By joining forces, anti-fraud and anti-money laundering teams – who both share the same fundamental objectives – can create an integrated and unified approach in the fight against fraud and financial crime. More than this, they can improve the speed and experience of customer onboarding and better identify potential risks to a financial institution too.

Key Takeaway: Create a unified approach

By joining forces, anti-fraud and anti-money laundering teams can better harness their data and insights to create a unified approach in the fight against financial crime.

Financial crime is costing the UK economy an estimated £290 billion a year. This is a colossal figure that has fraud and anti-money laundering teams working hard in the fight against criminal activity. The issue is, many of them are working in isolation.

However, the growing acknowledgment of the inherent links between fraud and money laundering has opened up a combined detection and prevention paradigm called FRAML (fraud + anti-money laundering).

With fraud and financial crime evolving and becoming even more sophisticated thanks to technological advancements such as artificial intelligence (AI), we will start to see more financial institutions fighting back by linking their fraud and anti-money laundering defences in this combined approach.

By taking a deep dive into FRAML, we can help ensure you and your business are equipped to detect and prevent financial crime. In this guide, we’ll take you through:

- The concept of FRAML within financial institutions

- The benefits and challenges of a FRAML approach

- The solutions you can use to combat fraud and money laundering activities

What is FRAML?

Fraud and money laundering are intrinsically linked. Once fraud has taken place, a criminal then needs to launder the money to be able to benefit from that fraudulent activity. However, there has always been a distinct disconnect in how each activity is detected, investigated, and prevented.

An anti-money laundering (AML) team is usually led by the Chief Compliance Officer, while anti-fraud teams are led by the Chief Risk Officer. Both of these departments will be identifying suspicious patterns and investigating alarming customer behaviour, but until recently they’ve always remained independent from one another despite their shared objectives.

What is FRAML?

FRAML stands for ‘fraud’ and ‘anti-money laundering’ and is a collaborative approach of the two that allows financial institutions to more effectively focus on regulatory compliance, security and combating financial crime like money laundering, identity theft and terrorist financing.

FRAML models utilise technologies like AI, machine learning, and real-time data analysis to monitor transactions and detect suspicious activities. This integration allows for a holistic approach to financial crime prevention, where fraud and AML teams share data and tools resulting in a more informed and comprehensive risk management process. This approach has proven effective in providing timely and accurate detection of financial crimes.

Key Takeaway: Harness the power of AI

Machine learning and AI will be integral to your organisation’s FRAML strategy. As well as allowing you to stay on top of fraud trends and predictions, you can speed up and sharpen every aspect of your approach.

Put simply, it’s a merging of two forces to bring their objectives and activities into alignment. This includes:

1. Finding and addressing suspicious transactions

2. Protecting customers, companies, and the financial industry from crime

3. Maintaining regulatory compliance

Why choose a FRAML approach?

Fraud and AML are so closely linked that using the data and insight from one will always enhance risk protection for the other.

Fraud is traditionally seen as an onboarding challenge while AML is considered a challenge across the customer lifecycle. However, both hold lots of information and data that the other one can benefit from. When viewing this data in isolation through singular tools or legacy systems, financial institutions are unable to get the complete picture of a customer’s risk profile. When pairing this data together through integration however, those isolated pots of data start to build a comprehensive view of the trends and potential concerns.

Key Takeaway: Data, data and more data

The more data, information, and analytics you have, the more you can detect and prevent financial crime.

Similarly, fraud and AML teams work to different timings meaning an isolated approach can hinder organisations when trying to fight financial crime. Fraud detection requires real-time monitoring, while AML uses retrospective data to help spot crime trends. Those data sets won’t marry as the timing doesn’t align. By bringing them together, the teams can bridge the gap and spot any anomalies in customer behaviour.

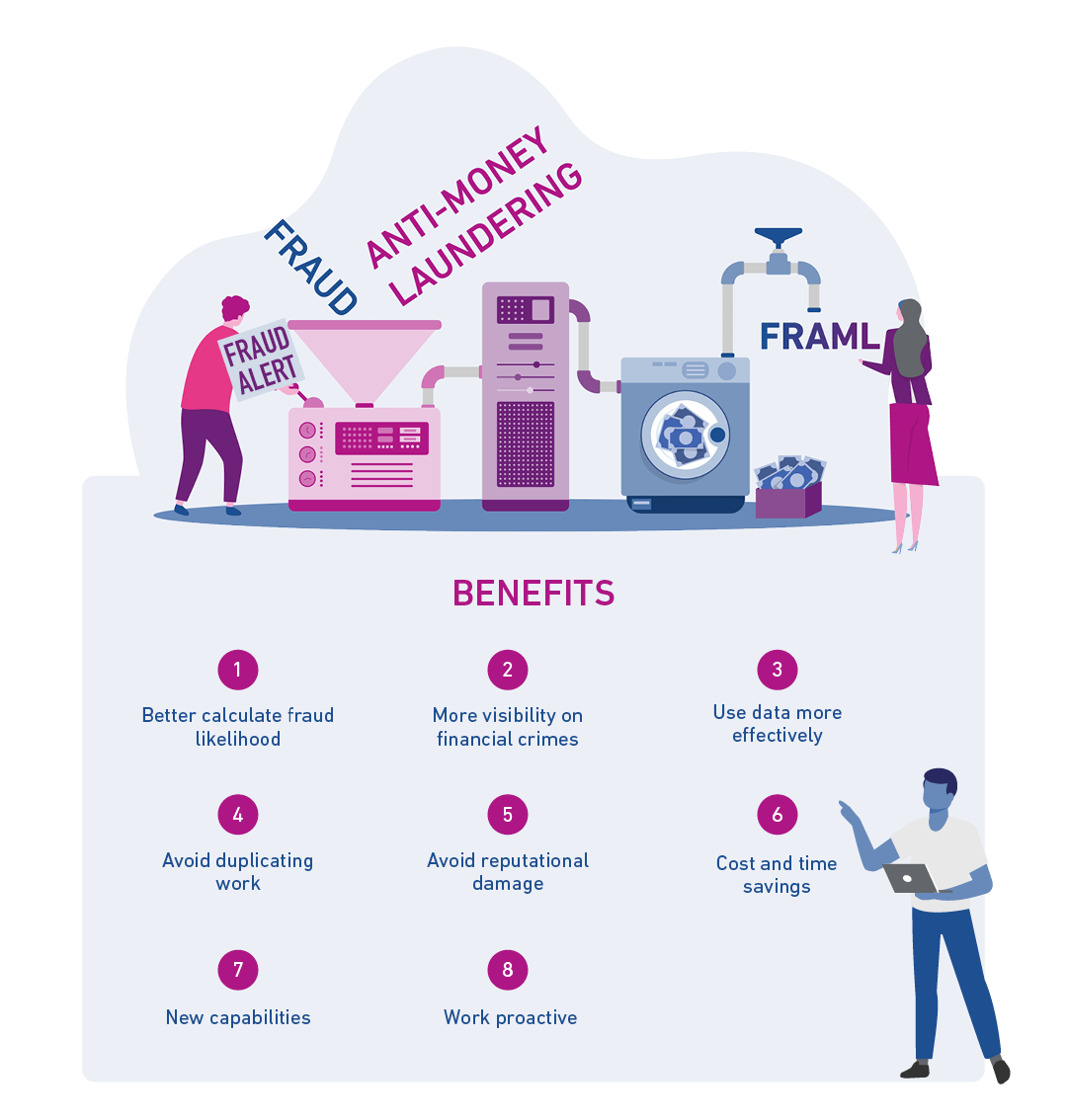

What are the benefits to FRAML?

There’s no doubt that FRAML is still in its infancy, and it may take some time for markets to truly be comfortable with this new approach. However, the benefits of adopting a FRAML framework are clear.

Better calculate the likelihood of fraud

By blending data analysis, strategies, and machine learning from two significant areas of your organisation, you will have better insight and capabilities to undertake fraud analytics. This in turn can help you identify and mitigate fraudulent activities in real-time to reduce financial losses, streamline operations, and comply with regulatory requirements.

Get more visibility on financial crimes

By joining forces, fraud and AML teams will gain a broader and deeper perspective on the financial crime threats facing the company. Say one team has its suspicions that a particular customer is committing fraud, but they need more proof in order to confirm this. It’s more than likely the other team will have data that can support the investigation.

Key Takeaway: Give your business the best chance

Essentially, FRAML gives a business the chance to gather more evidence to get the whole story of a potential crime.

Use data more effectively

Combining all sets of data in a single place allows both teams to better visualise customer behaviour and suspicious activity. These insights can then be used to make faster and more precise decisions.

Avoid duplicating work efforts

By having both teams siloed in their efforts, much of the investigative work and activity can end up being duplicated. FRAML allows for better productivity and streamlining.

Avoid reputational damage

The incentive to stop a fraudster is clear – you’ll save lots of money. While still vital, the benefits to preventing money laundering aren’t as immediately obvious. But in doing so you can ensure you adhere to regulations and save your organisation’s reputation and customers’ trust, which are both in jeopardy whenever financial crime takes place.

Key Takeaway: Not just a crime stopper

FRAML isn’t solely about preventing and flagging financial crimes. It aims to protect your organisation’s reputation, and create efficiencies in data management.

Make savings on cost and time

With both teams working in harmony, duplicate investigations and work efforts are avoided, making operations more cost- and time-effective.

Open up new capabilities for both teams

As well as sharing tools and data sets, teams can work tactically to share insights that may be the missing piece of a puzzle when it comes to suspicious transactions.

Work proactively to prevent fraud

By working together, teams can go from chasing their tail in trying to reactively detect fraud to proactively actively preventing it through broader insights and understanding.

What are the challenges to FRAML?

While the benefits to FRAML are obvious, it shouldn’t be considered a silver bullet solution. As with all crime prevention approaches, there are a number of challenges which can require a little more strategising in order to execute correctly.

In fact, your organisation may be weighing up whether the time and effort required to implement a complex, integrated approach is necessary right now. However, while money laundering doesn’t pose the same immediate challenges and risks that fraud does, it does leave financial institutions at risk of regulatory non-compliance and reputational damage.

FRAML doesn’t just seek to get ahead of financial crimes, it aims to protect an organisation more widely, as well as provide efficiencies in processes and data management as a whole.

Here are some other challenges that FRAML can pose:

Adopting new technologies

Implementing a FRAML approach will often require the use of advanced technologies such as AI or machine learning. As with any new technologies, development, and maintenance can be time intensive, resource-heavy, and require specialised expertise. In addition to this, as fraud and financial crime attacks evolve, organisations need to ensure their technology remains updated and effective.

Alienating customers by accident

Sometimes abnormal data can be perfectly justified. A customer may not be doing anything illegal, but detection systems could flag anomalies as a precaution. It’s important then that human assessment is used alongside machine learning so that if false positives arise, customers aren’t exposed to friction across their interactions or wrongly accused of a crime.

Complying with regulations

Regulations and legislations can be ever-evolving, with new or updated requirements requiring financial institutions to change their approach and operations. Making sure your integrated FRAML approach meets – and stays on top of – your country’s regulatory requirements can be particularly challenging.

Data integration and orchestration

One of the main challenges when creating a FRAML approach is bringing together data from a variety of different systems – many of which are likely to be old or disparate and not designed to be integrated. This alone can mean your fraud and AML data remain in isolated pots, making it hard to create a comprehensive, holistic view of the risks.

Data quality and management

An effective FRAML approach all boils down to having the appropriate data shared between teams. If one area of the organisation is sharing outdated or poor-quality data, then the whole approach is compromised, and the outcomes will be poor quality too. Organisations also need to be sure they are meeting data quality, privacy, and security standards as set out by regulations such as GDPR.

Differences in timing

Fraud detection typically requires real-time monitoring, while AML processes often involve analysing past data which has already been collected. This difference in timing can complicate the data and analysis integration of FRAML. However, advanced technologies, such as AI, can be a beneficial resource in aligning the timing of both activities.

Operational collaborations

While merging teams can be time-consuming and complex for smaller organisations, this can be an even bigger challenge for larger businesses. Bringing together such a wide variety of skill sets, priorities, and workflows is a huge operational undertaking that may require new training programs and culture changes.

How to adopt a FRAML approach

As with all financial crime prevention solutions, there’s no one-size-fits-all approach. A FRAML plan needs to be created based on an institution’s specific needs, risk profiles, and regulatory obligations.

However, there are some key considerations that are non-negotiable when creating your FRAML framework. These include:

1. Evaluating your current processes

By looking at your existing fraud detection and AML processes, you can better spot any gaps of where information or data is going unnoticed. This in turn allows for better integration of knowledge and expertise.

2. Fostering a culture of collaboration

Both fraud and AML teams will have a wealth of understanding, experience, and knowledge in their respective areas. Sharing this will help create improved oversight and data analysis. Plus, each team can learn and use strategies and processes that the other finds effective.

3. Joining up your risk assessments

By creating an overarching assessment that combines both fraud and money laundering risks, your business can better evaluate customer behaviour, transactions, and activity to spot any red flags.

4. Sharing data and technology

Ensuring that both teams have access to the same technology systems, as well as data, information, and alerts, means detection capabilities are bolstered leading to more effective prevention.

5. Establishing integrated technology and monitoring

By integrating two sets of advanced monitoring systems and analytics, both teams can better identify complex patterns or anomalies when it comes to data and customer behaviour. Emerging technologies like AI and machine learning can also help fix the isolation between fraud and AML teams by bringing data pots together.

6. Providing comprehensive training

Understanding the complexities of how fraud and money laundering link together, as well as the FRAML approach as a whole, should be fundamental for all employees. Ensuring everyone has comprehensive training allows them to feel confident and equipped to undertake FRAML.

7. Undertaking regulatory compliance

To avoid financial penalties, reputational damage, or even jail time, maintaining regulatory compliance is fundamental. Ensure your FRAML approach aligns with any regulatory requirements and guidelines.

8. Continually assessing the approach’s effectiveness

Regular monitoring, analysis, and feedback are needed to ensure your FRAML approach remains effective and useful. Make sure there’s a plan in place to refine processes accordingly, following each round of analysis.

In conclusion

A FRAML approach is the merging of data and insights from an organisation’s anti-fraud and anti-money laundering teams in order to detect, investigate and prevent financial crimes. However, we’re not just looking at a pure financial crime prevention strategy here, as the positive effects of FRAML are widespread.

It’s important to remember that right now FRAML is in its early stages. However, as the concept matures and its positive effects are felt, shared AML and fraud risk data will likely become a core data asset for organisations, and the key to maintaining accurate and up-to-date customer views.

This shared data will in turn drive customer and risk decisions that can benefit your organisation’s top and bottom line, as well as protecting customers and closing loopholes that criminals are currently using to perpetrate fraud.

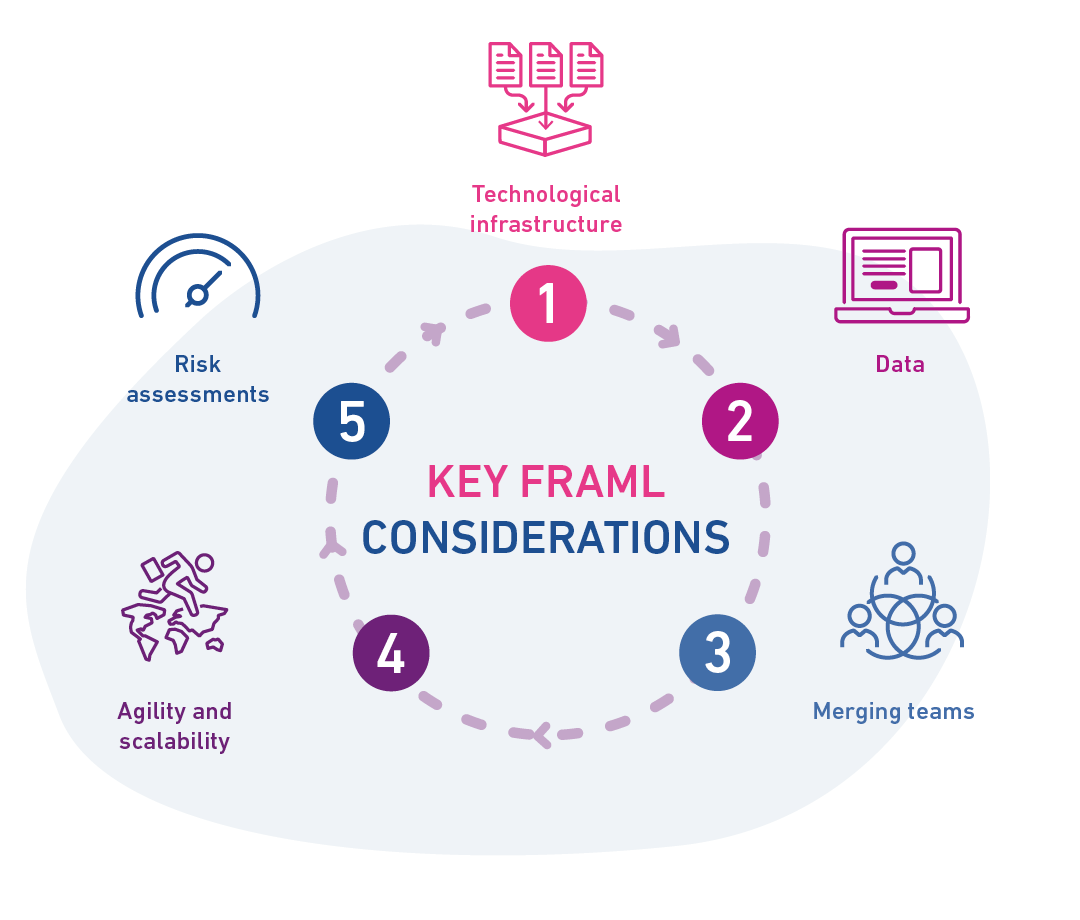

Your organisation’s key FRAML considerations:

1. Technological infrastructure

What technology do your fraud and AML teams currently use and can they be integrated? What additional advanced technology do you need to implement, like AI and machine learning?

2. Data

What data is currently being monitored and how can it provide insight to support both fraud and AML? Additionally, what are the practicalities needed to bring this data together and ensure quality, security, and privacy remains intact?

3. Merging teams

How can both fraud and AML teams be merged in the smoothest and simplest way? Will additional training or new processes be required?

4. Agility and scalability

As more transactions take place and more data is ingested, the more your FRAML approach needs to be adaptable and scalable. This flexibility in approach is also needed regarding risk and regulations changes.

5. Risk assessments

How can a holistic risk assessment framework – that considers both fraud and AML risks – be developed?

Let us help

Undertaking a FRAML approach from scratch can seem like a daunting prospect. However, you don’t have to tackle it alone. Our fraud and financial crime products are continually evolving to better support customers like you.

Take our CrossCore solution for example. Instead of having two separate business solutions, the platform brings together all the data and services you need into a single view. With the flexibility of an open API approach, it gives you greater control to manage your risk profile and customer journeys, particularly when you need to adapt to changing circumstances.

More than that, we’re currently working with the government and several large financial institutions to support the creation of an official data sharing initiative. We’ll feed into this using our experience and data of fraud and credit in order to optimise the solutions available for businesses just like yours.

If you’d like to hear more about this or how we could help your organisation, get in touch.