Reduce delinquency in telecoms through a data-first approach

Following a number of challenging years for the UK economy, telecoms operators, like many other sectors, have had to evolve and adapt to the struggles consumers are facing

In this article, Experian’s Mark Wright looks at the delinquency trend across the market, how this compares to other sectors, and how to use data to improve customer outcomes and deliver improved business performance.

Credit Reference Agency (CRA) data is used well beyond simply assessing credit card eligibility. Using the right mix of CRA data can help you make better decisions for your telecommunication customers, reduce fraud, and improve business growth. But in the midst of a cost-of-living crisis, how can we be sure we are building the best in-life picture of our customers?

Telecoms delinquency trends vs. other sectors

On average consumers are spending more on their communication services than this time last year[1], deemed to be the result of higher than inflation in-contract price rises, as well as increasing device costs. Finance is being offered by all operators to provide flexibility for the consumer, and therefore maintain and grow market share, but has this market dynamic, coupled with the cost-of-living crisis had an influence on payments and the credit risk teams’ bad debt levels?

Delinquency rates are gradually increasing across the telecoms market and is now at pre-pandemic levels. Whilst this is not a sudden, dramatic increase, it is something operators need to keep a careful eye on, and work through how the roll from initial arrears into disconnection and default can be controlled. Whilst Telecoms overall cure rates for customers missing payments can be in the high 80% to low 90%, we are observing an average roll from 1 payment in arrears to default over a 12-month period in the order of 50%. When we compare this to other unsecured lending sectors, all are around or just under 40%, with secured lending and utilities being lower still.

Once a consumer goes to 2 payments in arrears on their Telecoms account it becomes even more difficult to rectify the situation with more than 80% ending up in default. This level of roll to default is only observed on cards and retail finance once an account reaches 4 payments in arrears, with loans, secured finance and utilities having considerably lower roll to default rates.

So, why are there such differences between different types of credit product? Do you know how each customer prioritises their financial commitments, and if you start to see a customer getting into financial stress when are they likely to start to miss payments?

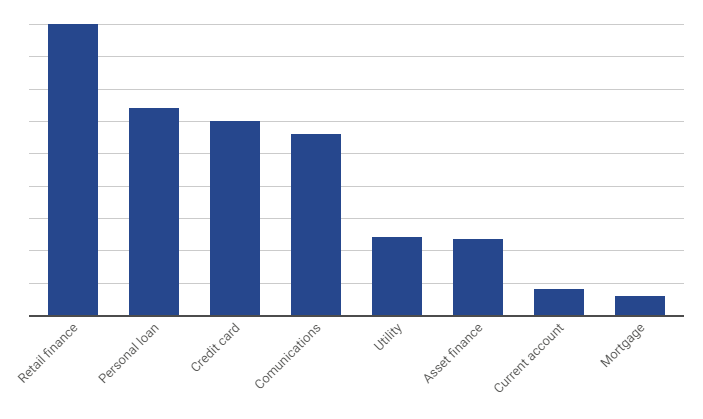

Our Credit Market Insight service, uses CRA payment performance data to benchmark an individual operator against the market across all stages of the credit lifecycle, and the insight can be used to highlight areas of opportunity and strategy development. When specifically looking at bill prioritisation, we see that on average consumers are prioritising mortgage, overdrafts and utility bills. Retail finance bills are likely to be missed first followed by credit cards, personal loans and then communications, however, this priority can vary by customer segment.

Missed payments over a 6-month period by type

Understanding a consumer’s current financial position and behaviour is key to helping you develop effective strategies to mitigate your delinquency challenge. Early, proactive support can deliver good outcomes for both the customer and your business. Losses can be minimised, revenue protected, and a positive customer experience can support future renewals and sales. The more effective use of data will drive significant collections benefit; however, this is also just as relevant at the point of acquisition. Taking on better quality customers at the front-end will reduce the flow through into collections, whilst bearing in mind there is always the fine balance between trading teams looking to increase volume, to drive revenue, and credit risk and fraud teams controlling losses.

Making the most of your data assets

Operators have used CRA data for many years to enhance their understanding of potential new customers at acquisition, although not all use this insight for effective customer management. Having a view of a customer’s external financial position with other organisations and potential triggers of changing circumstances can change how you interact with them and offer scope to improve overall business performance.

CRA data helps give fully compliant and reliable customer insight. Understanding the differences in datasets between your partner CRA and alternatives can help you determine the best outcome for both your customers, and your organisation.

In particular, customers around the margins may require a deeper assessment, or use of alterative data sources, not offered by every CRA.

In recent head-to-head analytical comparisons, operators concluded that Experian data was able to deliver an improvement over existing decision making, enabling GINI improvements of up to 6%, and leading to acceptance rate increases of 3-4% whilst maintaining or reducing overall bad debt losses.

However, customer profiles and key segments don’t stay still. New products are launched, potentially attracting a new customer demographic and variable external conditions can influence a customer’s ability to service their financial commitments. So how can credit risk and fraud teams remain confident their models are delivering the same value now as they were when they were developed?

Strategy and scoring model monitoring is key but can take time in interpreting the output and identifying areas for improvement. With the advancement of analytics and software capabilities, it is now possible to regularly monitor your strategy and automatically generate challenger machine learning models that can be easily implemented and trialled, driving optimised performance whilst ensuring good outcomes for the consumer. To date, machine learning (ML) models have not been widely adopted within Telecoms, although models are being trialled and future placeholder capabilities incorporated into decisioning strategies. Other vertical markets have started to realise this potential benefit, with some organisations reporting a 20% reduction in bad rates through using Experian’s ML driven Ascend Intelligence Services Challenger[2].

Transformation programmes for credit risk and fraud teams

Having the best data delivered through the best strategy and models is one thing, but you also need the ability to react quickly and adapt to change. Replacing legacy technology with more agile, innovative solutions (including the move to the Cloud), can deliver improved capabilities, faster benefit realisation and ultimately improved outcomes for customers.

These transformation programmes take time and key resource away from business-as-usual activities; however, this investment by credit risk and fraud teams can deliver significant benefit in the medium to long term. New capabilities delivered through advanced decisioning and analytics solutions will enable alternative strategies to be more easily adopted and trialled. Challenges such as No Intention to Pay, a current pain point all operators are grappling with, will be understood faster and allow mitigating approaches to be implemented.

The latest software decisioning platforms enable credit risk and fraud teams to create, test and optimise tailored customer journeys, easily integrate new predictive data sources whilst delivering optimised decisions quickly by considering multiple dimensions such as confirming identity, likelihood of repayment, affordability, and fraud risk. However, technology and the decisions made are only as good as the data that drives them.

How can we help?

The need to maximise the value of data, align strategy across credit risk, fraud and trading teams and react quickly both to external challenges and opportunities has never been greater.

Experian’s team of experienced consultants already support many organisations with data, analytics and software capabilities to help identify areas of opportunity and deliver improved business performance across many of these challenges. At a high-level, examples of where we can support you are:

- Review and benchmark credit risk and fraud business performance, across the key areas of the lifecycle; from acquiring new customers through to customer management and collections.

- Identify and support more effective use of CRA data and how this can drive significant business improvement.

- Identify and support current and future strategy and model development; quantifying where new capabilities meet business challenges and would deliver significant value.

- Understanding and improving the quality of your customer data to support improved customer outcomes and regulatory compliance, particularly through transformation programmes and new proposition launches.

[1] Telecommunications Market Data Update Q1 2023, Ofcom

[2] Advantage Finance and the challenge of scorecards, Experian