3 types of bank account data errors and how to reduce them

Why do bank account data errors happen?

Bank account errors are costly for both businesses and consumers. Businesses need to ensure that all account and reference numbers are formatted correctly before payments are processed. Bank account errors occur when this information is incorrect. There are also specific compliance standards, for example, for payments such as Direct Debits, it’s a BACS requirement1 to ensure the bank account details exist and are associated to the payee.

Getting the right outcome depends on inputting the right data, in the right format – and banking and payment systems are no exception. For example, even the smallest error in a bank account number, or in associated information such as an invoice number, may mean that a payment can’t be reconciled, and that the transaction can’t be processed.

The good news for businesses is that incidents of bank account errors and bank system errors – and the associated consequences – can be dramatically reduced based on a series of checks and balances, conducted before bank account details are passed on to payment systems. In this blog, we take a more in-depth look at the root causes of transaction errors, and outline how businesses can take the first steps towards minimising them.

What are bank account errors and what causes them?

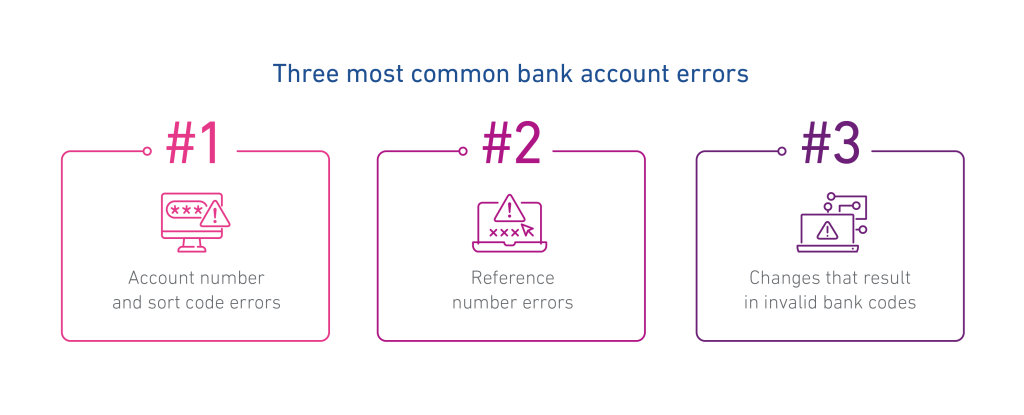

The starting point for businesses wishing to minimise bank account errors is to understand which types of errors are impacting payments, and how often they typically occur. The following sections outline the most common bank account errors, providing a basis for this kind of trend analysis, and helping businesses to investigate the root causes of failed transactions, and to implement effective solutions.

1. Account number and sort code errors

Errors such as an invalid bank account number or sort code typically occur when customers mis-key data into payment systems or company forms, for example, or when customer service representatives mis-hear or mis-key customer account information. This can also happen if data is being migrated or copied between systems, especially if manual keying of information is involved. This kind of mistake typically has serious and costly consequences, ranging from failed transactions to mis-direction of funds. Both result in potential financial losses for either organisations or consumers, costly and lengthy investigations, and negative customer experiences.

2. Reference number errors

In some cases, the bank account number and sort code for a company or customer is correct, but a corresponding reference number – such as a supplier number or invoice number – is wrong. In such cases, payments may be suspended pending investigation by the payment provider. As an additional challenge, the failed transaction may not be flagged to the person or organisation making the payment, leaving them unaware that the funds have not been delivered successfully. On the other end of the failed transaction, the recipient will not receive the funds as planned, and will be unsure how to move forward or who to contact to resolve the issue.

3. Changes that result in invalid bank codes

Industry and organisational changes, such as bank mergers, acquisitions or restructuring can result in changes to bank routing numbers (such as international SWIFT/BIC codes), and customer account numbers. When these changes happen, customers need to ensure that the latest details are used for all payments and transactions, and that direct debits and other automated payments and deposits are updated with their new details. This is crucial to ensure that transactions can be reconciled correctly and that the risk of failed transactions and mis-directed funds is minimised. Where details change due to mergers, acquisitions, or internal restructuring, organisations can minimise mistakes by communicating new account numbers and codes to customers in a timely way.

How do bank account errors impact businesses?

Invalid account numbers, hsmi errors, reconciliation errors, and other bank errors have serious consequences for both businesses and consumers.

This is because bank errors – and resulting failed transactions – require follow-up investigations, which are inevitably time consuming and costly. What’s more, these kinds of incidents result in customer dissatisfaction and, consequently, have repercussions in terms of the brand’s reputation, with many businesses finding that failed transactions are a cause of increased customer churn.

For consumers, failed transactions and misdirected funds can also be highly frustrating. Where customers are left waiting for funds for a prolonged period of time, the consequences can be even more severe, preventing the use of the funds for essential items and bills.

Impacts of common bank account errors

High costs: the expense of failed payments to financial institutions and corporates each year run into billions of pounds.

Customer churn: many companies lose customers each year due to failed payments or mis-directed funds.

Reduced straight-through-processing (STP) capabilities: reduced automation and increased need for manual processing increases operating costs.

How are bank errors usually handled?

Bank account errors are handled differently, depending on the organisation and where it is located globally.

In the US, for example, account numbers that are not valid, with no corresponding account, result in the transaction being rejected immediately. In Europe, on the other hand, payment providers will usually attempt to resolve the transaction, generally without informing the payee. This can be a helpful short-term fix if the transaction is reconciled effectively, but it can result in more serious consequences if funds are mis-directed. These kinds of mistakes can come to light gradually, causing long-standing resolution challenges and major inconvenience for consumers.

How can businesses minimise bank account errors?

One of the most effective ways to minimise bank account errors and the associated costs and negative consumer impacts is to confirm that payment data is accurate before it’s sent for processing. The good news for payment providers is that just a few simple, automated checks can dramatically reduce incidences of bank account errors, and significantly increase efficiency and straight-through-processing capabilities.

1. Ensure bank accounts are genuine

First, automated checks are needed to ensure that bank accounts are genuine and exist. This immediately eliminates a large number of failed payments due to mis-keying of bank account information, either by consumers themselves, or by customer service representatives at banks or other institutions or companies.

2. Ensure all bank account information is formatted correctly

Second, and equally importantly, the formatting of bank account details needs to be checked consistently and appropriately to ensure that all information is correct, and presented in a way that can be recognised and reconciled by the payment system. This check also eliminates a large percentage of bank account errors before they result in failed transactions or mis-directed funds.

How can we help solve bank account errors?

Our solutions can help you validate and verify your customer bank account details to make sure that an account not only exists but is also associated to the right customer. This way, your customers can successfully make and receive payments every time.

- Reduce errors: Give your customers the best possible experience

- Remain compliant: Be sure payments are made to and from the right customers

- Improve processes: Make payment processing more accurate and efficient

Our solutions enable process automation when it comes to managing and updating complex or changing payment data in your business and payment systems. We identify and implement changes to bank account data each week so you can stay one step ahead and minimise the risk of failed payments.

Take the next step to fewer bank account errors

Make sure you have the correct bank details for the account your customer owns, so you can make and receive payments smoothly, without complications.

Take the next step and find out how our bank validation and payment processing services can benefit your business.

Get in touch

Speak to one of our experts about our bank validation and payment processing services.

Get in touch[1] Paperless Direct Debit, BACS