Online identity verification and account security have become increasingly important in today’s digital age

As the number of online transactions and activities continues to grow, so do the risks of fraud and identity theft. With this in mind, we conducted a survey of 600 consumers to gain insights into their experiences of fraud, how companies have handled instances of fraud, and the importance they place on online identity verification.

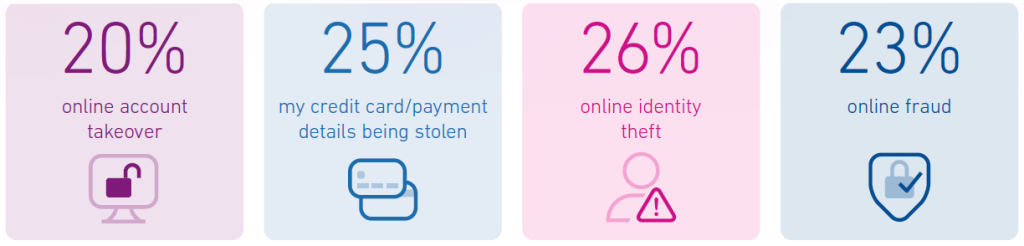

Our survey revealed that a significant number of consumers have experienced fraud or identity theft in the past year. Ranging across account takeover, stolen payment details, identity theft and online fraud, we found that fraud spreads far and wide across all industries.

Which industries are the most impacted by fraud, and are they doing enough to maintain customer loyalty, when it is so easy to change provider in today’s digital society?

The survey revealed interesting insights into the different forms of online identity verification that consumers are willing to use

While traditional methods such as passwords and security questions remain popular, there is a growing demand for more sophisticated methods such as biometric verification and two-factor authentication.

As the use of online services continues to grow, it is imperative that companies take steps to protect their customers’ personal information and provide effective fraud prevention measures. Failure to do so can result in a loss of customer trust, damage to brand reputation, and financial losses.

Physical biometrics

Such as facial recognition, fingerprint, voice recognition, retinal eye scan, etc.

PIN code

Sent to your mobile device via SMS, email or app notification.

Payment or identity data

Extracted from your mobile 'wallet' (e.g. contactless payments).

In this report, we cover:

Where are consumers experiencing fraud?

According to a recent Victims' Commissioner report, every year there are an estimated 4.6 million incidents of fraud in the UK.

How are consumers confirming their identity online?

Are the days of password and security questions over?

Are organisations effective enough in responding to fraud?

Sophisticated fraudsters continue to find new ways to bypass security systems or access personal data.

A sneak peek into...

UK Consumer Online Security Report

Introduction

As the UK continues to push further into the depths of technology, today’s consumer is becoming more aware of the options available to better protect them from fraud.

In our latest Identity & Fraud research, we looked at consumer expectation of online security and their recent experience of fraud. With quick onboarding, simple account set up and fast digital journeys, can we meet customer expectation and simultaneously prevent fraud?

1. Where are consumers experiencing fraud?

According to a recent Victims’ Commissioner report, every year there are an estimated 4.6 million incidents of fraud in the UK.

Whilst the scope, scale and loss resulting from the fraud can vary massively, our research shows that the origin of the incident isn’t biased towards one category.

Rather it is fairly evenly spread across the four core types of fraud or identity theft.

I have been a victim of:

Did you enjoy the read?

Download the full report

Our research highlights the growing importance of online identity verification and account security in today’s digital landscape.

Companies must take proactive steps to protect their customers’ personal information and prevent fraud, or risk damaging their reputation and losing customer trust.