Application FraudPreventing loss from fraudsters at the point of application

Guide

Why does application fraud matter?

Application fraud is a serious crime that can have detrimental impacts on a business. Repercussions can include huge financial losses, a loss of operational licence, severe reputational damage, and legal penalties. More than this, its impact is far-reaching and can be devastating for individuals and the wider community.

The first step to protecting your business against application fraud is by arming yourself with knowledge. What exactly is it? How could your business specifically be at risk? What prevention measures can you put in place to reduce your chances of falling victim?

What is application fraud?

Application fraud is the criminal act of submitting false, manipulated, or stolen information on an application for financial products (such as a loan or credit card) or other type of service for financial gain.

This can include:

- lying about income or credit history

- hiding addresses that feature previous adverse credit

- using fake or stolen identification and documents.

Application fraud can vary significantly in size and scale, from relatively small first-party fraud, such as a deliberate inaccuracy on a single application, to more sophisticated and complex identity takeovers using a mass of stolen information and data.

Fraudulent applications can be made across any lending or new account opening journey. From applying for credit, loans and mortgages, to insurance applications and mobile phone orders, any company that requires personal data from an individual to receive a benefit at the end of the process is at risk.

Application fraud is typically split into two types:

First-party application fraud

This is where a criminal deliberately provides false information or misrepresents their identity, such as exaggerating their income or lying about their employment.

Third-party application fraud

Aka identity theft, this is when a person’s details are used without their knowledge or consent so a criminal can create an account or apply for credit.

Prevention comes first

In 2023, Experian processed over 40 million searches for credit in the UK, and application fraud prevention rates have increased by 20% since 2021.

This shows how critical an application fraud strategy is for every business offering credit in the UK. By stopping a fraudster entering the customer database at the point of application, organisations can save themselves the monetary and reputational damage that can occur from this type of economic crime.

This is in addition to preventing future issues, such as money laundering, terrorist financing, or the trafficking of illegal goods or people.

Application fraud prevention starts with complex identity checks, but these checks shouldn’t negatively impact the customer experience. You don’t want to create friction or a bad sentiment for legitimate customers who may choose to abandon the process and go elsewhere. It’s a delicate balance, and companies of all shapes and sizes face these same issues.

Key takeaway

Application fraud is the act of deliberately providing false, misleading, or manipulated information during the application stage of a customer journey, for financial benefit. This crime is hugely detrimental to businesses and can, depending on the seriousness of the offence, result in prosecution and custodial sentences.

How can it impact a business and who’s most at risk?

The impact of application fraud can be devastating for individuals, industries, and society as a whole. As well as the stress and financial loss that occurs when an individual is a victim of identity theft, application fraud can lead to other types of financial crimes, such as money laundering and terrorist financing. These crimes can in turn help fund illegal industries like human trafficking and drug dealing, both of which are hugely damaging to communities.

For businesses, being associated with this type of crime poses many issues. It could cause a significant loss in staff time and focus on core operational activities while they work to rectify the fraud. More than this, it can mean huge monetary losses or serious hits to the company’s reputation. This in turn can damage trust and lead to a further loss of revenue. Plus, from a compliance perspective, the regulatory fines and loss of operating licence can also be disastrous to an organisation.

Like with most financial crimes, banks, building societies, and finance and leasing providers are most in danger of falling victim to application fraud. However, that’s not to say organisations from other industries shouldn’t remain vigilant. This includes:

- Accountants and tax advisers

- Cryptoasset businesses

- eCommerce platforms

- Gaming and casino businesses

- Trust providers

Difference between application fraud and new account opening fraud

On the surface, application fraud and new account opening fraud appear to be the same thing, and you’d be forgiven for thinking the terms can be used interchangeably. However, they each feature at different stages of the customer journey.

Application fraud – or the attempt of committing it – comes before account opening fraud. It is when a criminal applies for an account with stolen or falsified information. Here, their application may or may not be successful due to the strength and complexity of an organisation’s data checks.

New account opening fraud is the successful outcome of application fraud. With a new account now open, having been created using that stolen or falsified information, it can now be used for illegal activities such as money laundering or terrorist financing.

Key takeaway

While new account opening fraud may appear to be similar, it is instead the successful result of application fraud. That being said, new account opening fraud can be mitigated against by preventing application fraud.

Is application fraud on the rise?

Our most recent affordability update has shown that lenders are becoming cautiously optimistic about the UK economy. However, there’s no doubt that the past few years have been tough on people’s finances, creating challenges.

- Cost of living: The cost of living increase has created a temptation for some to misrepresent their personal information and make fraudulent applications in order to increase loan amounts or credit limits, sometimes with no intention to make the repayments.

- Technology and artificial intelligence (AI): Advances in technology have seen fraudsters commit highly complex and sophisticated scams, such as bypassing a company’s immature security system or falsifying documents en masse. Both instances can leave organisations vulnerable and unable to manage the high volume of applications in need of a manual review.

These situations have created a perfect storm in which application fraud remains a significant threat to financial institutions and organisations.

How can you reduce the risk of application fraud?

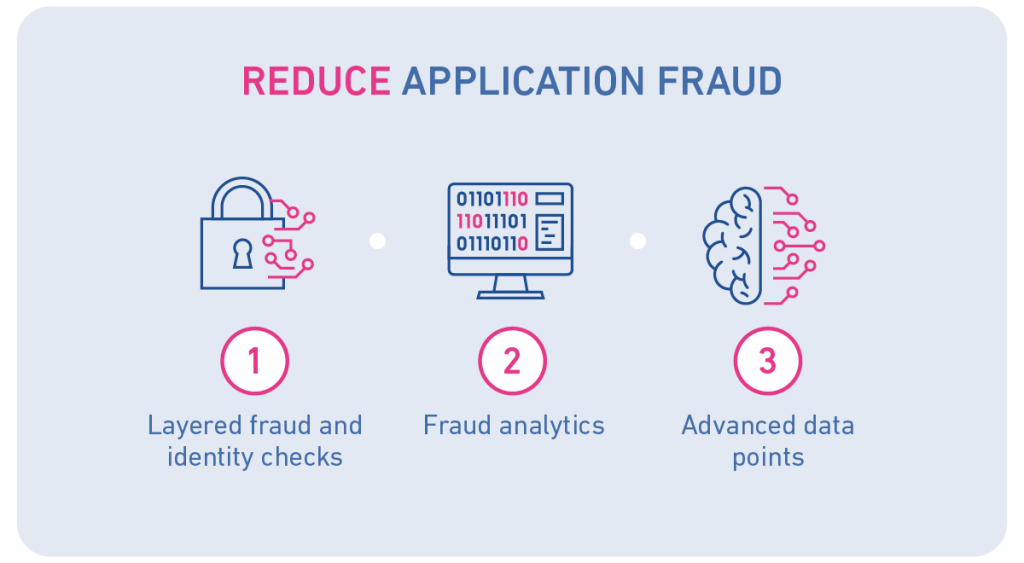

1. Implement layered fraud and identity checks

One of the most critical and effective ways to manage fraud during the application process is through layered fraud and identity verification. Blending capabilities, data, and analytics can empower a company to more accurately assess and identify both genuine and suspicious applications. This in turn means legitimate customers won’t be impacted by an overly complex process.

Experienced fraudsters can easily navigate a single system or handful of data points, so by combining data sources and technology to create a more sophisticated approach, businesses can better assess and analyse an application. More than this, an organisation will be able to flag any suspicious data points in context to the other information shown.

2. Stay on top of fraud data analytics

Fraud analytics is the blend of data analysis, statistical modelling, and machine learning to assess an organisation’s likelihood of fraud. Together, each area helps build a bigger picture of an individual’s application to help detect suspicious patterns and out-of-character behaviours. This is done across multiple data points and in real time.

Staying on top of this brings with it huge benefits in fraud detection and prevention. From finding fraud faster and more efficiently – which can be significant in saving time and money – to prioritising focus on riskier applications and therefore ensuring legitimate customers have a more frictionless and happier experience.

3. Use advanced data points for authentication

Fraudsters are becoming more sophisticated in their approach thanks to AI and machine learning. However, organisations can fight back using those same technological advances. In fact, they can get ahead of the need to do this by using advanced and non-traditional data points to help identify and prevent fraud before it takes place. This includes using device information, behaviour, and biometrics as methods of authentication – all of which are trusted and often expected by consumers.

Our recent research showed that 41% of consumers value online security above all else, so advanced authentication helps provide reassurance for the customer. More than that, 92% said if they were a repeat or existing customer it’s important they are recognised quickly, with authentication being an easier process compared to first-time onboarding.

Key takeaway

Fraud attacks are becoming more sophisticated thanks to AI, but organisations can adopt the same technological advances to fight back.

Reducing the risk of application fraud requires a layered approach with multiple identity checks. Blending data analysis, statistical modelling, and machine learning can also help you spot suspicious patterns.

In conclusion

From destroying an organisation’s reputation and consumer trust, to the monetary losses that can come from having to rectify the damage fraud leaves behind, application fraud can have devastating impacts on individuals and businesses alike.

As with all financial crimes, prevention is the best route forward and a robust strategy, featuring integrated data points and checks, can mitigate the impact this crime creates.

How we can help

One of the simplest ways you can start your fraud prevention strategy is to invest in robust application fraud measures. To find out the ROI of this for your business, simply tell us your product line, total applications per year, and the average card limit you approve, and our Application Fraud ROI calculator will give you an expected annual fraud prevention loss.

You may be interested in our CrossCore machine learning platform. Take a look at how we helped the financial services company NewDay create faster and more accurate fraud detection, while reducing the time and costs associated with investigating fraud.

It’s also worth keeping an eye on our Quarterly Fraud Index. This report details the latest trends and fraud activity across the wider lending space. By closely analysing industry data we can see changes in both first and third party fraud, as well as specific categories