Fraud Risk Management: Your Complete GuideYour businesses of all shapes and sizes are at risk of fraud, and many don’t even realise.

Guide

For most UK organisations, it’s business as usual as they continue to focus on operational resilience following a tough few years. The cost-of-living crisis has caused a massive change to millions of people’s personal circumstances, which in turn has made it more complicated to assess their fraud risk. This fragmentation of data and customer profiling is the new normal, and it makes for very shaky ground when onboarding new clients.

But that’s not the only concern. According to 2024 statistics[1], around 70% of medium businesses and 74% of large businesses have experienced some form of cyber security breach or attack in the last 12 months alone. That’s a lot of stolen data to be in the hands of fraudsters, and thereby increasing the risk of fraud even higher.

With the introduction of the Economic Crime and Corporate Transparency Act[2] in 2023, businesses have a new, more robust way of preventing the damage that fraudulent activity can create. However, many organisations aren’t using the Act to its full potential – if at all.

Smaller businesses and those outside of the fintech industry may feel that using ECCTA isn’t necessary, and that their standard fraud risk prevention processes are all that’s needed. But with money laundering estimated to cost the UK economy more than £100 billion[3] each year, business owners who aren’t taking the necessary steps to mitigate against fraud could be at risk of significant financial losses and reputational damage, as well as regulatory penalties and even jail time.

To avoid the costly ramification of fraud, we can help ensure you and your business have a better understanding of fraud risk assessments and management.

Understanding your risk of fraud

To gain a better understanding of fraud risk management, let’s first look at the most common types of fraud:

Accounting fraud

Bribery

Payroll fraud

Invoice fraud

Market abuse

Money laundering

Vendor fraud

Phishing attacks

Tax evasion

Terrorist financing

Wire transfer fraud

Who’s most at risk?

Understandably, the risk of fraud within fintech companies and larger organisations is higher and more prevalent. However, every business regardless of size and sector should remain vigilant. Including:

- Accountants and tax advisers

- Banks, credit, and financial institutions

- Cryptoasset businesses

- eCommerce platforms

- Estate agents

- Gaming and casino businesses

- Legal professionals

- Luxury goods and art dealers

- Management consultants, auditors, and insolvency practitioners

- Trust providers

What’s the risk to your business?

If you’re a small organisation, or things in your business appear to be running smoothly and you’re acquiring new customers or making money as normal, you may think your risk of exposure to fraud is low. However, even the smallest blindspots in both operational activities and customer base can lead to bigger problems.

Perhaps your company is still making manual data reconciliations which are prone to human error? Or maybe you have a feeling that something’s not quite right with the customer data you’re seeing, but it’s challenging to get the wider business to recognise that risk threat. After all, who’s going to invest in risk prevention capabilities when the losses aren’t overt, easy to justify, or tangible – perhaps they’re more reputational than monetary, for example?

Key takeaway

Fraud isn’t always immediately obvious. Even if your risk of fraud is low, a comprehensive fraud risk assessment and management process is vital.

Introducing the Economic Crime and Corporate Transparency Act

The Economic Crime and Corporate Transparency Act (ECCTA) is the foundation to the UK’s fight against economic crime, helping legitimate businesses thrive and not fall victim to things like fraud. It does this by encouraging cross-sector data sharing that can help prevent, detect, and investigate economic crime.

Here’s how it works

Until recently, those in regulated sectors such as banks and law firms, were constrained in their information-sharing ability. This restriction meant that many organisations were kept in the dark about suspicious customer behaviour or potential fraudulent activity.

However, by providing a unified approach through standardised data sharing, as well as Anti-Money Laundering (AML), Know Your Business (KYB), and Know Your Customer (KYC) checks, the Act promotes a comprehensive view of a customer’s fraud risk.

What kind of data will be shared?

The primary goal of the ECCTA is to act as a repository of information that organisations can use to identify suspicious behaviours and uncover risks. You’ll find all of the information and data from strict AML, KYB, and KYC checks, such as:

- Customer due diligence to verify the identity of customers and better understand their business.

- Ongoing customer transaction monitoring to detect unusual or suspicious patterns and activities.

- Rapid suspicious activity reporting of money laundering to the National Crime Agency[4]. This is particularly vital to the detection of fraud, as money laundering and fraud go hand in hand.

- Current Account Turnover data to establish what is considered ‘normal’ account activity.

- Multi-source data corroboration to validate that customers are presenting themselves consistently across various data sources.

- Robust internal training and guidance to ensure AML-regulation compliance.

By having this data in one single, accessible place you can more easily spot trends, anomalies, and potential red flags that could lead to fraud.

You can find out more about this, and what it means for your business, in our essential ECCTA guide.

Key takeaway

Routine identity checks are no longer enough. The updated ECCTA regulations will help you create a robust, overarching picture of your risk of fraud.

How to manage your organisation’s risk of fraud

1. Fraud risk assessment

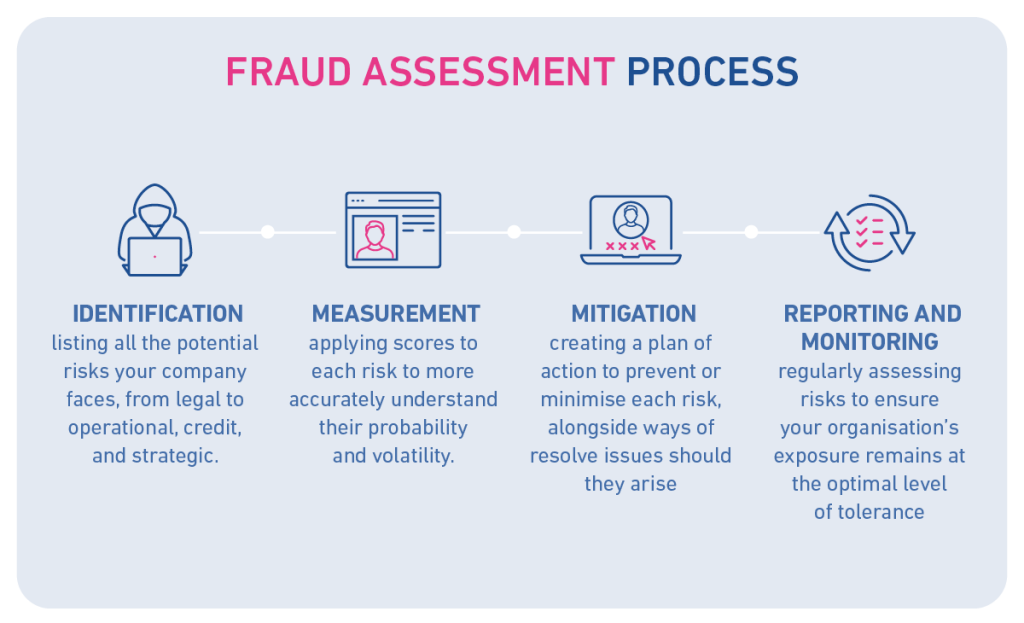

The first step to fraud risk management is in completing a fraud risk assessment. By examining things like company assets, financial documentation, and disclosures, an assessment aims to identify, uncover, and analyse potential risks, as well as giving you a game plan for mitigating or controlling them.

- Identification – list all the potential internal and external risks your company faces, from legal to operational, credit, and strategic.

- Measurement – apply numeric scores to each risk to more accurately understand their probability and volatility.

- Mitigation – create a plan of action to prevent or minimise each risk, alongside ways of resolving issues should they arise.

- Reporting and monitoring – regularly assess these risks to ensure your organisation’s exposure remains at the optimal level of tolerance.

While undertaking a fraud risk assessment, it’s always handy to have a checklist of things to watch out for. While this shouldn’t be considered a comprehensive list – as there will always be organisation- and industry-specific considerations – these are the most commonly made mistakes when it comes to risk assessments:

- Missing or incomplete customer data

- Using generic assessments and not industry-specific ones

- Not keeping risk assessments up to date

- Not communicating findings to the wider organisation

- Ignoring or failing to recognise regulation changes

2. Fraud prevention

As with all risks, prevention is better than cure. It’s far safer and more time- and cost-effective to lessen your organisation’s exposure to fraud than deal with the aftermath.

The ECCTA has made a significant difference in helping to prevent fraud. By strengthening information and data sharing between businesses, internal teams, law enforcement agencies, and regulatory bodies, your business is now privy to information that can flag suspicious behaviour, and stop fraud before it’s begun.

Robust internal training and awareness is also essential. Having employees trained and vigilant in fraud detection can lead to earlier prevention.

3. Fraud detection

As well as information sourced through ECCTA, employing advanced machine learning technologies to monitor and analyse transactions can help flag anomalies that point towards fraud.

Periodic internal audits that focus solely on fraud detection are also a key prevention method. You’ll also want to establish clear and confidential reporting processes, to better empower employees when reporting suspicions.

4. Monitoring and improvement

Fraud is an ever-changing target and as the methods of fraudsters and criminals become more sophisticated, so does your need for monitoring and the methods you use in order to prevent the crime.

Regularly update and enhance your fraud risk assessment, based on new risks, information shared via ECCTA, and recent incidents or lessons learned. Benchmarking your fraud risk management process against industry standards and best practices is also another good way to ensure you have covered potential risks that are unique to your organisation or industry.

Key takeaway

Fraud risk prevention is the key to protecting your business, and it starts with a comprehensive assessment.

In conclusion

Following on from a sharp rise in fraud, with money laundering alone estimated to cost the UK economy over £100 billion per year, the ECCTA has been established and tighter fraud risk checks are required to protect UK businesses.

By strengthening information sharing and collaboration, as well as enhanced due diligence procedures, companies can mitigate the risk of fraud for themselves, their customers, and industry as a whole.

However, not everyone has got the memo and many businesses are either unaware or underprepared for this changed landscape. As well as awareness around the new regulations, a fundamental mindset shift in how companies tackle fraud is needed.

Let us help

You don’t have to undertake a fraud risk assessment alone. If you’ve spotted that there could be an issue, thought you were covered but know that may not be the case anymore, or you’re keen to get ahead of the curve and understand your fraud risk more fully, we can help.

To start your journey into uncovering your fraud risk, why not use our application fraud ROI calculator and get in touch following your results?