As digital adoption has increased, identities have become more complex

ID has evolved over many centuries, with the first written identity documents and passports being created in the 1400s. The modern version of this passport came into existence in 1914. From those early efforts, other government issued identity documents, including driver’s licences, arose. Now, digital and physical identities are linked. Licences and passports often include biometric markers, such as facial, hand or iris verification. Through this, it is possible to know exactly who is interacting with a company through their website, app, in person or on the phone.

In the years leading up to the pandemic, many organisations had been investing in digital transformation programmes, but the pandemic pushed every organisation into this space and, in 2020, anything that could be moved online was moved online. And in the midst of this upheaval, they saw seismic shifts in customer behaviour and expectations. Consumers had little choice but to turn to digital channels and services en masse during the pandemic. As digital adoption has increased, identities have become more complex.

While the arc of history may be long for physical and digital identity, the growth of digital has reshaped the speed at which organisations and governments adapt to identity and ledger design

While some things have changed, certain requirements remain in any identity platform design, including:

Download the whitepaper nowStandardisation

An organisation needs the ability to consistently capture data and characteristics that can be useful to a specific individual.

Interoperability

An organisation must have the ability to resolve an identity to a specific person.

In this insight report we cover:

The present

The present state of digital identity

The impact

COVID-19's impact on digital transformation and identity

The challenges

The challenges to overcome

The future

The future of identity and constructing future identities for businesses and consumers

A sneak peek into:

Capturing the digital identity evolution through a layered approach

The consumer preference for digital services

One reason banks, eCommerce, and healthcare organisations have had to adjust to put digital identity at the forefront is that customers have come to require – and seek – online offerings.

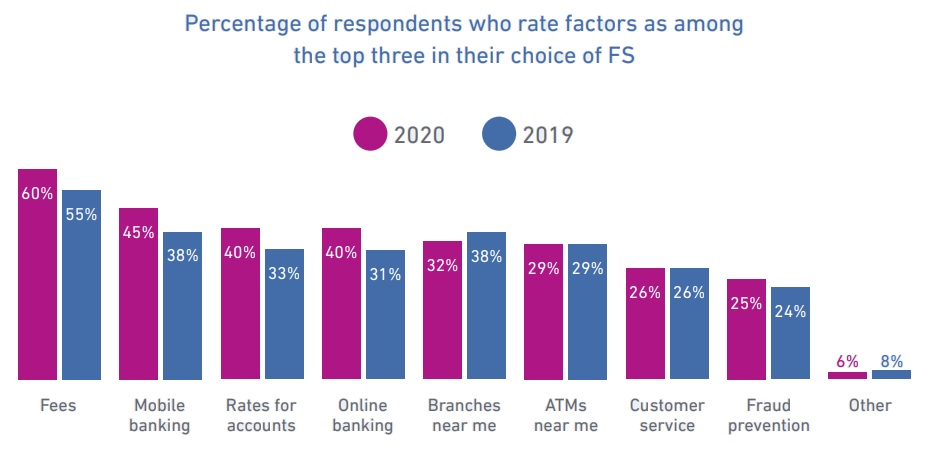

Online banking, for example, increased from 37% in June 2020 to 40% in January 2021. The numbers vary depending on the age group. Consumers over 40 are more likely to use online banking – 40% compared to 36% of those under the age of 40. The use of mobile wallets is also strong. In the UK, 65% of consumers use mobile wallets – globally it’s 70% of consumers using mobile wallets.1

Mobile and online banking have become a must-have for consumers

The consumer preference for digital services goes well beyond banking to all areas of life, impacting a variety of industries. Those over the age of 40 increased their rate of online grocery shopping by 10 percentage points over the past two years.2 The same goes for online food delivery 2020 witnessed restaurant-to-consumer deliveries grow by £3.7bn to reach £11.4bn – double the 2015 market value – and that number is expected to grow to £12.6bn by 2024.

Did you enjoy the read?

Download the full paper on capturing the digital identity evolution

It’s imperative that organisations continue to evolve their identity management strategy in alignment with shifting dynamics. The evolution of digital identity is a journey, not a destination.