As the fraud landscape continues to grow more complex and challenging, organisations are investing in diverse technologies and solutions that can help to reduce losses and poor customer experiences. Prominent among these are innovative AI and machine learning (ML) models that drive efficiency through process automation; optimise fraud detection and prevention; and personalise online customer experiences.

More consumers than ever are aware of AI and its value in terms of improved security and online experiences

This years’ Experian UK&I Identity and Fraud report has found that the vast majority of consumers are now aware of AI and ML – and are beginning to understand how it can improve online security and streamline online interactions and experiences.

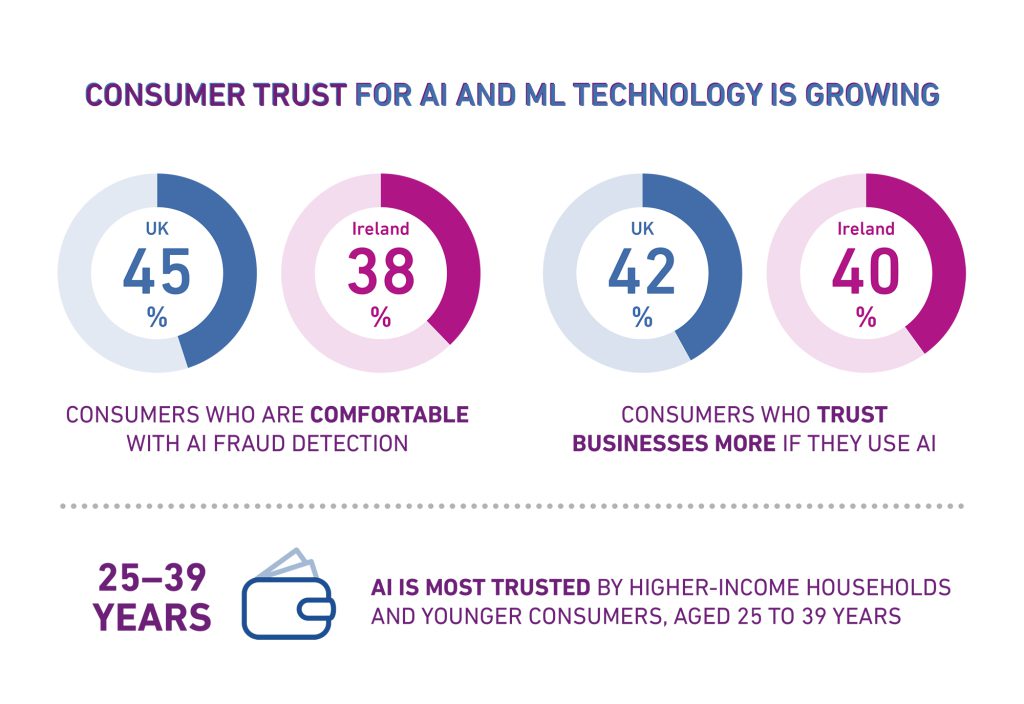

Overall, 83% of UK consumers and 85% in Ireland are aware of AI technology. Perhaps more importantly, 45% of UK consumers, and 38% of consumers in Ireland understand its potential to personalise their online experiences. Not only that, but more than half of all consumers in the UK and Ireland are now comfortable dealing with AI assistants, especially when it comes to resolving simple queries online.

The report also reveals that consumers are increasingly confident in AI’s ability to detect and prevent fraud. Specifically, 45% of consumers in the UK and 38% in Ireland believe AI can help to detect if their identity or account have been used fraudulently, or if their credit card has been used without their permission, for example.

Taken together, these insights show that consumer acceptance and trust of AI is growing significantly. This is excellent news for organisations who are investing to develop new AI-powered ID and fraud solutions that boost their ID and fraud capabilities, and to provide faster, more convenient online experiences for genuine customers.

Businesses also trust in AI and ML for effective customer identification, authentication and credit risk assessments

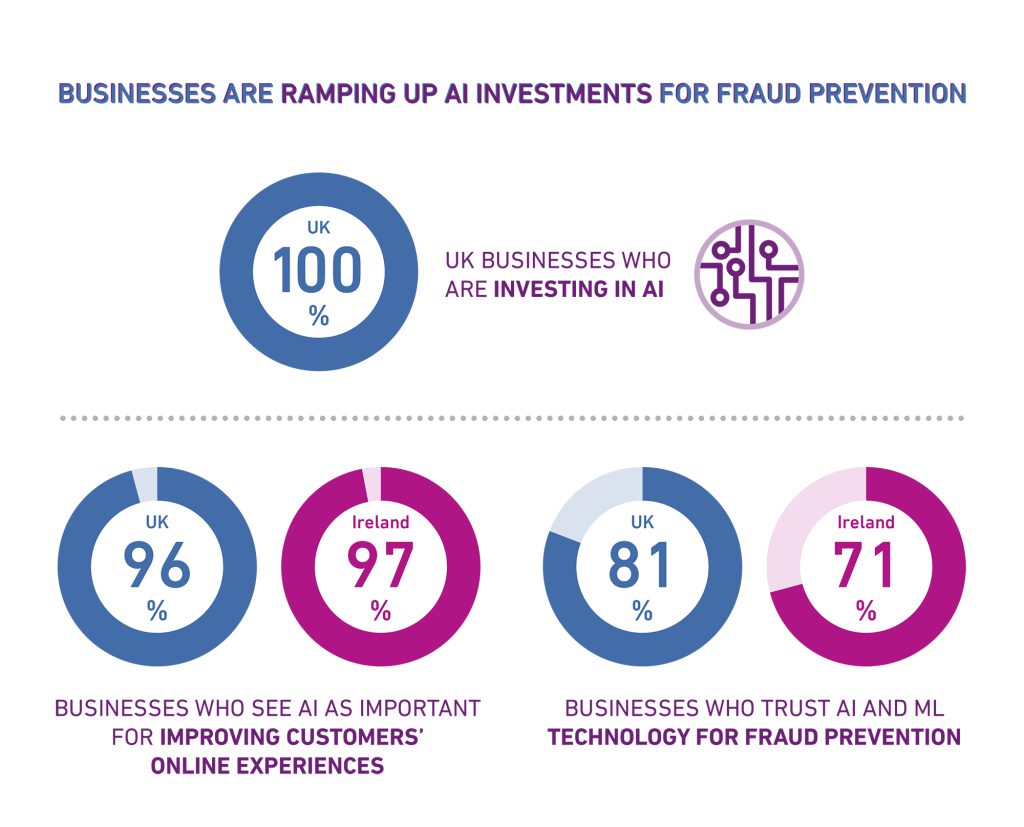

This years’ ID and Fraud report discovered that it’s not just consumers who are learning to trust AI and ML for fraud prevention. Businesses are also convinced of the potential of AI to boost their anti-fraud capabilities, and to provide fast, secure, convenient services for customers online.

This is evidenced by the fact that 81% of UK businesses, and 71% of businesses in Ireland, say AI and ML are trusted technologies for fraud prevention. The report also found that Machine Learning is a highly trusted technology for organisations looking to address and manage customer credit risk more effectively, supporting rapid, accurate, data-driven decisioning.

Finally, AI and ML are increasingly seen as technologies with a key role to play in financial inclusion initiatives. In the UK, for example, 41% of organisations say that AI is likely to be implemented to support financial inclusion initiatives, with the figure rising to 48% in Ireland. This is based on AI’s ability to analyse vast datasets extremely rapidly, and to identify areas where organisations can improve financial inclusion through community outreach or other kinds of initiatives.

100% of UK businesses plan to invest in their AI capabilities – aided by trusted outsourcing partners

For 100% of UK businesses, AI is a key target for investment. This is not surprising considering that the technology offers major opportunities to improve security based on faster, more accurate customer identification and authentication. AI is also almost universally seen as ‘somewhat’, ‘very’, or ‘extremely’ important for improving customers’ online experiences by 96% of companies in the UK and 97% in Ireland.

However, to deliver the required AI and ML innovation within a short timescale, 69% of organisations in the UK and 71% in Ireland are either currently outsourcing specialised areas of their business or have the intention to do so in the future. In particular, 29% of UK businesses and 38% of businesses in Ireland expect to outsource projects related to AI, whether they are optimising existing models or developing new ones.

AI and ML for fraud detection and prevention

The greatest challenge when it comes to fraud detection is that more than 99% of applications and attempts to access sites and services are genuine. This inevitably leads to unnecessary investigation of genuine applicants – which increases admin costs and disrupts the customer experience.

The great strength of AI and ML technology is the ability to automate identity management and authentication to a much greater extent than has previously been possible. This allows organisations to keep applications out of manual review queues to reduce operating costs, and ensures that all genuine customers can access faster, better, more secure service experiences.

For more insights on the latest AI and ML trends, and how organisations are using these innovative technologies to ramp up their ID and fraud capabilities, download the full report here.