Time for change

Across the UK, banks are developing financial crime transformation programmes that strategically monitor their commercial portfolios in new ways. There’s a genuine intent to actively manage financial crime risk and combat money laundering by continually watching for data changes and events, rather than running full reviews on a fixed, periodic basis.

In this paper, we’ll share our experiences and insights around enabling financial crime automation. We’ll explore what’s needed for effective event-driven reviews, explain how they work and take a step-by-step look at what makes the Experian process so powerful.

Download the whitepaper now to understand more the importance of automated, event-driven processes in preventing financial crime.

In this paper we cover:

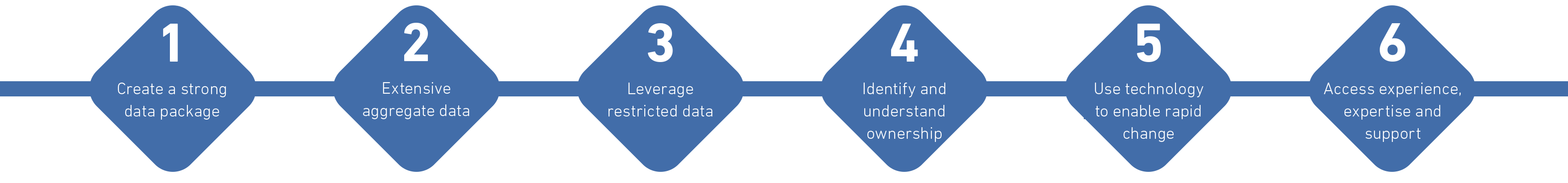

What's needed for an effective event-driven approach?

The six critical capabilities you'll need for effective event-driven reviews

What can these critical capabilities help you do?

What you'll be able to achieve when you put these six critical capabilities in place

A step-by-step guide to the Experian approach

From initial load and data inspection, through to introducing event-driven reviews, we'll take you through our best practise approach

A sneak peek into:

What's needed for an effective event-driven approach?

1. Create a strong data package

Successful event-driven reviews need accurate matching capabilities that enable third-party data sources to enrich your internal data, either corroborating that no risk exists and no intervention is needed, or identifying discrepancies so investigations can begin.

We believe most banks will struggle to achieve this level of matching accuracy in house. It’s a crucial part of the process, and one where Experian draws on the history and variants of company names and addresses using business-matching software we’ve been refining for over 30 years.

For banks to match this process, we’d need to release over 40 million records, gathered from more than 20 suppliers, and banks would need to develop their own proprietary algorithms, demanding a huge investment of budget, resource and time. Added to this, some of these data sources are legally prohibited from leaving Experian, presenting real challenges for external matching efforts.

This is one area where it makes sense to bring in expert support. Our unique matching capability is at the heart of what we do – trusted across the financial sector to empower organisations and unlock significant benefits.

2. Extensive aggregate data

The ability to aggregate data quickly and accurately is essential for event-driven reviews. Our third-party aggregation service is exhaustive and combines our own business, consumer and fraud data with a wide range of open data:

Official registers

Companies House, Persons of Significant Control, Gambling Commission, Charities Commission, Financial Conduct Authority, Jersey Financial Services, money services businesses (MSBs), Care Quality Commission, Edubase, and HMRC Non-EU Imports and Exports

Licence holders

Food Standards Agency, Licensed Premises, Vehicle and Operate Services Agency and MOT stations

Directory data

Market Location, Thompson, Local Data Company and 118

Experian data

Commercial Bureau and Consumer Bureau

Did you enjoy the read?

Read our paper to find out...

our experiences and insights around enabling Financial Crime automation.

We’ll explore what’s needed for effective event-driven reviews, explain how they work and take a step-by-step look at what makes the Experian process so powerful.