The identity journey itself started over 100,000 years ago, recognising individuals through the jewellery they were wearing then later tattoos and body art. Fast forward through history, and we have seen the first census, passport and fingerprints all introduced to help verify someone is who they say they are. With the ever-evolving technology landscape, we continue to see new identity verification tools, such as facial and voice recognition, introduced into daily society – and of course most recently, tools such as COVID passports, confirming individual vaccination status.

Whilst understanding who you are speaking to is vital throughout the customer lifecycle, having clear and verified identity from onboarding is critical. But customers are now expecting more, and want an easy, friction-free experience. Customers no longer want to visit banks, or even speak on the telephone for applications. They want fast, integrated processes with instant results.

But how does this align with organisation needs, and legacy systems?

Digital maturity scale

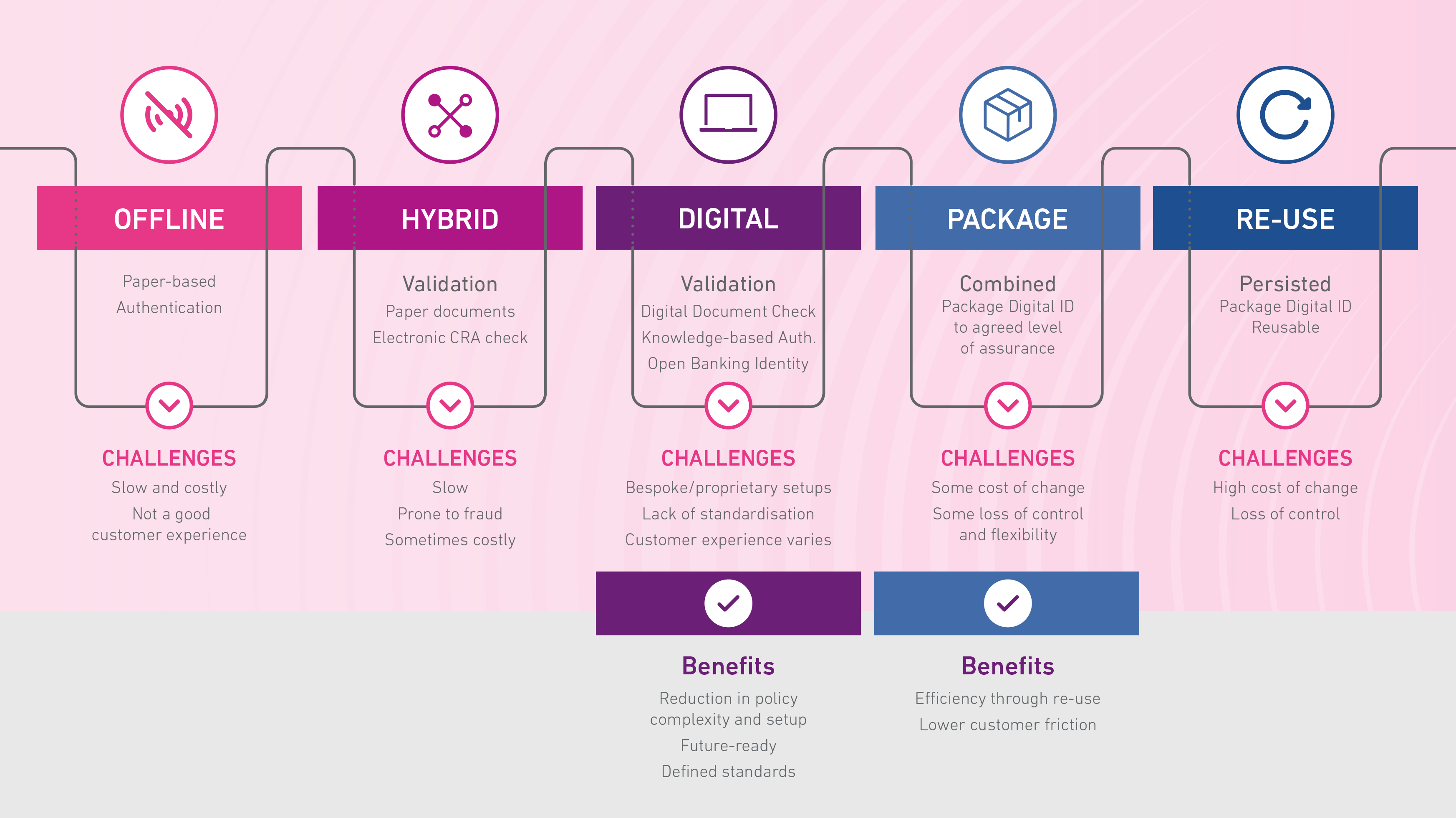

All businesses sit somewhere within a digital maturity scale. Whether still asking for physical face to face meetings and provision of paper documents, or a fully integrated digital verification processes, every organisation requiring identify checking will sit somewhere within the following scale:

- Fully offline – Authentication via physical documents

- Hybrid – Validation via an electronic Credit Reference Agency check, but physical documents for anti-impersonation / verification

- Digital: Verification – Digital document check, Knowledge-based authentication, Open Banking Identity

- Package: Combined – Packaged Digital ID

- Re-use: Persisted – Packaged Digital ID Reusable

But why are some businesses ahead of the curve, and why are others still, even now in a post-COVID world, struggling to build a Digital Identity process?

In our recent poll, 54% of respondents said the main barrier towards introducing a reusable Digital ID was that technology and operating models were insufficiently mature, and 44% cited loss of control of a customer journey and interaction as their main reason.

What is GPG45?

The Good Practice Guide 45 (GPG45) provides organisations with guidance on how to verify someone’s identity. Developed by both public and private sector representatives, including Experian, the UK government’s GPG45 guide does not instruct specific tools or process for ID verification, allowing organisations to decide on what is best for them to achieve the necessary outcomes.

One such process includes integrating a reusable Digital Identity into customer profiles.

Building digital GPG45 profiles

There are 5 dimensions within ID detail capture for scoring purposes: Strength, Validity, ID theft, Activity History and Verification.

The level of confidence in the identity profile will vary depending on the types and number of pieces of evidence collected, and how they were collected. For example, a passport document capture and photo verification (e.g. through selfie) through a robust electronic process can help show that the identity both exists, and link the individual to that identity.

Adding secondary dimensions to the ID process can mitigate risk, and work towards building a reusable Digital Identity:

- Device data

- Biometrics

- Bureau fraud score

- Email risk score

Offering the consumer several approaches to identity verification can help organisations achieve a higher pass rate and better inclusion, e.g. helping those without physical documents, as well as providing mechanisms to achieve higher levels of confidence within Trust frameworks (e.g. through a passport “chip check”).

With recent changes to online shopping ID verification requirements through the introduction of SCA (Strong Customer Authentication), businesses are now required to include a two-stage verification into buying journeys. New and innovative, friction-free methods of verification will be more widely integrated into digital journeys, so as not to disrupt a buyer’s experience.

To understand how Experian can help your organisation develop stronger identity verification processes, get in touch

Get in touchWhy digital?

By layering multiple data points, Experian can offer a verified, auditable view of your customer – enable organisations to look in depth at all elements of the decisioning process around onboarding customers at a holistic level.

Reusable Digital IDs allow a faster and more cost-effective journey for the customer, helping them stay engaged in the onboarding process, and helping you know exactly who you are onboarding.

Where can we introduce reusable digital IDs?

Whilst customers today are already using reusable Digital IDs to help with KYC & AML verifications, with greater regulation in many industries, the option to build in a reusable Digital ID will add benefit in many industries.

For example, age verification requirements are becoming more prevalent as the world has transitioned to a digital world. Websites with age-restricted sections, such as alcohol purchases, are able to implement reusable Digital ID to provide proof of age and provide customers with a low-friction journey, whilst enabling compliance with necessary age-proofing regulation.

However, not all organisations will need the full spectrum of data available. In such instances, only core information needed to verify identity can be used to ensure customer privacy. In the examples above for example, the organisation would only need to know the customer’s age, not their date of birth.

Travel and tourism are other areas where implementing Digital IDs can benefit the customer and businesses. Allowing business to prove hotel and private residential stay guests are who they say they are.

Through implementing reusable IDs organisations are able to quickly and efficiently verify identity and enable a positive, and compliant, customer journey.