Accelerate your predictive analytics through integrated ModelOps

Accelerate your predictive analytics through integrated ModelOps

During 2023, Experian conducted research, both here in the UK and around the world, looking at how financial organisations are designing, developing and implementing modelling – hereafter referenced to as ModelOps. Their overriding objective is to accelerate and improve their predictive analytics and, ultimately, to continually redefine their decision-making business.

The research aimed to uncover the key trends and business challenges in data ingestion and model building across a wide selection of use cases – including marketing, credit risk and fraud detection – as well identifying the bottleneck that companies face in this data assessment and model development lifecycle. It was also undertaken to inform Experian’s data and analytical platform strategy in general, and the subsequent alignment of our new ModelOps analytical capability.

The survey involved conversations with multiple senior risk and analytical individuals with deep insights into the multiple model building and associated operational activities.

Not only did the research confirm that changes are needed to remove the numerous blockers, but it revealed important insights regarding the maturity of the modelling industry. It also revealed a series of common analytical and data ingestion challenges.

In this report, we cover:

The importance of accelerating predictive models

How faster model development and deployment can give financial organisations a competitive edge.

Challenges in data ingestion and model development

Identifying the bottlenecks that slow down predictive analytics and how to overcome them.

Experian’s integrated ModelOps architecture

A deep dive into how Experian’s Ascend Unified Platform optimizes model creation, deployment, and maintenance.

Leveraging real-time data for decision-making

How constantly updated data helps improve accuracy, agility, and business outcomes in a rapidly changing market.

A sneak peek into:

ModelOps Report 2024

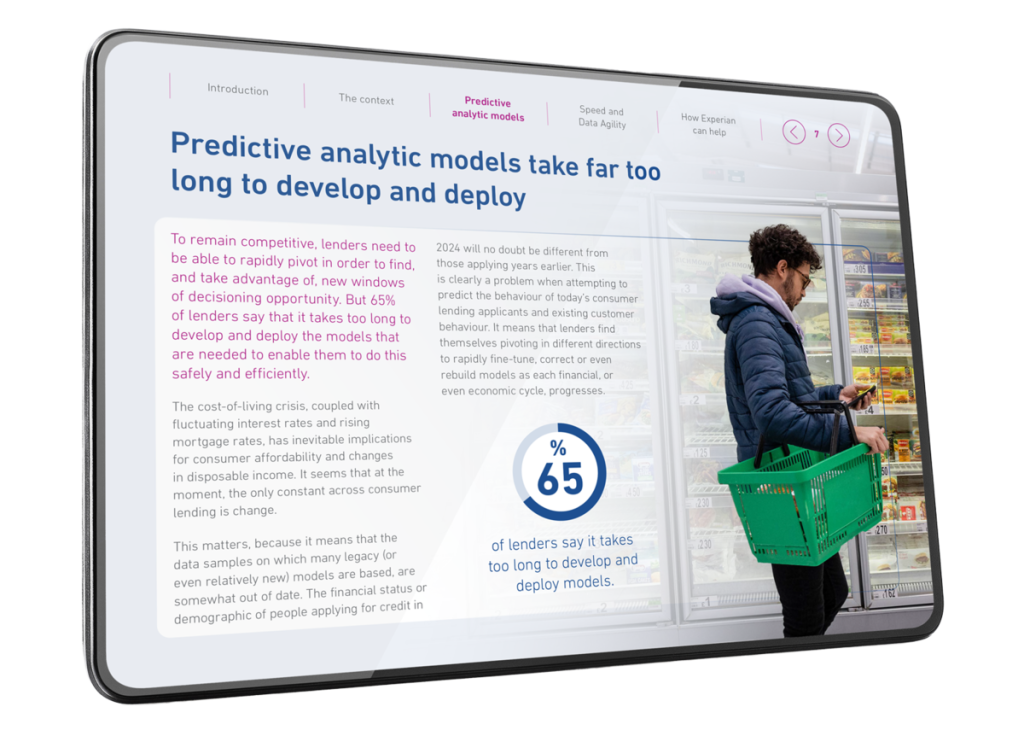

Predictive analytic models take far too long to develop and deploy

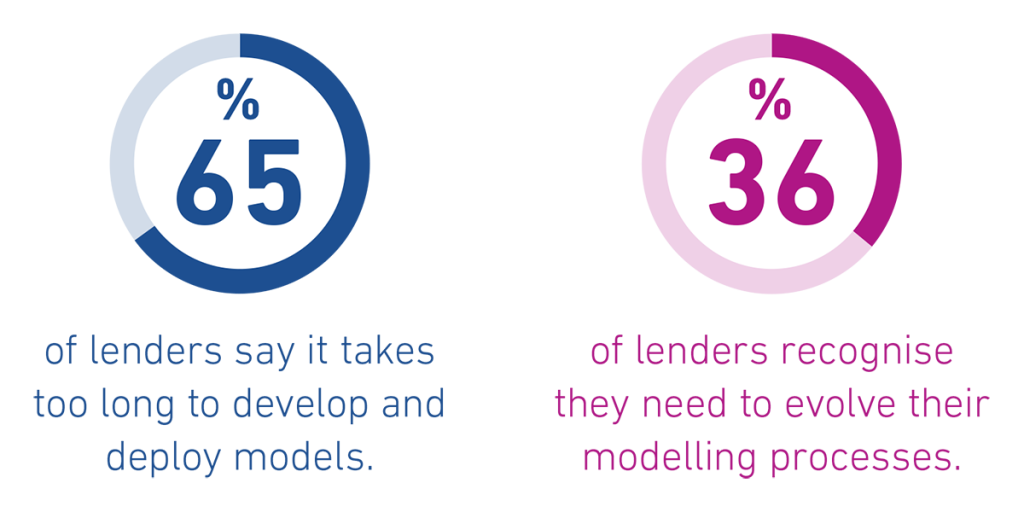

To remain competitive, lenders need to be able to rapidly pivot in order to find, and take advantage of, new windows of decisioning opportunity. But 65% of lenders say that it takes too long to develop and deploy the models that are needed to enable them to do this safely and efficiently.

The cost-of-living crisis, coupled with fluctuating interest rates and rising mortgage rates, has inevitable implications for consumer affordability and changes in disposable income. It seems that at the moment, the only constant across consumer lending is change.

This matters, because it means that the data samples on which many legacy (or even relatively new) models are based, are somewhat out of date. The financial status or demographic of people applying for credit in 2024 will no doubt be different from those applying years earlier. This is clearly a problem when attempting to predict the behaviour of today’s consumer lending applicants and existing customer behaviour. It means that lenders find themselves pivoting in different directions to rapidly fine-tune, correct or even rebuild models as each financial, or even economic cycle, progresses.

Did you enjoy the read?

Take a look at the full paper

Read our paper to find out how Experian’s integrated ModelOps architecture can help your organisation accelerate model deployment, leverage real-time data, and make faster, more accurate decisions. Stay ahead of the competition and transform your predictive analytics approach today.