Money mulesWhat they are, how they work, and how to protect your business.

Guide

Money mules are individuals who willingly or unwittingly assist criminals in transferring and laundering illegally obtained funds. Money mules play a crucial role in facilitating various forms of financial fraud, such as phishing scams, online scams, and cybercrime.

The truth is that 42% of first-party current account fraud[1] is now intricately tied to the shadowy world of money mules. The economic toll of money laundering in the UK surpasses a staggering £100 billion annually[2], while Authorised Push Payment (APP) fraud losses hit £485 million in 2022.

What is a money mule?

A money mule is someone who transfers illegally obtained money on behalf of others or who will sell the use of their account for illegal transfers to take place. Criminals recruit individuals as middlemen in moving stolen funds between accounts or countries.

The key is for all businesses, especially those within the finance industry, to stay up to date with what money mules are, how money mule fraud works and the latest detection and prevention technology available, keeping your finances, your reputation and your customers safe.

What is a money mule?

A money mule is someone who transfers illegally obtained money on behalf of others or who will sell the use of their account for illegal transfers to take place. Criminals recruit individuals as middlemen in moving stolen funds between accounts or countries. These money mules receive deposits into their bank accounts and then wire the money to other accounts as directed by the criminals. Money mules can serve as a means for laundering money, facilitating Authorised Push Payment fraud, and other types of fraudulent schemes.

In exchange for their “services”, the mules get to keep a small percentage of the funds as payment. But they also face legal consequences if caught since money laundering and fraud are serious crimes.

The money mule scam is popular with online fraudsters who need ways to quickly move money before their victims realise they’ve been duped. The mules provide anonymity and make it harder for authorities to trace the funds back to the criminals.

What are mule accounts?

Mule accounts serve as conduits for the illegal transfer of funds. These accounts, typically opened by the money mules, rather than the criminals behind them, provide a layer of anonymity for criminals engaged in fraudulent activities.

What is smurfing?

Smurfing, a cunning tactic employed by money launderers, involves breaking down large sums of money into smaller, less conspicuous transactions. This method aims to evade detection by authorities, as smaller transactions attract less scrutiny.

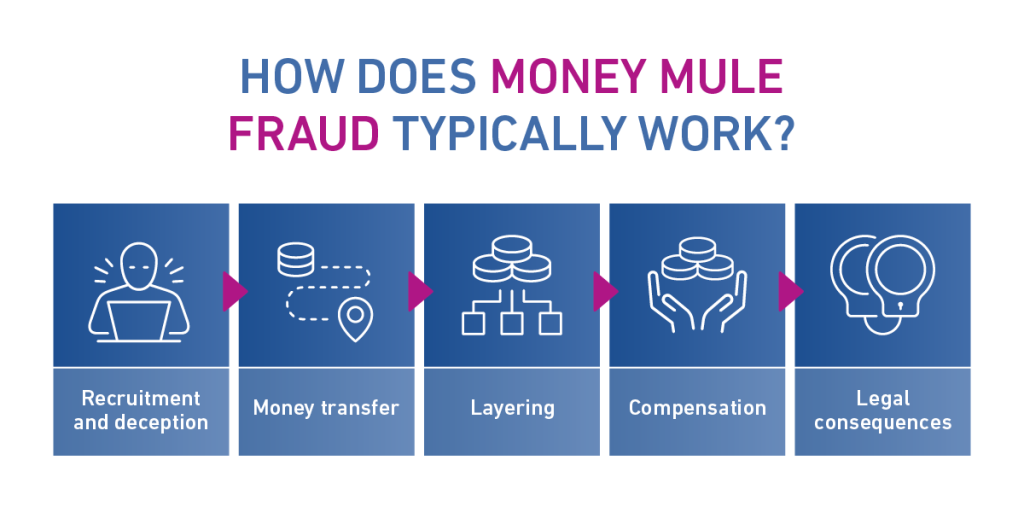

How does money mule fraud typically work?

Money mule fraud operates as a carefully orchestrated process, leading to severe consequences for participants and the broader financial system.

Recruitment and deception

Criminals often recruit individuals through job ads or social media messages. They promise easy money for simple tasks like receiving and transferring funds. These “jobs” seem legitimate but are scams. Some money mules will be witting participants in the scams, others will be unaware of the illegal nature of the transaction.

Once recruited, money mules provide their bank account information so fraudsters can deposit stolen funds or launder illegal money. The mules then withdraw or wire the money as directed, keeping a small percentage as payment.

Money transfer

Fraudsters deposit stolen money, like from phishing scams or ransomware, into the mule’s account. They may start with a small amount to gain the mule’s trust before depositing large sums. For the unwitting money mule, the mule sees money in their account and assumes the job and deposits are legitimate.

They then instruct the mule to withdraw cash, wire transfer the funds, or move the money to cryptocurrency. The mule sends a large percentage of the funds to the fraudsters, keeping a small cut for themselves. By the time the fraud is detected, the money has disappeared, and the mule is left legally responsible.

Layering

After the money mules receive the illicit funds into their accounts, fraudsters may instruct them to break the money into smaller amounts. This is to avoid detection and make tracking difficult for authorities, it’s referred to as ‘layering’.

Mules may be told to transfer these smaller amounts to various accounts, sometimes across different countries or into different financial systems like cryptocurrencies or prepaid cards. Once the money mule has transferred the money, it will likely be split up again and transferred to other accounts before the fraudster receives it via a shell organisation.

By involving multiple transactions, types of currency, and financial institutions, layering complicates the money trail and shields the fraudsters behind several layers of transactions.

Compensation

Mules are promised a share of the funds for transferring money – easy profit for minimal work. However, the reality is starkly different. Many mules receive far less than promised, or nothing at all, once the illegal activity is completed.

Legal consequences

Regardless of whether the mule is aware that they are part of a criminal scheme, the legal consequences are severe. They can face criminal charges for money laundering and fraud, leading to imprisonment, fines, and a criminal record.

Mules may lose their own money, face lawsuits, and suffer long-term damage to their credit score. Banks and law enforcement are increasingly sophisticated in tracking and prosecuting such frauds, and once implicated, individuals find it challenging to clear their names and recover financially and socially.

Who is most likely to get targeted?

Money mules are most often recruited from vulnerable populations like students, the elderly, or unemployed people. As a business, you may want to reach out to these demographics specifically with targeted education campaigns, so they know to stay vigilant.

Criminals frequently target people with money troubles or a lack of financial knowledge and experience. They promise “easy money” for simply transferring funds or packages, preying on people’s desire for financial relief or gain.

Young adults new to managing their finances are also common targets. Criminals may approach university students or recent graduates with promises of “no-risk” ways to pay off student debt or earn spending money.

Sadly, senior citizens can be targets for mule scams due to isolation or unfamiliarity with technology. Criminals can gain access by phone or online, then convince the person to transfer money or ship goods on their behalf.

How do money mules get caught?

Money mules typically get caught because their suspicious activity is detected. Law enforcement agencies and financial institutions use various methods to detect and catch them. Here are some common ways money mules may get caught:

- Transaction monitoring: Banks and financial institutions monitor accounts for unusual activity like large cash deposits, wire transfers to foreign countries or accounts not tied to the account holder.

- Surveillance: Law enforcement regularly monitors communication channels for money laundering or fraud discussions. Emails, phone calls, and even social media messages can be monitored.

- Informants: People working with money mules can turn into informants to avoid prosecution or reduce their sentences. They provide information to law enforcement about the network of mules laundering money, which can then be investigated.

How often do money mules get caught?

Money mules don’t always get caught, but the risk is increasing due to better law enforcement tactics and more sophisticated anti-fraud technology. While there’s no exact number, as crackdowns happen, they often catch many mules at once.

Money mule red flags

Knowing what to look for when it comes to spotting money muling is key to protecting your business and your customers. Here are key indicators that might suggest a customer or account is involved in money muling:

- Unexpected or unexplained large deposits or transactions.

- Frequent requests for international or rapid transfers to various accounts.

- Accounts that primarily receive and send funds, lacking typical commercial activities.

- Offers or job positions that involve handling and forwarding payments without clear, legitimate business activities.

Machine learning for money mule detection

Machine learning (ML) is potent in countering money mule activities. Its real-time analysis of diverse digital data enables anti-fraud systems to swiftly identify relationships across users, devices, transactions, and channels.

When suspicious behaviour triggers a high-risk score, the system dynamically adjusts, either triggering enhancing security measures or initiating a manual review. The risk engine actively monitors flagged activity, ensuring prompt intervention by the fraud prevention team and, if needed, escalation for deeper investigation.

This integration of machine learning fortifies security measures and equips financial institutions with a proactive, dynamic defence against evolving patterns of fraudulent behaviour.

Support from anti-fraud systems

When financial institutions initiate onboarding for new accounts, the lack of historical data poses a challenge. But, a smart anti-fraud setup can quickly spot known malicious behaviour profiles.

In these cases, what works well is taking a close look at how the new account holder accounts compared to what’s typical among other customers. This looks into things, like:

- Spending behaviour relative to the average: Evaluating the spending patterns of the account holder in comparison to the overall customer average.

- Payee profile analysis: Scrutinising the payee profiles associated with the account to detect any anomalies or deviations.

- Sequence of actions: Examine the action sequence taken by the account holder to identify any irregularities or suspicious patterns.

- Navigation data to detect machine-like or bot behaviour: Analysing navigation data, like mouse movement and typing speed, to identify signs of bot behaviour. That could look like unusually fast actions, linear mouse movements, perfect typing, and high request volumes.

- Identification of abnormal or risky locations: Assessing the geographic locations associated with the account for unusual or high-risk locations.

- Account owner’s relations to other users: Investigating the relationships between the account owner and other users within the system.

To enhance the effectiveness of the risk mitigation strategy, the risk engine should be capable of aggregating data across all digital channels. This helps it spot links between users, IP addresses, and devices that have a history of fraud. It looks at things like usernames, accounts, where they are, what device they’re using, their session details, and who they’re paying.

If the system notices any weird changes in someone’s personal details, it’ll mark it for a closer look. This marked activity is then watched and checked out when needed, helping banks keep an eye out for potential money mule fraud.

How banks can prevent money muling

Banks can employ a multifaceted approach to effectively prevent money muling and safeguard their financial ecosystem. Here’s how:

Monitor accounts: Regularly monitor accounts, especially new accounts, for signs of money laundering. Things like large cash deposits, transfers from overseas, or activity inconsistent with the account holder’s profile can be red flags. Fraud detection software and transaction monitoring systems can help identify suspicious patterns.

Enhanced due diligence: Conduct enhanced due diligence on high-risk accounts like those belonging to students, unemployed individuals or recent immigrants. This includes verifying the account holder’s identity and the source of incoming funds to ensure their legitimacy before allowing transfers or withdrawals.

Staff training: Proper training for bank employees on money laundering methods, fraud detection and risk assessment is key. Staff should know how to spot signs of money laundering activity, like individuals receiving multiple electronic fund transfers or cash deposits from unknown third parties. They should know the right questions to ask and procedures to follow if money mule activity is suspected.

Education: Banks employ educational initiatives to educate their customers about the risks and consequences associated with money muling. Through targeted campaigns, informational materials, and online resources, financial institutions strive to raise awareness about the role individuals may unknowingly play in illicit activities.

Monitor online activities: Monitor websites, social media platforms, and mobile apps for advertisements recruiting money mules. They can work with these companies to quickly take down suspicious ads and accounts to disrupt money laundering operations. Monitoring online crypto asset exchanges and peer-to-peer platforms where money mules may be recruited or paid is also important.

Share information: Share information on detected money mule activity, accounts, transactions and recruiters with other financial institutions, law enforcement agencies, and private-sector partners. Information sharing helps identify connections between money mules, uncover the full scope of criminal networks, and prevent further illegal activity. On 26 October 2023, the Economic Crime and Corporate Transparency Act[3] was passed with new provisions introduced that will make it easier for AML-regulated businesses to share customer information with each other for the purposes of preventing, investigating and detecting economic crime.

How our Experian Mule Score protects businesses and their customers

The Experian Mule Score helps businesses detect and avoid money mule activity. This proprietary score analyses over 200 variables related to a customer’s identity, behaviour, and transaction history to determine the likelihood of mule behaviour. The Machine Learning model has been trained on over 70,000 confirmed mule cases by linking and deriving unique patterns in the way mules typically repay their credit and use their current accounts.

A high Mule Score means the individual exhibits characteristics similar to known money mules. These customers pose a higher risk for businesses since their accounts may be used to launder illegally obtained money. On the other hand, a low score suggests the customer resembles legitimate consumers and likely presents a normal level of risk.

Businesses can use the Mule Score for smoother, faster customer onboarding by providing quick and reliable application evaluations. Those with high scores may require further review or be denied to avoid potential fraud and compliance issues. By reviewing existing customer mule scores regularly, you can quickly identify those that are at risk of becoming compromised.

Stay vigilant

As we navigate the intricate landscape of money mule fraud, it becomes evident that a multifaceted approach is essential to combatting this pervasive threat. From understanding recruitment tactics to leveraging advanced technology for detection, staying informed and proactive in the ongoing battle against financial crime is crucial.

Learn more about how we can help you detect and prevent financial crime.

Related products

[1] Experian launches new service to prevent ‘Money Mule’ account fraud, Experian PLC

[2] Experian launches new service to prevent ‘Money Mule’ account fraud, Experian PLC

[3] Economic Crime & Transparency Bill: What it Means?, Experian, YouTube