Trade credit allows clients and small businesses to get what they need without having to pay right away. This system means creditors can help businesses improve cash flow management and purchase necessary inventory without immediate capital – helping to build trust and lifetime value out of customers.

And while both creditors and clients benefit from this relationship, awareness of the vulnerabilities as a creditor are key to protecting your business and optimising your growth. That’s why a thorough understanding of how to make the most out of trade credit is important for suppliers who want to expand their customer base and foster loyalty.

Learn how to use trade credit effectively, the advantages of offering credit, and how to mitigate risk.

What is trade credit in business?

Trade credit allows companies to get goods or services without paying for them immediately, using short-term credit instead. They pay for it later by an agreed deadline, typically within 30 to 90 days. The supplier has the responsibility to invoice the company and keep track of what they owe. It can be seen as both a capital asset and a liability, depending on who you ask.

Suppliers consider the money owed to them as a valuable asset on their books that they will receive in the future. However, it’s a liability for customers because it’s money they owe and have to pay back. It’s a liability for suppliers too – there is always some risk that the customer may not pay. This is why some suppliers choose to get credit insurance – to protect themselves if the customer can’t pay them back for whatever reason.

Trade credit is a type of commercial financing that gives businesses flexibility when paying to keep their operations running smoothly. That’s why businesses, particularly small businesses, often favour suppliers that offer trade credit.

Common types of trade credit and real-world examples

Suppliers can offer trade credit to clients in various ways, such as Buy Now Pay Later or revolving credit options. It’s important to understand the most common types of trade credit to help decide which could be right for your business.

Open account

The seller provides goods with payment due within 30-90 days, the most popular type of trade credit. Example: A manufacturer ships goods to a retailer with net 30-day payment terms.

Cash-on-Delivery (CoD)

A payment arrangement where payment is made when goods are delivered, not beforehand. Example: A distributor receives cash payment from another business at the time the goods are handed over.

Instalment credit

Partial payments over an agreed period. Example: An office equipment supplier offers business instalment payments over six months for a copier.

Consignment

A business gives its products to another business to sell. If the second business sells the products they pay the first business who loaned the products; if not, they return the products. Example: A clothing manufacturer gives shirts to a retail store. The store pays for each shirt sold and returns unsold ones.

Revolving credit

Ongoing access to funds up to a limit. Example: A hardware store has a £5,000 revolving credit line with a supplier. It orders materials up to that limit, pays off £2,000, then can immediately use up to £2,000 again without reapplying for new credit.

Business-to-Business Buy Now, Pay Later (BNPL)

Allows deferred payment for 30-60 days, typically with a structured payment plan. This differs from an open account which lets businesses pay for goods after receiving them within a set time. BNPL splits the total cost into smaller, planned payments over time, sometimes with extra costs, offering a clear payback schedule. Example: Wholesale supplier enabling businesses to purchase inventory and pay later, aiding cash flow management.

Trade credit vs bank finance: what’s the difference?

With trade credit, businesses buy goods or services on account from suppliers, paying later. It’s a direct arrangement between buyer and seller, bypassing financial institutions. Bank finance involves loans or credit lines from banks or credit unions, with terms set based on creditworthiness and loan purpose. Trade credit is common for routine purchases as it aids the cash flow of businesses, while bank finance supports various needs like investments and expansions.

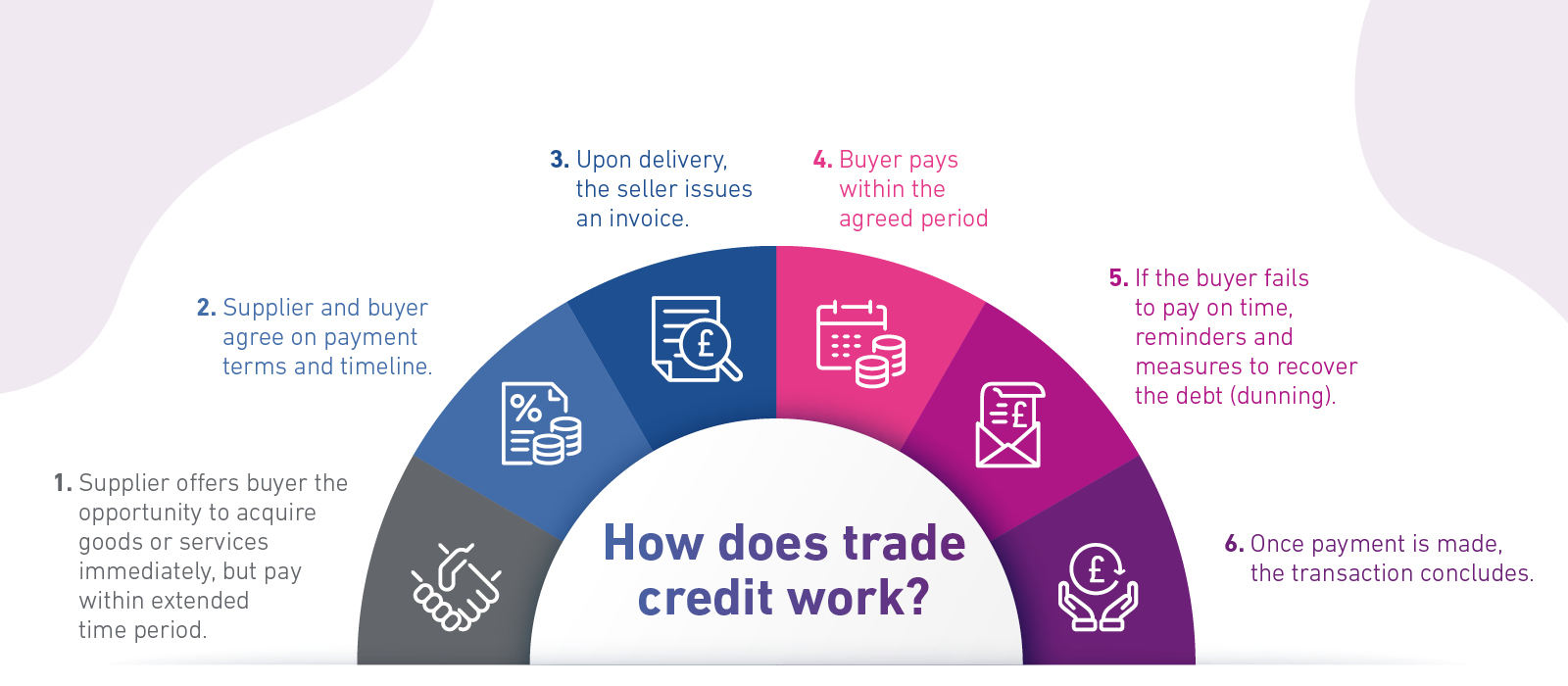

How does trade credit work?

Trade credit enables buyers to procure goods or services on credit, agreeing to pay within a specified period after delivery.

The supplier and buyer agree on payment terms, such as “net 30 days,” dictating the repayment timeline.

Upon delivery of the goods or services, the seller issues an invoice, and the buyer is expected to settle the payment within the agreed period.

If the buyer fails to pay on time, the supplier may begin dunning – sending reminders and potentially escalating measures to recover the debt, such as small claims court.

Once payment is made, the transaction concludes, allowing buyers to manage cash flow while enabling sellers to attract customers with flexible payment terms.

Who uses trade credit?

Both suppliers and customers utilise trade credit. Suppliers use it to attract customers and boost sales, while customers benefit from deferring payment. The versatility and flexibility of trade credit make it a popular financing option for managing cash flow and fostering business growth. Here’s a closer look at who uses trade credit:

- SMEs use it to purchase inventory without immediate payment, helping them conserve cash for other critical business needs. Due to their limited access to traditional financing and the need for flexible payment terms, trade credit helps SMEs manage fluctuating cash flows.

- Large corporations use trade credit to optimise finances and manage supply chains through favourable payment terms, enhancing their liquidity.

- Retailers can utilise trade credit when stocking up before peak seasons and paying suppliers after sales are made.

- Manufacturers may take materials for production on credit. This helps maintain continuous production cycles without immediate cash expenditures, aligning payment with the completion and sale of finished goods.

- Service providers may use trade credit to procure supplies or subcontractor services to complete projects and generate revenue before paying their suppliers.

- Startups rely on trade credit for operation and growth amidst limited capital.

Why offer trade credit? The advantages

Allowing clients to purchase goods or services on credit poses several benefits for businesses:

Cash flow management: Despite the deferred payment, trade credit can benefit cash flow by providing a steady revenue stream. While cash isn’t received upfront, the assurance of future payments allows for predictable cash flow planning.

Competitive advantage: Many customers prefer purchasing on credit rather than paying cash upfront, so offering this option can attract more customers and increase sales.

Customer loyalty: Businesses can build stronger relationships and loyalty by extending credit to customers. Customers may be more inclined to continue doing business with a supplier offering flexible payment terms.

Makes buying easier for customers: In any business, you want to make it as easy as possible for your customers to purchase. Well, trade credit can do just that, thereby stimulating sales, even when customers may not have immediate funds available.

Increasing your share of wallet: Simply offering trade credit is one thing, but when your onboarding systems are seamless and efficient, you set yourself above your competitors. You can increase your share of wallet by utilising the latest technology to ensure your processes are smoother than anyone else’s.

Key Takeaway: Set yourself above your competitors

Simply offering trade credit is an advantage, but you can set yourself above your competitors and gain share of wallet when your onboarding systems are seamless, easy and efficient.

The disadvantages of trade credit for suppliers

While trade credit can offer various advantages for suppliers, like increased sales and customer loyalty, it also comes with risks and costs that must be carefully managed, such as:

Administrative costs: Managing trade credit takes time, uses resources and personnel, increasing operational costs.

Cash flow constraints: Delayed payments from customers can strain cash flow, potentially impacting your ability to meet financial obligations.

Opportunity cost: Extending credit ties up capital that could be used for investment or expansion which may cause suppliers to miss out on opportunities or growth.

Potential for disputes: Offering trade credit can lead to disputes over things like payment delays, term disagreements, and documentation discrepancies, harming supplier-customer relationships.

Risk of bad debt: Customers defaulting can cause significant losses and harm profitability through bad debts.

Suppliers must weigh these factors and implement effective credit management policies to mitigate the disadvantages of offering trade credit.

How can I minimise risks using trade credit management?

To minimise the risks of offering trade credit, suppliers need to implement solid trade credit management strategies – digital tools, reliable data, thorough credit history assessments, and effective credit control are just a few of those.

- Digitise processes: Almost 20% of credit professionals struggle to speed up credit checking decisions. Automating trade credit management processes addresses this challenge, providing faster, consistent, and error-free screening. It expedites onboarding for low-risk customers and allows more time for flagged cases. Decisioning automation streamlines decision-making, ensuring consistency, control, and better customer experiences. Features include automatic decision-making, customisable attributes, and expert rule setup, enhancing efficiency and fraud prevention.

- Acquire high-quality data: Use platforms with access to large and accurate databases. With access to better quality, large-scale datasets, you can more effectively identify legitimate opportunities and swiftly flag risky ones, reducing the risk of engaging with financially unstable clients. Always ensure your data is reliable and up-to-date to make informed decisions.

- Assessing creditworthiness: Utilise tools such as the Commercial Delphi Generation 6 and trade references for thorough evaluations of financial reliability in credit applications. Understanding commercial affordability is crucial, especially given the limited financial data available for small companies and non-limited entities. Data from Commercial CAIS and CCDS provides insights into a business’s financial health, helping assess its ability to meet financial obligations. By analysing this data alongside key metrics like credit limits, balances, and sector risk factors, you can gain a comprehensive understanding of a business’s affordable limit. This approach promotes informed decision-making and responsible practices in the commercial sector.

- Determine credit risk: Suppliers should assess credit risk by effectively evaluating a customer’s financial health and payment history. Establish credit limits, ideally not exceeding 10% of the customer’s net worth, to manage exposure. This approach ensures suppliers extend credit to reliable partners, safeguarding against defaults and maintaining healthy cash flows.

- Set appropriate credit terms: Conduct due diligence to understand potential customers’ trading history and risk level. Tailor credit terms based on the risk assessment to mitigate potential losses.

- Implement credit control management: Set up stringent dunning processes to collect late payments from customers. Monitor and manage credit control effectively to ensure timely payments and minimise default risks.

- Utilise credit risk mitigation strategies: Explore options like credit insurance or letters of credit to enhance protection against defaults and financial losses, complementing digitisation, data acquisition, assessment, and credit control.

- Use systems that flag changing circumstances: Implement systems that alert you when customers undergo changes that could impact their payment ability. Receive notifications across a comprehensive range of criteria to proactively manage credit relationships.

- Stay vigilant: Monitor changes in payment behaviour, including days beyond terms and previous high-risk accounts that may struggle with new circumstances. Employ automated systems that notify you of these changes, freeing up resources for other tasks.

Key Takeaway: Which can you implement?

Review which of the above recommendations you are able to implement to reduce the business risks associated with providing trade credit.

Staying on top of fraud risk as a trade creditor

Increased regulatory and market expectations for creditors to proactively identify and mitigate fraudulent activities. This heightened vigilance is essential as the number of startups and small businesses continues to grow, bringing with them the challenge of ‘thin file’ accounts that complicate the credit assessment process, directly affecting trade fulfilment and ultimately impacting profitability.

In response, refine your vetting process to employ advanced technological tools such as automation and digitisation. These technologies streamline the authentication of business principals, enhancing accuracy and speed to prevent potential customer drop-off during the verification phase.

And by integrating both commercial and consumer data into the decision-making process, you’ll benefit from a comprehensive understanding of a business’s financial standing. This dual-data approach is pivotal in meeting the rising standards for fraud prevention and in making confident credit decisions.

Embracing technological advancements and sophisticated data analysis is no longer optional but essential for maintaining trust and competitiveness in a market increasingly vulnerable to fraud.

How to manage late payments

Not all customers will pay their bills on time, so it’s important to have an effective credit management policy for late payments.

Firstly, a robust contract should always have a section that explains to customers the course of action if payments are late, for example interest charges or points of escalation, such as small claims court. You should also consider a credit management system to monitor customer compliance with payment terms and assess potential risks like bankruptcy.

As missed or late payments occur, start by contacting the customer to understand the reason for the delay and emphasise the expectation for timely payment.

If payment remains outstanding, escalate by issuing warnings and formal notices, specifying a deadline before legal action is considered, if that is the route you decide to take.

Consider credit insurance to delegate late payment follow-up and collection tasks. Credit insurance isn’t just about getting paid if your customers can’t pay you, it’s a smart solution for saving time and preserving customer relationships. By delegating late payment follow-up to experts, you can focus on running your business effectively while ensuring your finances are secure.

Effective lending starts with accurate data

Effectively navigating trade credit requires precise, data-driven insights for risk management and decision-making.

Experian’s Commercial Bureau, trusted by over 35,000 clients, offers a suite of solutions, including Commercial Delphi Generation 6. Commercial Delphi is our latest commercial risk score, utilising current account turnover data to more accurately assess customer risk, empowering businesses to manage credit risk effectively and optimise financial performance.

These solutions equip trade suppliers with comprehensive credit check services and are designed to enhance your ability to assess customer credit limits accurately, offering robust protection against bad debt and bolstering confidence in your credit offerings to solvent customers.

Embrace the confidence that comes with Experian’s insights and make informed decisions that drive your business forward.