Age verification for online gamblingUnderstanding compliance and security with gaming age restrictions

Guide

It’s not only critical to protect underage players, but a strict verification process protects operators too. The UK’s Gambling Commission takes firm action when operators are caught out. In 2023 alone, UK fines for gambling operators surpassed £200 million.

What is age verification for gaming?

Age verification ensures that only eligible people over the legal age participate in online gambling. The process uses personal data and documents to verify a person’s identity before they can play online casinos or games. Age verification is fundamental for the prevention of underage gambling.

Why is age verification so important for gaming operators?

Because so many underage individuals illegally sidestep age limits and prematurely access gaming websites, a robust and intellectual age verification system is key in:

- Preventing underage gambling: Protect minors by restricting access to gaming content like horse racing to promote a safe and responsible gaming environment.

- Regulatory compliance: Ensure you’re meeting regulatory requirements to avoid hefty fines and sanctions for non-compliance. This also reduces the likelihood of facing legal actions associated with breaches of gaming/gambling regulations.

- Facilitating market entry and expansion: To expand your online presence across borders, age verification is essential for gaining and maintaining licenses.

- Maintaining integrity and enhance trust: Uphold the reputation of the gaming industry as trustworthy and secure, essential for building confidence amongst eligible users and retaining players.

Key Recommendation

The right amount of ‘friction’ and verification in the customer journey can psychologically make them feel secure without disrupting their onboarding to your system.

How age verification is supporting a safer industry

In 2023, 26%[1] of 11 to 17-year-olds surveyed admitted to gambling their own money in the prior 12 months. 53%[2] of them had seen gambling adverts online.

More and more, at increasingly younger ages, minors are gaining access to the digital world. With gambling messaging reaching over half of minors, and a quarter of those admitting to a relationship with gambling, gambling companies must take responsibility to ensure this doesn’t escalate to online platforms.

Early exposure to both the positive and negative extremes of gaming, such as big wins or losses, can increase a person’s interest[3] in gambling later in life and lead to harmful behaviours such as addiction.

By ensuring that only individuals of legal gambling age can access and participate in online gaming, age verification safeguards minors from the potential harm associated with early gambling.

Gaming compliance considerations

For online gaming operators, staying compliant involves a proactive approach, utilising the most innovative technology to ensure a smooth process for users, especially in light of the UK’s 2019 regulatory enhancements.

These changes mandated that operators must verify a customer’s age before they could deposit funds, game, or even access free-to-play games – essentially requiring verification to be completed upfront, rather than within the previous 72-hour window post-registration.

Now that users can’t play until verified, onboarding must be as fast as possible.

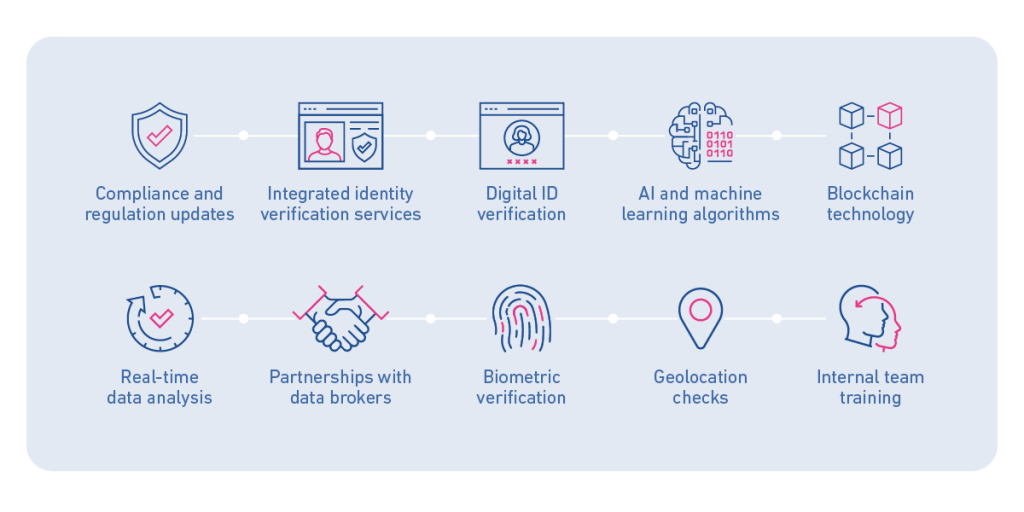

Compliance and regulation updates

Stay aware of regulatory updates that could mean you have to adjust your onboarding or verifications process.

Consider an external dedicated compliance team, like Experian, to handle age verification to help you stay compliant without taking up your team’s time and resource.

Digital ID verification

Encourage the use of digital ID verification solutions, like those rolled out by the UK Government[4], where players can use government-approved digital identities to verify their age and identity online. This reduces fraud and streamlines the verification process so that legitimate customers can play faster.

Blockchain technology

Blockchain-based identity solutions provide secure, immutable, and transparent verification processes, allowing users to prove their age without revealing any additional personal information.

Real-time data analysis

Continuously monitor player activities and verify age and identity information dynamically. The insights gained from real-time analysis assist in making quick and informed decisions for fraud prevention.

Partnerships with data brokers

Partnerships with data brokers or third-party verification services can provide additional layers of verification, flag previous cases of fraud and cross-reference information to ensure accuracy via their extensive databases of public records.

Biometric verification

Introduce biometric verification methods, such as facial recognition or fingerprint scanning, to confirm a player’s age, which are extremely hard to bypass.

Geolocation checks

Geolocation technology helps ensure that players game in locations they are legally allowed for their age, supporting effective enforcement of regional age restrictions.

Internal team training

Keep teams updated and trained on the latest regulatory standards and best practices. Additionally, implementing a strong compliance oversight mechanism helps promptly identify and correct any irregularities.

Keeping ahead of current and upcoming regulations ensures, gaming operators remain complaint and can always offer players a smooth and secure gaming experience.

AI and machine learning algorithms

Machine learning (ML) and artificial intelligence (AI) automate document analysing for swift, and more importantly, accurate verification. The technologies can even employ facial recognition to match IDs with live images, enhancing fraud prevention.

ML and AI excel at pattern recognition: detecting unusual user behaviour that may signal fake information. These behaviours could go unnoticed by traditional systems or manual checking.

ML algorithms continuously learn and adapt to improve their accuracy. AI’s predictive analytics forecasts potential online gaming compliance issues before they happen, allowing you to be proactive.

AI and ML assist players in quickly and accurately verifying their information. This helps provide a smooth user experience without compromising on thoroughness. They are also effective in scaling to efficiently handle large amounts of verifications.

If you decide to outsource your age verification process, look for a provider that’s already working with these technologies to ensure you’re getting the best service available.

Integrated identity verification services

Integrated identity verification services utilise secure and scalable methods such as digital ID verification, biometric verification, and large database checks. This multi-layered method validates a player’s age and identity to make sure they are eligible.

The automation and scalability of these services enhance your efficiency and strengthen your reputation for security and compliance. Users enjoy a safe gaming environment, with quick sign-up and onboarding, that protects their data and builds trust in the platform.

The combination of security, convenience, and regulatory compliance is key to success in a crowded market. It makes online gaming safer and more enjoyable for everyone.

Critical challenges and solutions for iGaming operators

Navigating regulatory compliance

- Challenge: HMRC regulations dictate that operators offering remote gaming to UK players are liable for General Betting Duty (GBD)[5], Pool Betting Duty (PBD) and/or Remote Gaming Duty (RGD) taxes. So you need accurate figures on your UK players to ensure you don’t under or overpay on tax. Balancing this compliance with minimal operational impact can be tricky.

- Solution: Integrating innovative identification, such as those mentioned above, into sign-up procedures can help you meet tax obligations efficiently. It minimises operational disruptions and ensures smooth yet compliant customer onboarding.

Streamlining player verification

- Challenge: The player verification process, critical for compliance and customer retention, often suffers from delays and errors, leading to failed sign-ups.

- Solution: Optimising identity verification to swiftly and accurately screen new players can mitigate these challenges. By refining these processes, you can deter fraud, enhance onboarding rates and uphold trust in transactions.

Optimising costs

- Challenge: These taxes for gaming operators in the United Kingdom mean increased overall costs, making the efficient management of expenses essential. This is particularly relevant in handling chargebacks and reducing payment fraud, which significantly impact profit margins.

- Solution: Investing in areas such as better management of chargebacks to credit cards and implementing up-front solutions that link bank account or credit card ownership to an individual. This can minimise payment fraud, reduce costs and improve onboarding efficiency, crucial for customer retention and loyalty.

Key Takeaway

Check your provider for gaming age verification and Know Your Customer (KYC) can display:

- Large data coverage across various sources

- Granular detail on various checks passed or failed

- A multi-layered approach such as adding biometrics or contact detail verification

- Flexibility to tailor your checks based on the likely risk presented

Work towards compliance with Experian

Staying ahead of compliance can feel like a full-time job, and we understand you might be worried about balancing compliance and security with your time and budget resources. But it doesn’t have to be a maze.

Experian turns these verification challenges into opportunities, offering you a toolkit designed to refine and secure your operations. This goes beyond just regulation compliance to set a new standard in responsible gaming.

Our services are built on more than 1.7B data items which are growing all the time. This data underpins our CrossCore Identity Services for KYC, which are trusted by more than 800 clients, including over 20 gaming companies, for millions of transactions each year.

Better understand compliance, reduce your risk of fines and safeguard your customers with Experian.

[1] Young People and Gambling 2023, Gambling Commission UK

[2] 2023 Young People and Gambling Report, Gambling Commission UK

[3] Exploring the gambling journeys of young people, Gambling Commission UK

[4] Enabling the use of digital identities in the UK, GOV.UK

[5] General Betting Duty, GOV.UK