business not committed to sustainability – a 2022 survey[1] showed that 78% of investors want businesses to prioritise ESG efforts. Companies that proactively address these risks are seen as more stable and less likely to face disruptive challenges.

Compliance

One major risk that makes sustainability key for businesses is regulatory compliance. With governments around the world tightening environmental regulations, companies committed to sustainability are better positioned to comply with these laws and avoid fines, sanctions, or operational disruptions.

The Bank of England and the Financial Conduct Authority (FCA) are intensifying their demands for detailed ESG disclosures through mechanisms like the ESG Sourcebook and Sustainability Disclosure Requirements (SDRs). Quantifying climate-related financial risks and enhancing transparency around Net Zero plans and Scope 3 emissions is only going to continue.

Making a contribution

While it’s key to business longevity to incorporate robust sustainability practices, overall, corporate sustainability is about tackling the environmental, social, and economic issues that are harming our planet and the people on it.

Businesses need to assume responsibility for the impact they’re having to not only minimise the negative, but actively enhance the positive.

The benefits of sustainability for businesses

1. Cost reduction

Implementing sustainability can lead to substantial economic benefits for companies. For instance, reducing reliance on energy, water, and new materials can cut costs and boost profitability.

Circular economy principles can be financially beneficial – in the UK, adopting a robust circular economy framework could inject an estimated £75 billion into the economy[2], cut 33 million tonnes of CO₂eq emissions annually[2], and create up to half a million jobs[3] by 2030.

2. Brand enhancement

The right sustainability strategy can enhance a company’s reputation, building trust and loyalty among customers and investors alike. Companies perceived as responsible are more likely to garner positive media attention, attract quality partnerships, and enjoy a strong corporate image.

3. Market demand and competitive advantage

There’s a growing consumer preference for sustainable products and services. Companies that cater to this demand not only capture and expand their market share but also strengthen their competitive edge. Investors recognise this trend and are more likely to invest in companies that align with the market’s shift towards sustainability.

4. Customer loyalty and acquisition

Customers today are not only more environmentally and socially conscious, but are also well-attuned to greenwashing from brands – they’re seeking businesses that make authentic efforts towards sustainability and tend to remain loyal to brands that reflect their values.

A recent study[4] concluded that sustainable strategies can positively influence brand image, customer satisfaction, and ultimately, customer loyalty, while First Insight[5] found that 73% of Gen Zs are willing to pay more for sustainable products.

Although many Gen Zs may be young, combined with Millennials, they’re responsible for 25% of total retail spend in the UK[6]. By 2030, that’s expected to grow to 39% as more Gen Zs reach working age.

5. Innovation and Longevity

Sustainability often drives innovation by pushing companies to develop new products and technologies. This innovation not only aids in solving environmental and social challenges but also secures a company’s longevity by keeping it relevant and ahead of market trends.

How to implement sustainability in your business

From SMEs looking to hit the ground running, to larger-scale businesses that want to spend more time focussing on their sustainability strategy, we’ve outlined a simple method to get things off the ground:

1. Define your vision for sustainability

Identify the current situation within your business: where the biggest strengths and weaknesses are, and where there are opportunities. Make sure to address existing and upcoming regulations and compliance here. For example, a weakness could be failure to comply with an upcoming regulation.

Once you understand your business’s situation, work with stakeholders to agree appropriate targets. You may consider using outsourced sustainability experts here.

This is also the time to look into emissions reductions finance opportunities, such as Sustainability Linked Loans for SMEs, or Emissions reduction-as-a-service. The eligibility or commitment criteria for funding may help guide your targets.

2. Comprehensive sustainability strategy

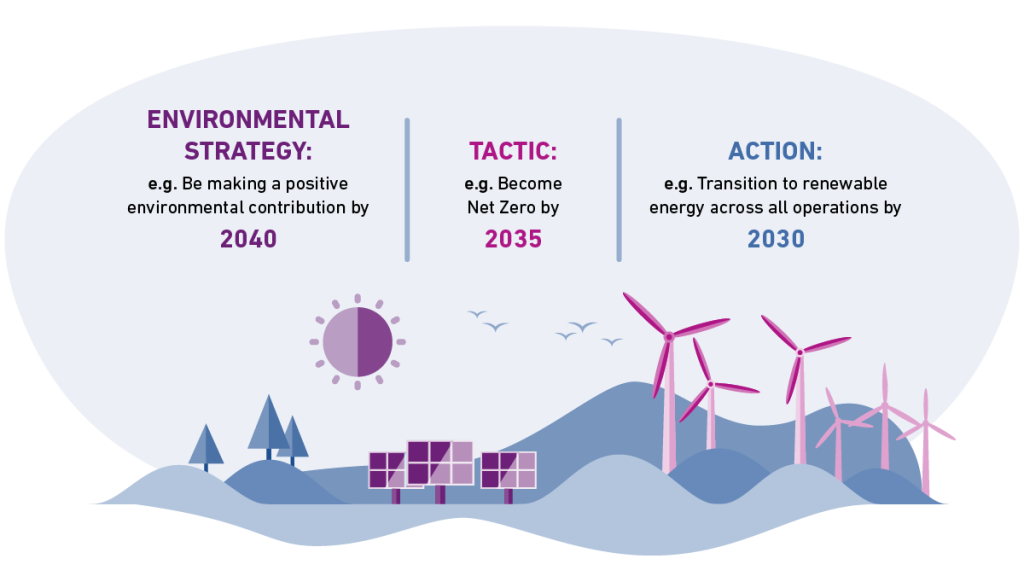

With targets, you can now outline the roadmap to get there – you may even consider a unique strategy for each of the three corporate sustainability pillars. For example, your environmental strategy may be making a positive environmental contribution by 2040.

From there, you can breakdown the strategy into actionable, prioritised tactics. Start with specific sustainability initiatives that offer tangible, measurable results to demonstrate their value and gain more buy-in. So, if that’s to make a positive environmental contribution by 2040, one of your tactics may be to become Net Zero by 2035.

These tactics can then be broken down into more digestible actions, like a transition to renewable energy across all operations by 2030.

Key takeaway

Ensure your strategy has a meaningful impact and doesn’t just sound good. Both consumers and investors are privy to greenwashing and it’s not something business can, or should want to, get away with.

3. Integrate data and technology

There’s increasing pressure, especially from consumers, to offer clear, accessible sustainability data such as greenhouse gas (GHG) emissions, waste, biodiversity, social impact and more. Consumers are boycotting brands that aren’t strong on sustainability, and businesses ending relationships with non-eco partners.

Collecting and preparing data takes both time and cost resource, which is why many SMEs are struggling with it. However, it’s fast-becoming a non-negotiable, so spending time understanding how you can integrate this into the business is fundamental.

One solution is utilising digital technologies as much as possible, such as AI – to help categorise transactions into emissions categories automatically, for example. This way you can operationalise sustainability efforts at scale, enhancing efficiency and transparency. It also allows you to create a repeatable process for data aggregration and reporting that, long-term, reduces the effort and resource expended.

4. Monitor, report, and iterate

You need to benchmark – decide what your measurements will be and how you’ll measure them. The data you’ll gain from benchmarking and reporting will also help you communicate more transparently with both shareholders and consumers.

Regularly assess and report on sustainability performance, then use this data to refine strategies and enhance compliance and effectiveness.

Some of the most common reporting frameworks for corporates and large businesses include:

- Greenhouse gas protocols

- PCAF guidance for measuring and report – Scope 3 Finance Emissions

- Transition Plan Taskforce (TPT) guidelines

Key takeaway

Remember to stay ahead of regulatory changes and be aware of your business jurisdictions. For example, an EU-based business with business in the UK will be subject to both EU regulations, as well as some UK regulations.

The right corporate sustainability strategy shouldn’t negatively impact your bottom line. So before you launch anything, be sure to have concrete data confirming that you can successfully roll out your strategy without impacting the health of your business.

ESG Insights: empowering lenders to support sustainability goals

If you’re a business or SME committed to advancing your sustainability initiatives, you understand the critical importance of having the support of informed and proactive lenders. For lenders, having access to accurate and comprehensive ESG data on borrower portfolios is essential to make informed decisions to ensure alignment with your own sustainability goals.

With Experian’s ESG Insights, lenders can seamlessly integrate detailed emissions profiles and broader ESG profiles of portfolio businesses, giving an actionable, clear view of the ESG risks and opportunities within an SME portfolio. This robust, reliable tool is designed to help lenders manage climate risk, meet regulatory requirements, and enhance processes with precision and ease.

Go forward sustainably

Adopting and enhancing sustainability practices is more than a compliance requirement; it’s a strategic advantage that positions your business for long-term success and contributes to the urgent global effort to combat environmental decline.

By effectively managing your environmental impact, engaging with your community, and adhering to governance standards, you not only align with global sustainability trends but also attract and retain forward-thinking investors and customers.

Embrace this transformative journey to meet the present demands and shape a sustainable future for your business and the planet.

[1] Business and investors at odds over sustainability efforts, EY

[2] ‘How a circular economy can help us build back better’ in Six-point plan for post-COVID growth, wrap.ngo

[3] Employment and the circular economy: job creation in a more resource efficient Britain, Green Alliance

[4] Analysis of the Effect of Sustainable Marketing Strategy, Brand Image, and Customer Satisfaction on Customer Loyalty in the Manufacturing Industry in Karawang, West Science Interdisciplinary Studies

[5] The State of Consumer Spending: Gen Z shoppers demand sustainable retail, First Insight

[6] Inside the latest Clearpay report on Millennial & Gen Z shopping trends, Clearpay