With AI at everyone’s fingertips, we discover how businesses are adapting, what consumers value most, and how compliance needs are changing.

The 2025 Experian Annual Fraud and FinCrime report delves into the views of over 2000 consumers, and 200 UK businesses to determine how fraud is changing and how business priorities are shifting in response to emerging threats.

We uncover how businesses are changing investment priorities to better fight against new and emerging fraud threats. We reveal critical insights into the latest fraud trends, the technologies shaping fraud prevention, and the strategies that are keeping businesses and consumers secure. Learn how you can stay ahead of fraudsters, protect your customers, and enhance your digital security.

Download the report now to equip your organisation with the knowledge and tools needed to thrive in a rapidly evolving landscape.

In this year's report, we cover:

New methods and motives

What’s driving fraud today?

The generation gap

Who is really concerned about fraud?

Identity crisis

The importance of authentication

Striving for compliance

Fighting financial crime with data and technology

A sneak peek into:

UK Fraud and FinCrime Report 2025: Trends and tactics on the frontline of fraud and financial crime

1. No respite in anti-fraud war as AI attacks and counter-attacks proliferate

The hyper-convincing alternate reality being generated by generative artificial intelligence (gen AI) is having very real consequences for UK businesses in 2025.

From deepfake footage and cloned voices to synthetic identities and forged official documents, the technology’s fabrications continue to supercharge the tactics of international crime groups while lowering the technical barrier for lone bad actors.

Deepfakes are being applied to camera feeds in real time, fooling human observers and biometric authentication systems alike. And gen AI is empowering criminals in distant countries to forge coercive emotional connections with UK consumers.

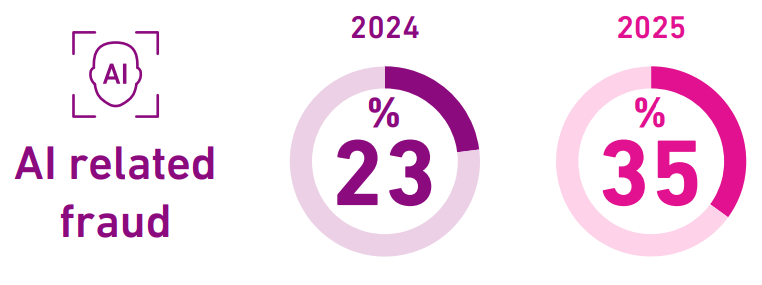

Just 23% of businesses told us they knowingly encountered gen AI related fraud in 2024, but within the first few months of 2025, this had jumped to 35%.

The percentage of retail banks affected has more than doubled from one in five in 2024 to almost half in Q1 2025. Our data shows that digital-only retailers are also at the sharp end of the threat, as are telecom providers.

Did you enjoy the read?

Download the full UK Fraud and FinCrime Report 2025

Understand how businesses are adapting investment priorities in the face of evolving fraud threats.